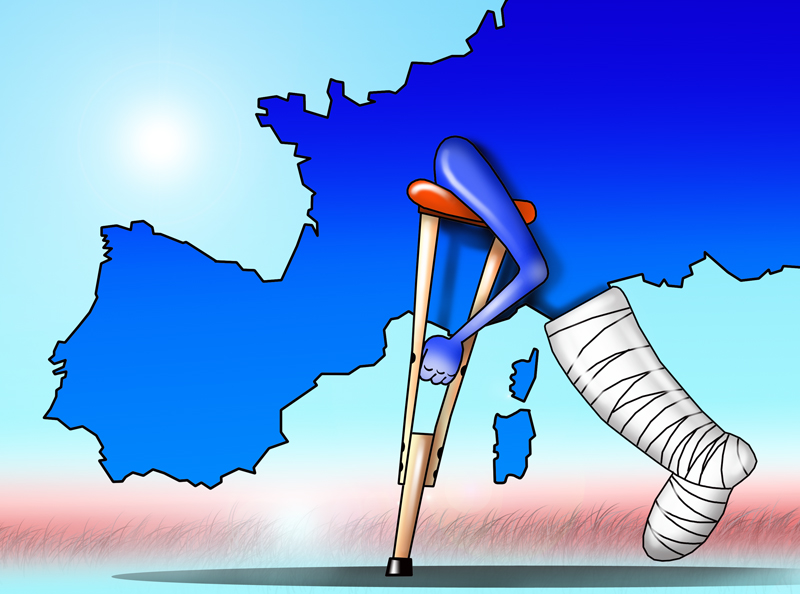

The European Central Bank allocates billions of euros to Italy; however, the country fails to recover keeping spending impressive amounts from the ECB.

In his first press conference this autumn, Mario Draghi said that transmission of the monetary policy has never worked better. But in less than a week, the Bank of Italy data showed that it is not as easy to transfer attractive monetary policy as regulators want.

Thus, the Bank of Italy's liabilities towards other eurozone central banks rose by more than 10% to 327 billion euros in August, topping a previous record high.

To recover its economy, Italy needs a weaker euro. According to Morgan Stanley’s calculations on fair value for the country, the euro is overvalued by about 15% in Italy.

Experts at Deutsche Bank say that the biggest political risk for the euro area is not politically paralyzed Spain or upcoming elections in France and Germany, but Italy and its referendum. Other analysts agree with this.

If Rome fails to take radical measures in the near future, the country which was one of the European Union founders will become one of the greatest risks for the euro area. According to analysts at Morgan Stanley, there is a 35% probability that Renzi’s referendum will be a success.

After the referendum it is most likely that a transitional government will be formed, perhaps even led by Renzi, and it will also deliberately delay the reform process.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română