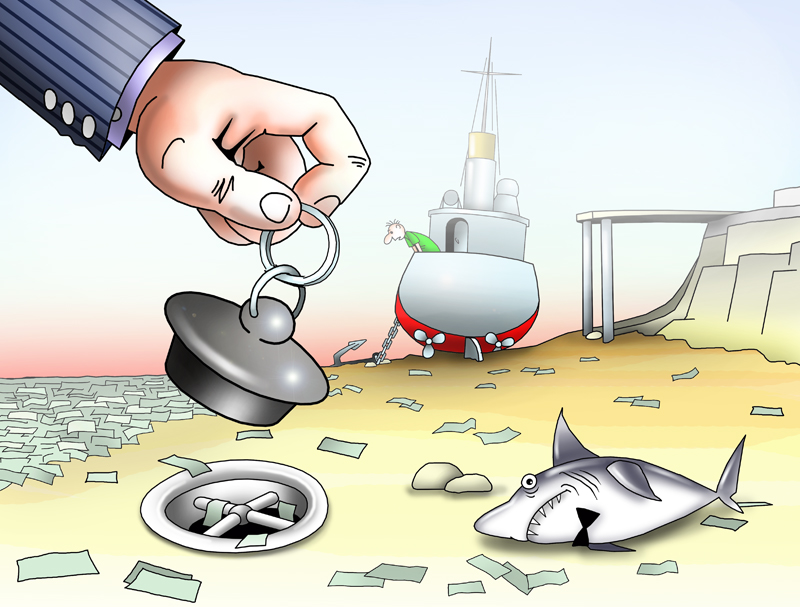

Over the past few years, investors have been piling into emerging market assets. However, this situation has started to change and the appetite is expected to wane, thus affecting emerging markets’ economies.

“As political risks continue to increase in emerging markets countries, we will see a decrease in both the number of supportive monetary policies undertaken by the G20 economies as well as the overall level of geopolitical uncertainty that currently exists in the developed world,” said Eric Simmons, analyst at Global Risk Insights (GRI).

Increased investors’ appetite for EMs was caused by the unrelenting nature of accommodative policies, which put downward pressure on the US dollar. Meanwhile, this boosted oil prices and, consequently, had a positive impact on emerging markets.

Moreover, economies of China, Russia, Turkey, Brazil, Brazil, Qatar, and the UAE quickly recovered after the world’s financial crisis, adding further to global investors’ interest in EMs.

However, situation on emerging markets has markedly deteriorated after the oil price collapse and sharp appreciation of the dollar. In 2016, things became worse amid growing geopolitical tensions, including a coup attempt in Turkey, an impeachment proceeding in Brazil, a refugee crisis in Syria, and bombings in Thailand. So central banks are cautious and unwilling to change their monetary policy course.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română