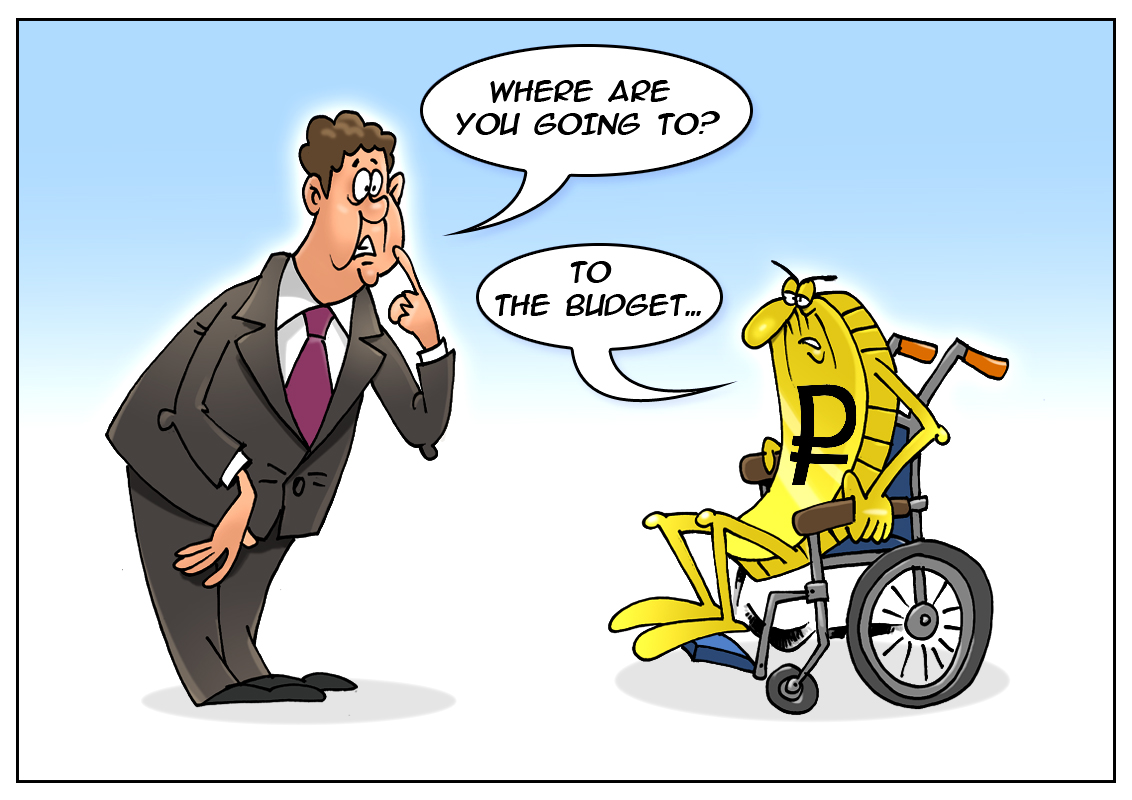

Russian top-level officials claim at recent international summits that the domestic economy is slowly but surely getting into gear. Meanwhile, Russian nationals have to survive high consumer inflation, shrinking wages, and low purchasing power. Some analysts say the government is still opting for more austerity measures rather than a genuine economic reform. The Kremlin is voicing concern that the Russian ruble is showing remarkable resilience despite the headwinds.

Indeed, domestic exporters are not interested in the strong national currency as they sell oil and gas for dollars and euros. To prevent the ruble from unwanted appreciation, the economy ministry allowed for the weak ruble in a draft budget for the next three years. In other words, the weak ruble is welcome to Russian policy makers. It means no measures will be adopted to reinforce the national currency in the short term. Russia’s budget for 2017-2019 is based on the assumption that oil will average $40 a barrel, consumer inflation will ease to 4%, and the national currency will weaken to 71.1 versus the US dollar by 2019. The ministry expects the ruble to trade at 67.5 against the US dollar in 2017. The ruble is to weaken to 68.7 against the dollar in 2018.

“As long as the global economy, financial and commodity markets come into balance, Russia’s economy is expected to recover gradually. GDP growth is assumed to enter positive territory in 2017 to reach 0.6%. The economy is to expand 2% in 2018-2019”, the ministry made comments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română