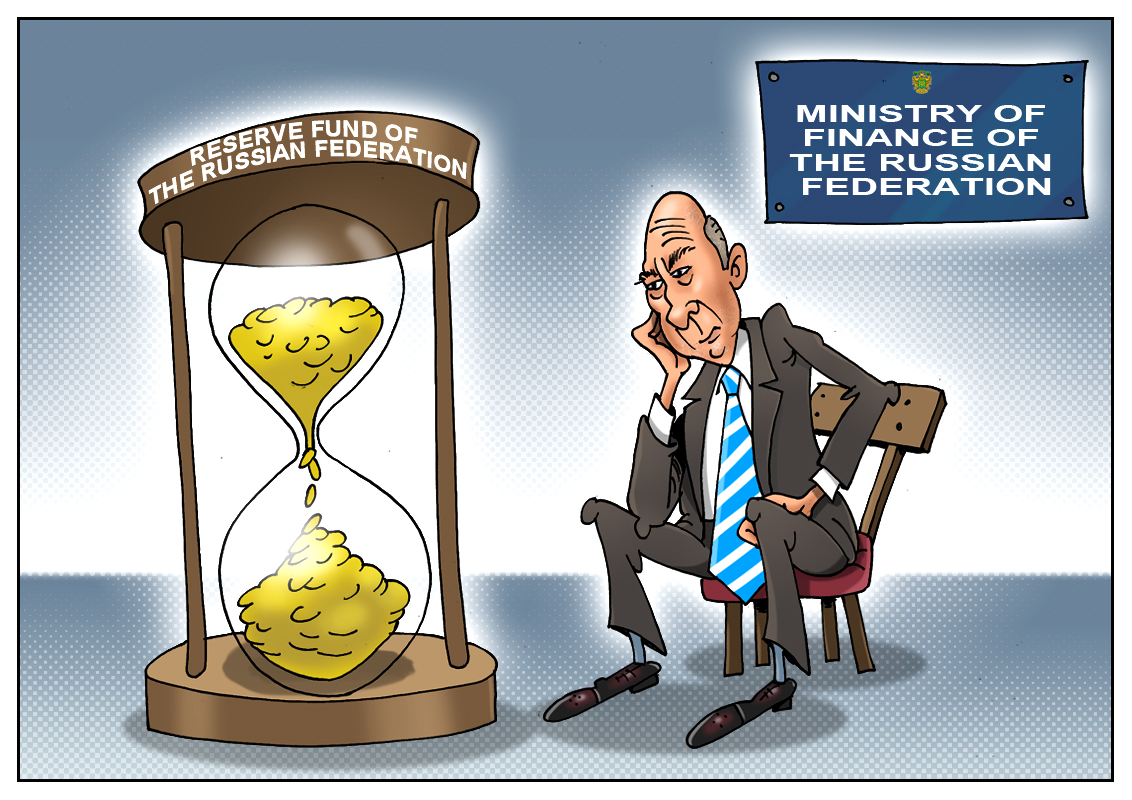

After almost two years in recession, Russia’s reserve fund will be depleted in mid-2017. The available rainy day fund will have to be allocated for filling the budget deficit gap. According to estimates of Russia’s finance ministry, the reserve fund will dry up completely by the end of 2017. Once the reserves are depleted, the Kremlin will have to turn to the National welfare fund. “The Reserve Fund, as I remember, will be used up over the next year," deputy finance minister Alexei Lavrov said. It is not settled yet that the public budget will be replenished entirely by the reserve fund. The finance ministry is considering other sources, in particular domestic borrowings, the official stated.

The massive state budget deficit was caused by a slump in oil prices and Western sanctions in response to Russia’s brutal intrusion into Ukraine’s affairs. The government's reserve fund is designed to cover shortfalls in the national budget at times of low revenues from oil and gas, the main export commodities. The Reserve fund equaled $87 billion in September 2014, just before oil prices started to collapse. As Russia is shedding cash at an alarming rate, it is no wonder the fund will shrink to almost zero by mid-2017. It means that the government has to resort to extreme measures.

Apart from the Reserve fund, Russia has solid gold and forex reserves to cushion the ruble from a further fall. The welfare fund totaled $73 billion in early July. The fund is not intended to cover budget gaps, but rather to finance future pensions and large-scale investment projects.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română