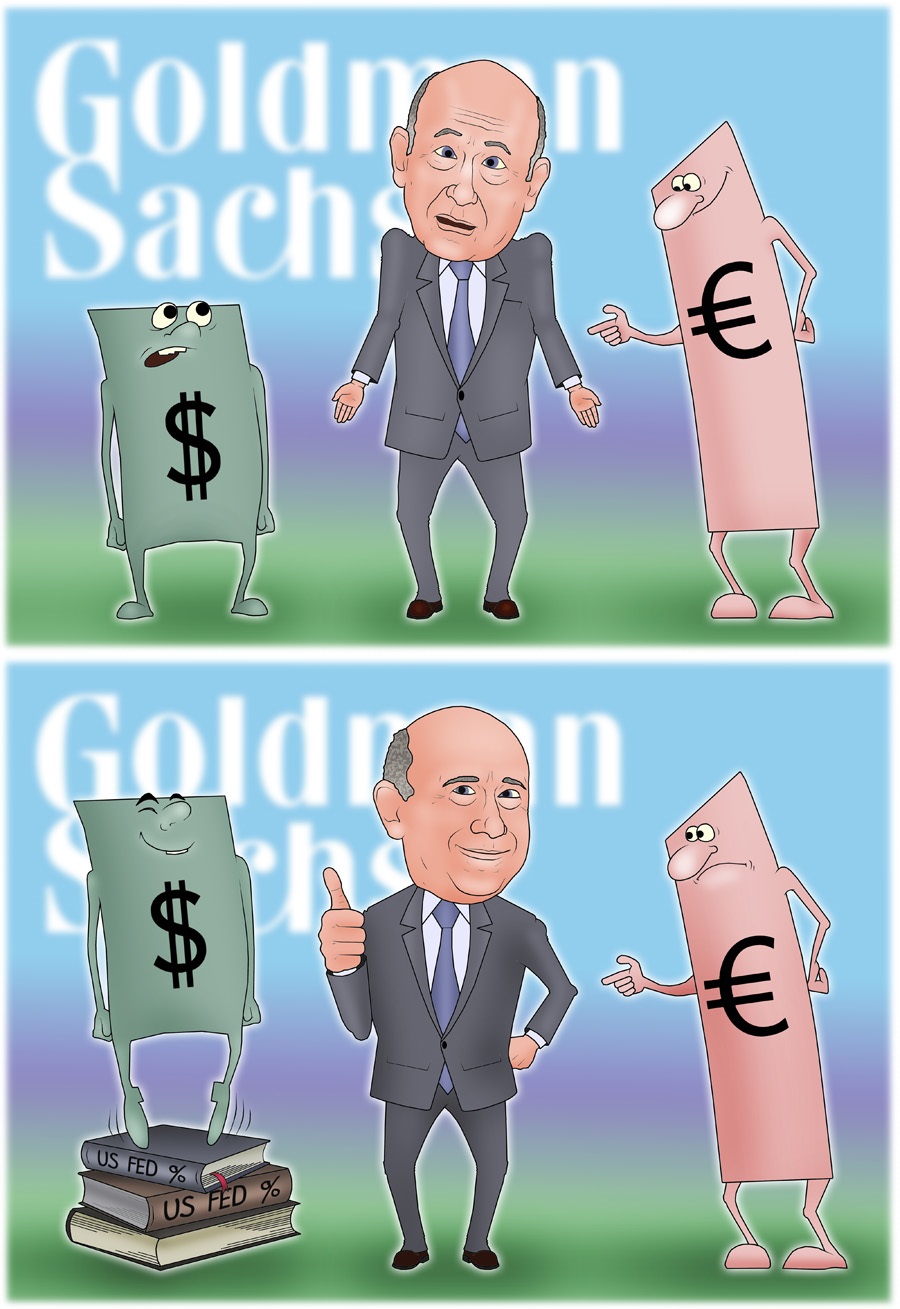

The US dollar is likely to reach parity with the euro in 2017, Goldman Sachs chief economist Jan Hatzius told in an interview to CNBC.

From his viewpoint, this scenario is highly feasible amid expectations for a few increases of the funds rate by the US Federal Reserve. Fed’s policy meetings are scheduled for June, September, and December.

The expert assumes a strong likelihood that the US Fed will decide to raise interest rates three times in 2017. In this case, the value of the US currency will be much higher for commercial banks in the US than in Europe. Therefore, it will encourage a further rally of the US dollar.

At the same time, Jan Hatzius does not expect the European Central Bank to tighten monetary policy until 2019. "The primary driver here is not valuation but really interest rate differentials”, the Goldman Sachs economist made a comment.

The US central bank lifted the key interest rate only once in 2016 that was announced on December 14. The funds rate was increased to 0.5-0.75% from 0.25-0.5%. Besides, the Fed policymakers set the agenda for three rate hikes in 2017. It is more hawkish than two hikes priced in by markets for 2017. The key interest rate is expected to be at 1.375% on average this year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română