Economists note a slowdown in China’s GDP growth recently. However, the rate of increase is still quite strong. China accounts at least one-third of the world's growth.

Ahead of the G20 summit in September, there are calls for reforms in China, however the country’s internal risks are rather high.

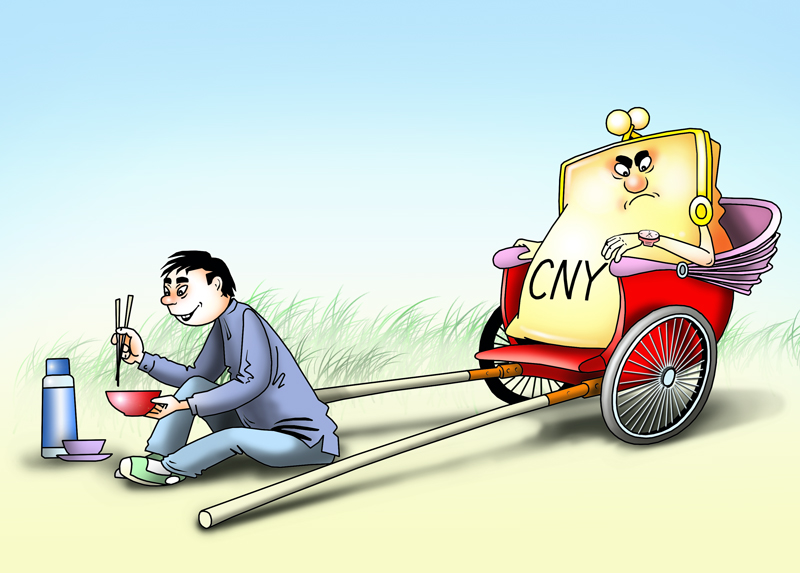

According to IMF first deputy managing director David Lipton, Chinese domestic credit continues to expand at an unsustainable pace, with corporate debt accumulating to dangerous levels.

According to the International Monetary Fund’s annual report, China’s credit is growing about twice as fast as its output. A rapid increase is recorded in both the non-financial private sector and in the financial sector that remains far from being transparent.

Experts say these are warning signs for the Chinese economy and the government has realized the problem. But, to solve the crisis, global reforms are needed, which are difficult to implement. The reforms should address the root causes of the corporate debt problem, such as budget constraints for state-owned companies, government guarantees of debt, and excessive risk taking in the financial sector.

Analysts claim it is high time for reforms in China. Banks’ balance sheets still have a relatively low volume of non-performing loans. The government maintains high buffers: debt is quite low, and foreign-exchange reserves are rather high.

Experts believe China can cope with the debt problem before these buffers are exhausted. But it must start now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română