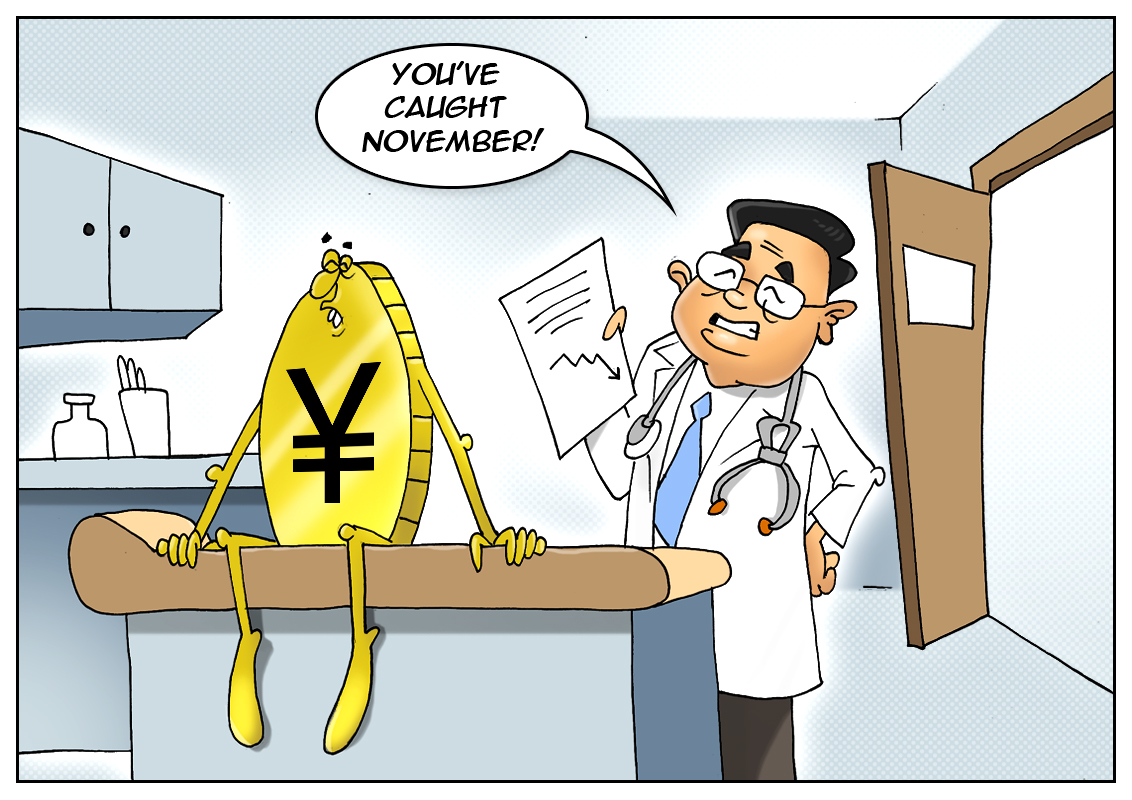

Reportedly, November turned to be the worst month for the yen in almost seven years. The Japanese currency along with the global markets was hurt in the aftermaths of Trump’s victory in the US presidential race. Additionally, the increasing likelihood that the Fed will tighten its policy in December put the yen under pressure.

Overall, the yen depreciated by 6.5% in November. The currency had been sliding for three straight weeks since November 4 which was the biggest fall since 1995. “Amid caution that the rise in the dollar and stocks may have come too far, uncertainty about an OPEC production cut and lackluster Black Friday sales in the U.S. and other negative factors have led to a pause in the Trump market,” chief FX analyst at Daiwa Securities Yuji Kameoka said. The expert pointed out that yields of the 2-year Treasury bonds have been increasing steadily and has already reached highest levels since 2010. At the same time, the US dollar advanced by 3.5% against the major currency basket at the fastest pace since May. Recently, the greenback has been paring its gains, but analysts are sure that this weakening is technical as there are no fundamental reasons for a pullback.

“The dollar will edge higher later in the week on favorable US employment conditions and political uncertainty ahead of Sunday’s Italian referendum on constitutional reform”, Elias Haddad, a currency strategist at Commonwealth Bank of Australia said. So, the last month of this year can become even worse for the Japanese yen.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română