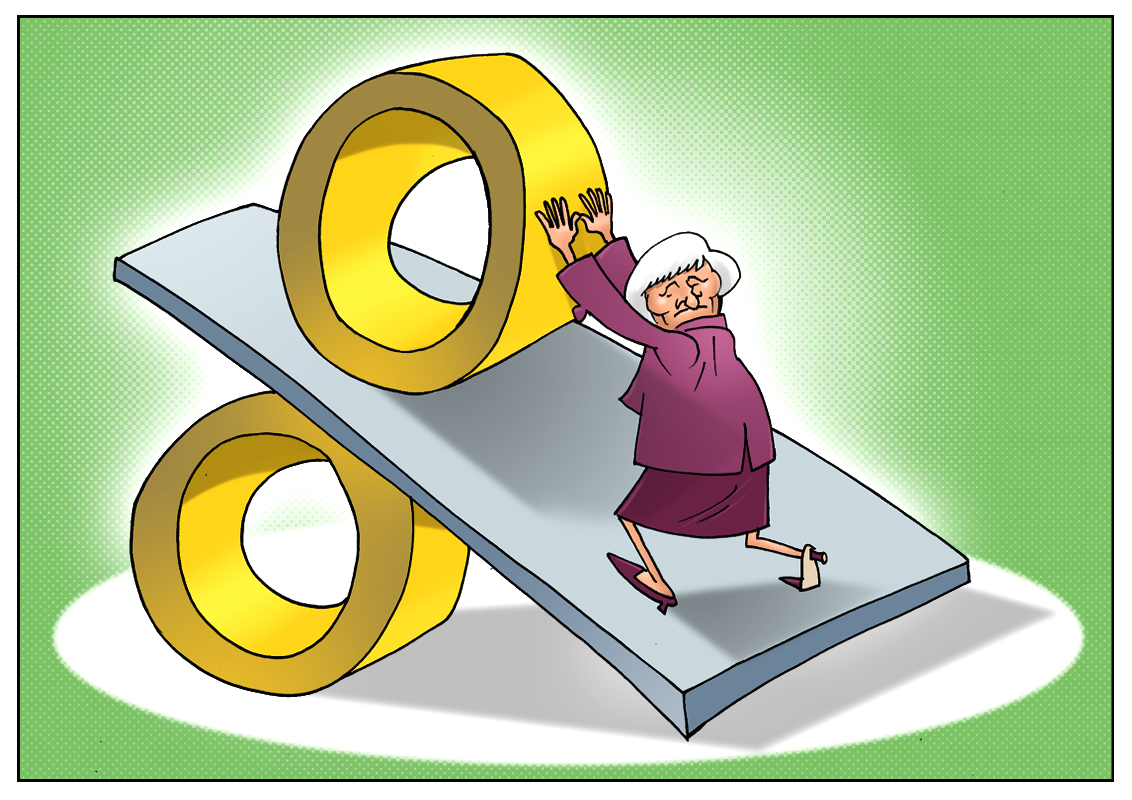

As it was widely expected, the US Federal Reserve voted to raise the key interest rate by 0.25 percentage points at its 2-day Federal Open Market Committee (FOMC) March meeting. The rate will be in the range of 0.75 to 1.00 percent. "The simple message is the economy is doing well," Federal Reserve Chairwoman Janet Yellen said. "We have confidence in the robustness of the economy and its resilience to shocks."

One of the reasons for such a decision was the pace of inflation which neared the Fed’s target level of 2 percent in the recent quarters. Meanwhile, experts noted that the US Federal Reserve uses favorable conditions in the financial markets instead of speeding up the tempos of the rate hike. The FOMC virtually unanimously voted to raise the key interest rate; one out of nine members disagreed and suggested leaving rates unchanged. The Fed maintained its key interest rate at 0 percent since December 2008. Then it raised the funds rate in late 2015 and 2016. Many investors and analysts expected the Fed to hike the rates during that meeting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română