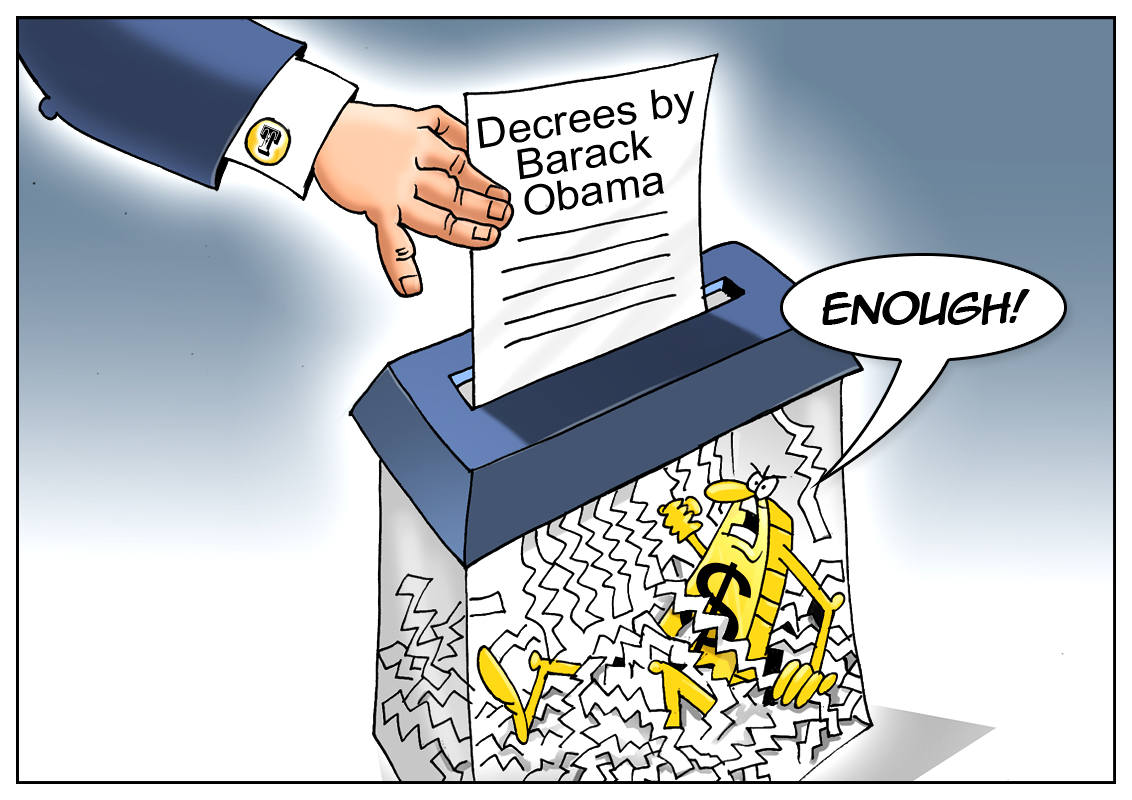

The US dollar has given up the rapid post-election rally. However, it is too early to bet on the dollar’s weakness in the long term. Meanwhile, investors have been split on the greenback’s direction. In the wake of Trump’s victory in the US presidential election, the US dollar gained momentum as investors were inspired by massive fiscal stimulus pledged by Trump. Since then, the dollar was following a steady rally which took it to the levels last seen in 2002. In the run-up to Inauguration Day and afterward, the US dollar went into a nosedive. The US currency is still trading broadly lower amid Trump’s protectionist rhetoric.

The new US President has already decided to exit from the Trans-Pacific Partnership trade deal (TPP). Now he is going to revise the North American Free Trade Agreement (NAFTA). Besides, Donald Trump is considering a 20% border tax on imports. With this crucial measure, the President and his Republican colleagues aim to bolster manufacturing in the US and add new jobs. The currency market responded with sell-offs of the US dollar. US Treasury secretary nominee Steven Mnuchin said “an excessively strong dollar may have negative short-term implications on the economy.” Speaking about Trump-driven rally in the US stock market and the overvalued dollar, analysts call the developments “trading on illusions”.

Now the market realizes that the new US administration is determined to break with the strong-dollar policy. A weaker greenback makes American goods cheaper for foreign buyers, such as Europe and Asia, thus boosting US exports.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română