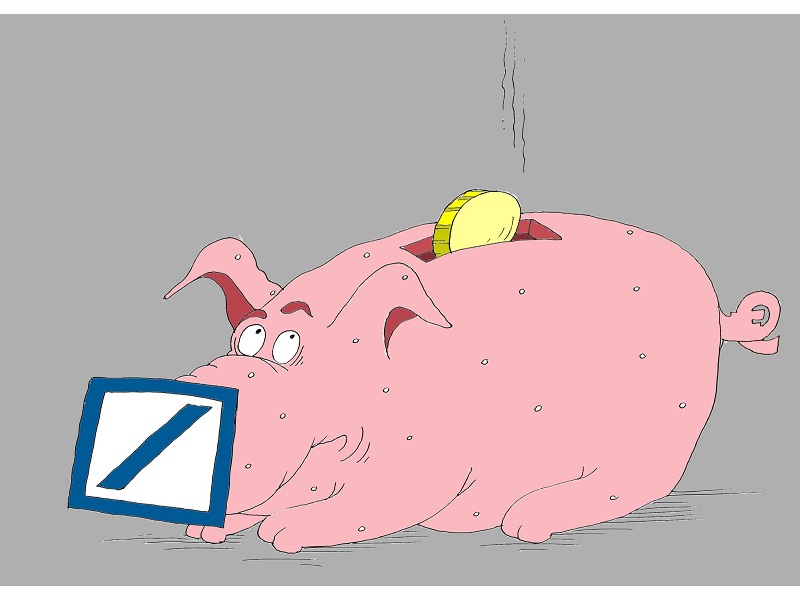

On March 5, Deutsche Bank AG said it had plans for an 8 billion euro capital increase. The move is aimed at reaching the core capital ratio of 14%. The bank announced as well that its Global Markets and Corporate & Investment Banking divisions will be merged into a single Corporate & Investment Bank.

It is the third time Deutsche Bank is raising capital over the past four years. Previously, it incurred multi-billion expenses to settle the regulators’ claims.

The capital increase, expected to be launched on March 21 and run through April 6, will comprise the issuance of new shares. Over the next two years, the bank expects to get up to 2 billion euros of additional capital accretion from asset disposals.

Deutsche Bank will also sell a minority stake in Deutsche Asset Management, its asset management business. The financial institution’s costs will be reduced to approximately 21 billion euros by 2021 from 24.1 billion euros. The bank will also combine Postbank and Deutsche Bank’s Private & Commercial clients business.

“Our decisions are a significant step forward on the path to creating a simpler, stronger and growing bank,” John Cryan, Chief Executive Officer, said.

Marcus Schenck, CFO, and Christian Sewing, CEO of Germany and Head of Private, Wealth & Commercial Clients, are appointed Deputy CEOs.

Deutsche Bank said that the capital increase will reinforce its financial strength substantially and position it for significant growth.

Last year, the bank reduced net losses to 1.4 billion euros from 6.8 billion euros. Earnings of the financial institution fell by 10% to 30 billion euros. At the end of 2016, Deutsche Bank reached a $8 billion deal to settle the UK and US probes.

Deutsche Bank shares fell last year on mounting concerns about its financial position. However, shares have almost doubled over the past six months. According to experts, the bank needs a $5 billion to $10 billion capital increase to comply with all requirements for capital adequacy and to form reserves in the event of new penalties.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română