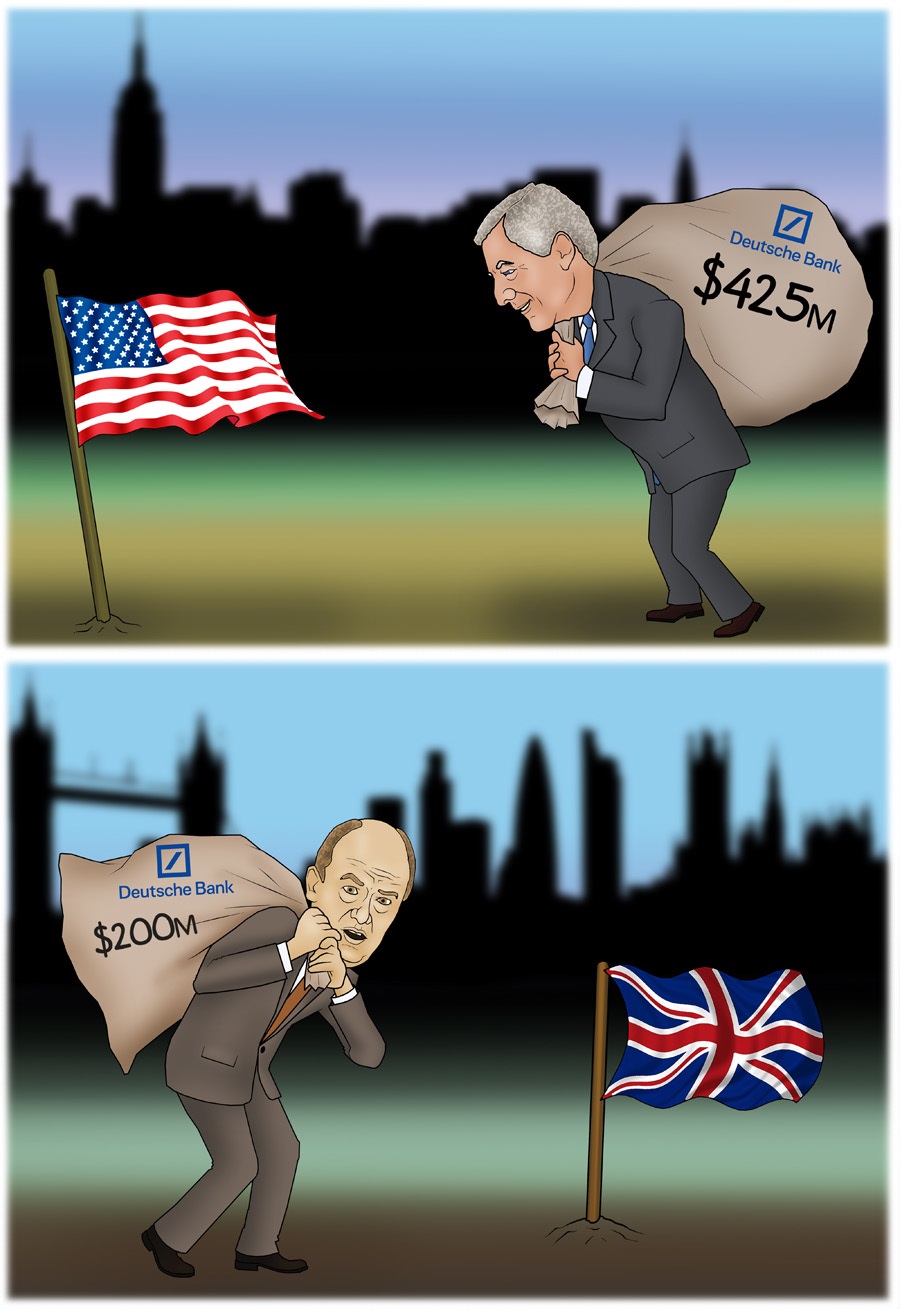

According to Reuters, Deutsche Bank has agreed to pay $425 million the New York State Department of Financial Services (DFS) in fines for so-called mirror trades carried out between 2011 and 2015. The scheme involved buying Russian stocks in roubles for a client and selling the identical value of a security for US dollars for a related customer.

Moreover, Britain's Financial Conduct Authority (FCA) will fine Deutsche Bank $204 million. The Bank organized $10 billion in sham trades that could have been used to launder money out of Russia, the latest in a string of penalties that have hammered the German lender's finances.

Blue-chip stocks for $2-3 million for at a time were bought in Moscow for roubles, shortly after that affiliate participants sold it at the London branch. Clearing was done by the New York operators. Thus, the US authorities investigated the case.

The New York State Department of Financial Services (DFS) considered that implementing the scheme Deutsche Bank acted in an “insecure and inappropriate” way; consequently the laws of the state were violated.

Deutsche Bank claims that it could not indicate the intentions.

Since early 2008 Deutsche Bank has paid over $13.9 billion in fines and charges. That made a considerable impact on the bank’s financial results. Meanwhile, the German government said that it has not intended to elaborate a bailout plan for the financial institution yet.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română