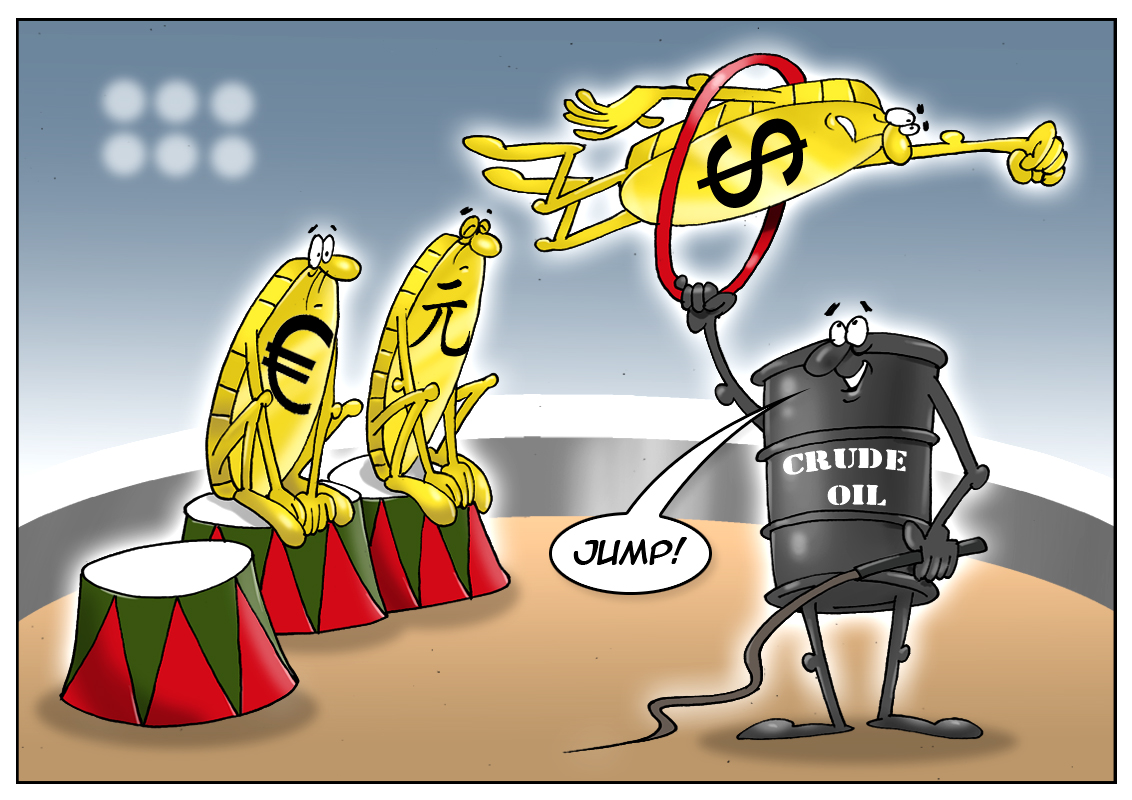

Oil-linked currencies are rising in value on the back of recent developments in the oil market. Indeed, currencies of emerging markets and oil exporting countries are benefitting from the persistent oil rally. The Canadian dollar, Russian ruble, and South African rand are among those which were badly hurt as a global oil glut has dragged prices lower and lower for most of the last two years. The commodity reached a nadir of $27 a barrel in February 2016.

At present, vulnerable commodity currencies are gradually gaining ground as crude has hit yearly highs. So, the Australian dollar and New Zealand dollar have recovered to 10-month highs against the US currency. The Canadian dollar has soared to a 9-month high against its American rival. The Russian ruble has been firmly in an uptrend since November 2015. The South African rand has been hovering at the highest level so far this year. This owes much to recovering oil prices that surged almost 50% since early April.

To sum up, crude prices received a boost amid recent data on a steady decrease in US oil rig count, higher demand, and slowdown in shale oil production in the US. "It is quite amazing how oil prices have recovered from lows," said Niels Christensen, FX strategist at Nordea. "As long as oil remains above $43 a barrel we think commodity currencies will remain supported."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română