As widely expected, the Fed’s decision to hike the rate triggered a rise in the greenback. This time the American currency managed to climb to a 14-year peak versus other majors. The US dollar began its ascending movements ahead of the FOMC meeting as most analysts were sure that the central bank will finally dare to tighten its policy.

The dollar exchange rate skyrocketed to highest levels since 2002 amid hawkish comments from the Fed policymakers. They signaled that markets should await another rate increase in the nearest future. The US economic indicators reflect healthy conditions, and the outlook is also positive, which makes a case for another rate hike. Specifically, another three rate hikes are expected next year. This is what the Fed’s post-meeting statement said. In the longer term, in 2018-2019 to be exact, economists expect the Federal Reserve to lift the rate three or four more times unless there is any economic turmoil.

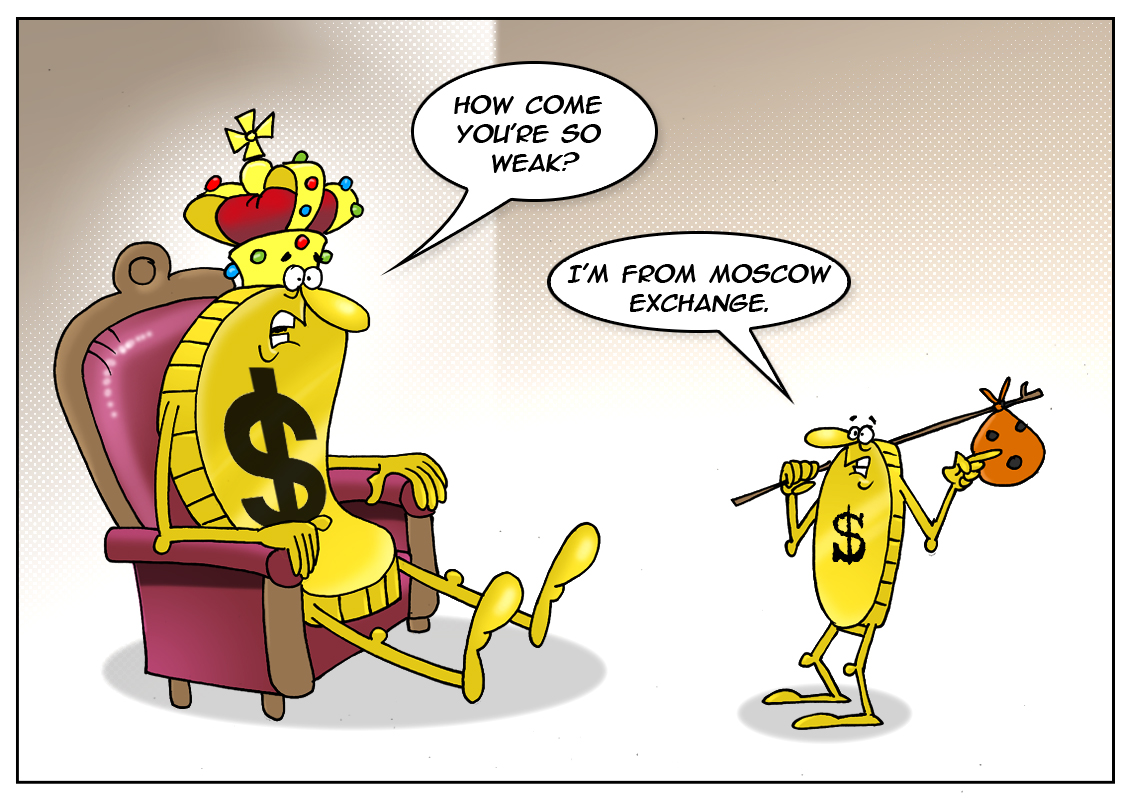

The Fed’s actions put oil prices under pressure. The commodity retreated to $53.5 per barrel, but then it managed to recover losses. Thanks to that, the Russian currency was able to withstand a struggle against the greenback. Moreover, the American currency lost part of its profits on the Moscow exchange.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română