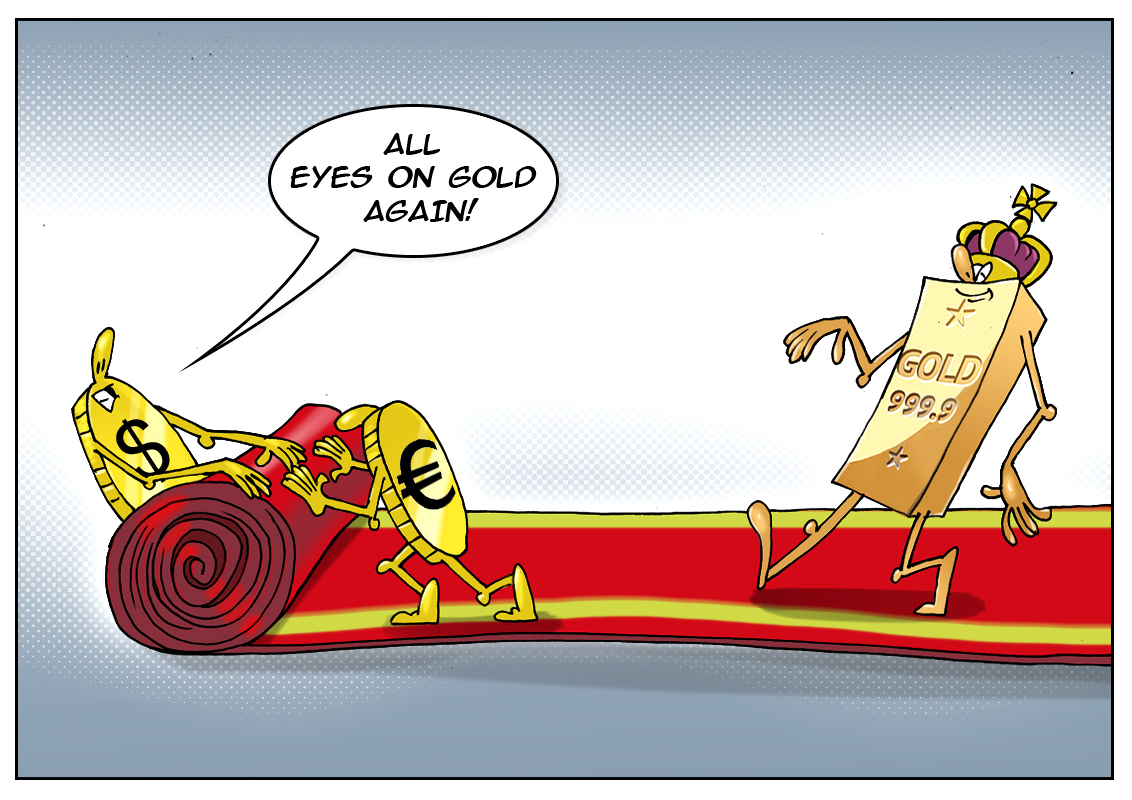

Gold prices rise on the back of growing interest in this asset. The precious metal has always been considered the instrument, in which funds can be invested safely, especially in hard times. That is why gold is called a safe-haven asset. Nowadays, the metal trades near multi-month highs, and demand for it keeps increasing. The World Gold Council reported that global investment demand for gold surged by a whopping 141 percent in the June quarter of 2016 in annual terms. However, demand in the technology sector dropped by 3 percent in the second quarter of 2016, and global jewelry demand shrank by 14 percent.

Investors are extremely concerned by the current situation in global markets and prefer gold as the safest instrument. This proved to be the right decision. Since January 2016 the gold price has soared by almost 30 percent. Statistics reflect gold’s popularity. During the first six months this year, overall global gold demand totaled 1.550 thousand tons, while investment demand made up 1,064 tons, or around 60 percent of the overall figure. For the first time on record, investment became the largest component of global gold demand. The American gold eagle is still at the peak of popularity. Sales of this gold bullion coin jumped by 84 percent, or by almost 500 tons, in the first half of 2016. It seems gold is going to be in the lead for a long time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română