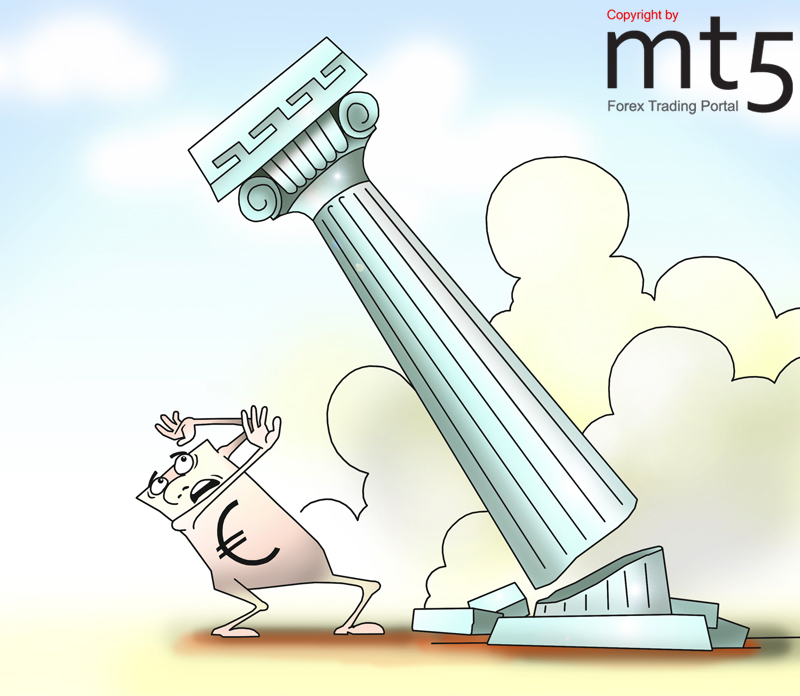

According to the negative forecast, the European banks’ losses in case of Greece’s default may constitute 34.4 bln. euro. It was announced in a weekly Moody’s report. You can find the Weekly Credit Outlook report for May 16 here.

Moody’s report showed that the major threat is represented by banks losing investors confidence and concerns over the Greek authorities to refuse assist financial institutions. The banks losses in case of Greece’s default will then exceed the volume of the loans they provided and investments in the local economy. Last week the Greek government claimed that the country may lack 110 bln. euro allocated by the EU and IMF to cope with considerable state debt. Greece officials decided that the country needed a supplementary loan of 60 bln. euro. At present the national debt equals 340 bln. euro.

Deutsche Bank head Josef Ackermann said that the EU should provide Greece with further financial aid as Greece’s debt restructuring would be a big mistake which would bring about destabilization of the situation in eurozone. The final decision on whether the bailout for Greece will be boosted is expected to be made after the results of Greece’s budget examination are published.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română