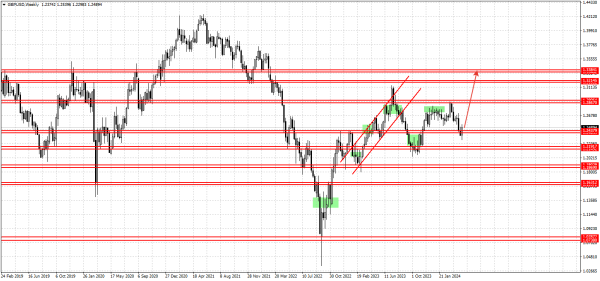

I am looking at the GBP/USD pair on the weekly chart. When the pair was trading near the support at 1.07380, the UK was implementing a tax reduction policy under the new Prime Minister. However, this tax reduction policy failed, causing the pound to plummet as nobody was satisfied with it. In general, investors fled from the UK, leading to such a situation. After that, the entire UK government changed, shifting from tax reduction to tax hikes. The Bank of England also intervened in the market, and investors, in general, returned to the UK. The situation normalized, everything went back to normal, and it even soared higher, with the EUR/USD pair reaching 1.32145. In other words, there was a significant decoupling at that time. An ascending trend channel was also formed, although this channel was much steeper than that of the EUR/USD pair. Then the pound started to decline, just like the EUR/USD pair, and the pair reached the support at 1.21917. All of this was also because the European Central Bank stopped tightening its monetary policy. And then, when it became known that the Federal Reserve would soon start cutting interest rates, the pair reached the resistance at 1.28670. It started moving in a range, as the UK remained the only country that did not announce the end of its policy tightening. It seems to me that this is why the pound held at these levels. Then, when it was announced that the UK would soon start easing its monetary policy, the pound broke below the support at 1.24379 but then moved above that level. I assume that the pair may move higher from current levels towards the resistance at 1.38841. It may even go up to the resistance at 1.33841.

*L'analyse de marché présentée est de nature informative et n'est pas une incitation à effectuer une transaction

Commentaires: