Last week, US-based Goldman Sachs purchased $2.8 billion in Venezuelan bonds issued by state oil company Petróleos de Venezuela SA (PDVSA).

According to the Wall Street Journal, PDVSA issued the bonds in 2014, which mature in 2022. Goldman Sachs paid about 31 cents on the dollar for the bonds. The price represents a 31% discount on the trading Venezuelan securities maturing the same year.

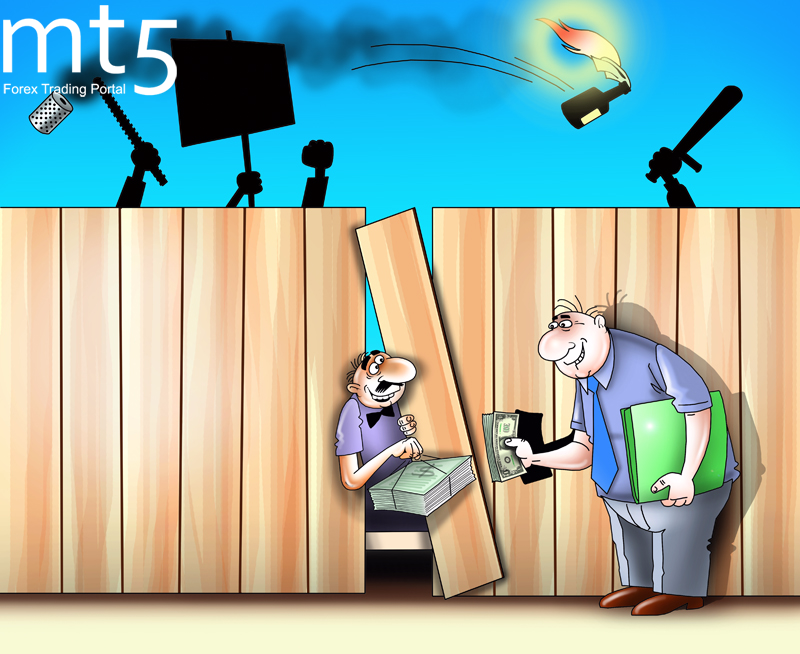

Some experts claim Goldman Sachs counts on bonds more than doubling in price in the event of a change of power in the country.

Some media report that the circumstances could push the United States to finance the war to prevent Venezuelan oil from falling into the hands of Russia and China.

Today, Venezuela's total debt is estimated at $66.28 billion with the yield of 1-year bonds almost reaching 50%. Thus, investors say the default is a sure thing. Even the country’s 20-year bonds are paying more than 20% yields.

Venezuela’s economy is seen to contract by 3.5% this year, at a far slower pace than a 19% decline a year before.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română