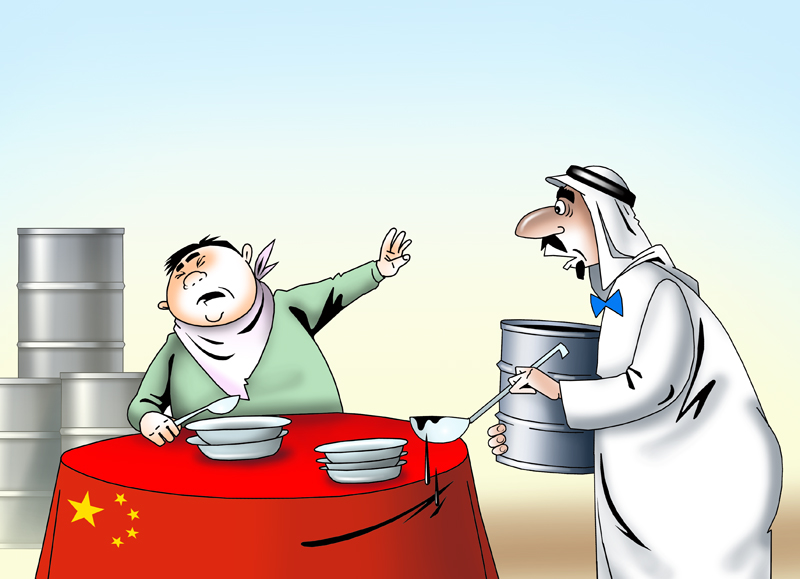

This week Chinese oil market showed mixed performance, thus triggering questions whether China’s economy would contribute to oil prices recovery or not.

Meanwhile, analysts are still bearish on China.

According to the latest report of the International Energy Agency (IEA), China’s oil demand increased by 1.4 million barrels per day in the first quarter of 2016, while in the second quarter it grew by a modest 0.9 million barrels per day.

That was mainly due to subdued demand in China and Saudi Arabia. Particularly, China’s demand for gasoline, diesel fuel, bitumen and crude oil was well below expectations.

According to S&P Global Platts, Chinese oil demand contracted by 7.2% to 10.88 million barrels per day in May. Meanwhile, the country’s imports plummeted by 41% from the same month a year ago.

At the same time, China processed a record 11 million barrels per day of oil in June, up 3.2% from June 2015. However, given that the domestic demand was far below that figure, China had to boost exports of refined fuels by 38% on a yearly basis.

In 2016 China’s oil production fell by 4.6%, the lowest level since 2012.

At the moment, state-run oil companies have to cut spending. Earlier in the year, Petro China even closed several unprofitable deposits.

In the meantime, the country’s strategic oil reserves were almost filled at the end of July. That means China is in no need to import more oil, so total imports could shrink by 15%.

Previously, China played an important role in the oil market balancing. But experts say China’s price pressure could dramatically increase in the second half of the year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română