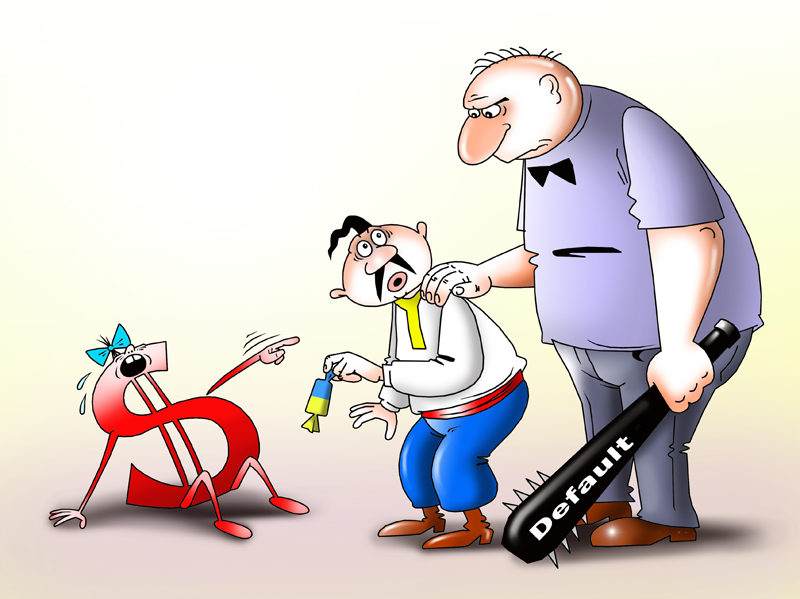

S&P Global Ratings has lowered its long-term issuer credit rating for the city of Kyiv, Ukraine's capital, to 'CC' from 'CCC+', with a negative outlook. The agency said the decision is based on the government’s move to restructure its local currency bonds.

The negative outlook reflects the agency's view that the failure to pay debt on bonds in time is almost inevitable. If Kiev does not fulfill the next payment on the bonds in December, the rating will be lowered to 'D’. In case, the government will fully redeem the bonds in national currency, S&P can raise the rating. However, such a scenario is unlikely, experts say.

In September 2015, the Finance Department of Kyiv City State Administration extended the maturity of the city's domestic bonds totaling UAH 4.29 billion by 12 months.

According to the latest data, Kiev's debt for utility services exceeds UAH 1 billion, of which UAH 917.4 million accounted for Kiev debt for consumed electricity to 'Kyivenergo'.

Meanwhile, Prime Minister of Ukraine Vladimir Groisman said that the government will not even discuss the budget sequestration.

The next meeting of the IMF Board of Directors on the allocation of the next tranche for Ukraine is scheduled for September 14.The financial assistance involves allocation of $17.5 billion of credit for 4 years.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română