Foreign central banks trimmed their US Treasury debt holdings by $17 billion in August to the lowest level since 2012. So far the situation is only getting worse. The latest data showed that there is a massive sell-off of US Treasuries among global central banks. Their holdings of US debt fell by $27.5 billion for the week, the biggest weekly decline since January 2015. This pushed the total amount of custodial paper to $2.83 trillion, the lowest since 2012.

Moreover, there was $335 billion in Treasury selling in the period July 2015-June 2016. After a few months, the number has risen to a new all-time high $343.4 billion.

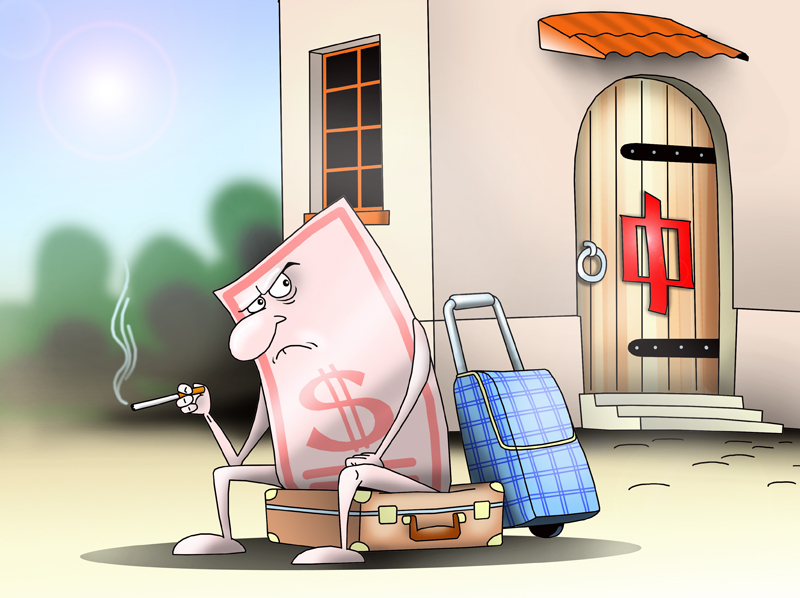

The biggest seller was China. The country’s balance of US government debt was down $22 billion in July 2016 compared with the prior month.

Thus, it is increasingly obvious that foreign central banks and sovereign wealth funds holding US paper are liquidating it at a very fast pace.

Speaking of China, it is particularly the way the government wants to stop its currency’s devaluation. Meanwhile, Saudi Arabia sells US debt to finance its budget deficit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română