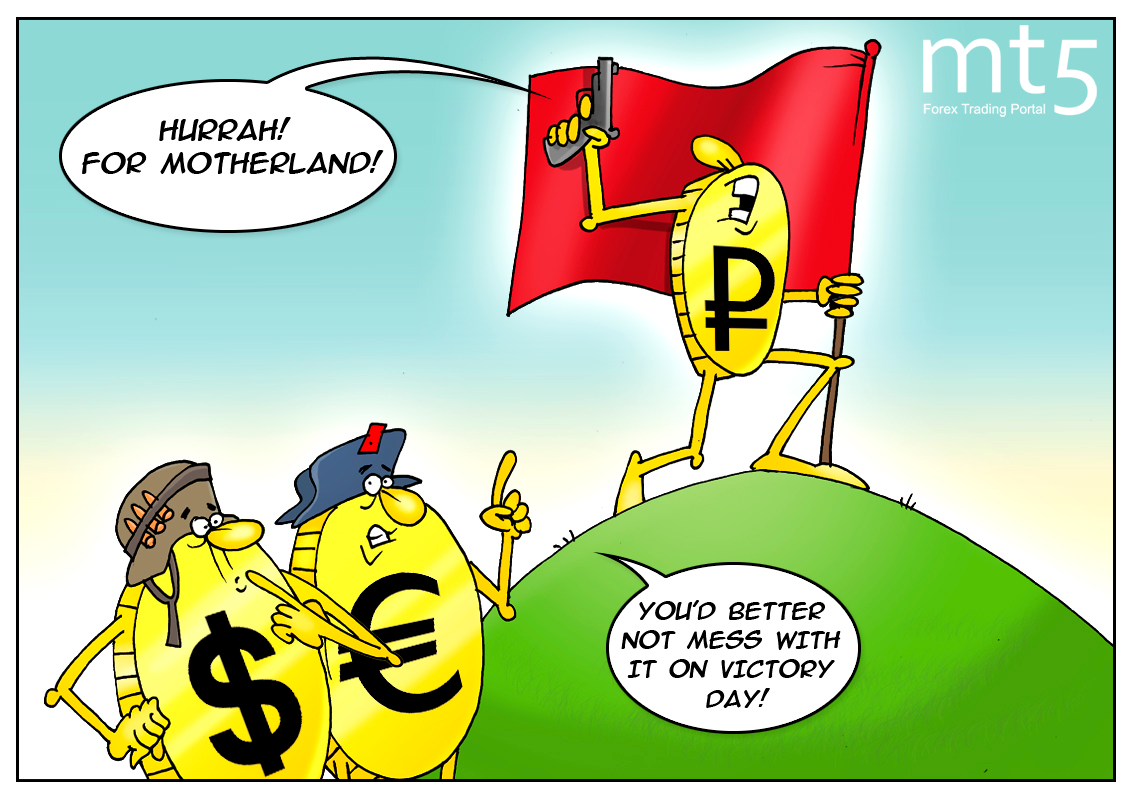

The Russian currency survived a string of the public holidays in May. Despite a recent downward correction of oil prices, the Russian ruble’s fall came to a halt and the ruble settled at 58 against the US dollar. Experts praise great resilience of the Russian currency which has been recently unaffected by high volatility in the oil market. Being a commodity currency, the ruble is very sensitive to oil prices. However, crude oil shed 9% in the first week of May, but the ruble lost just 3% in value.

The Russian government is not pleased about the overvalued national currency. The authorities are interested in a weaker ruble as it ensures bigger fiscal revenues from oil exports and offsets a negative impact of low oil prices. “The price of the Russian export oil blend has already declined to 2,800 rubles a barrel. In case oil does not reverse upwards in the nearest days, the Russian ruble is likely to weaken to 60-61 against the greenback,” analyst Vasily Oleinik shares his outlook. At present, the ruble is firmly trapped in a range from 58 to 60 against the US dollar, though its real forex rate should be 62 under the current oil prices. Therefore, the Russian currency is set to a further fall in the short term unless oil enters the bull market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română