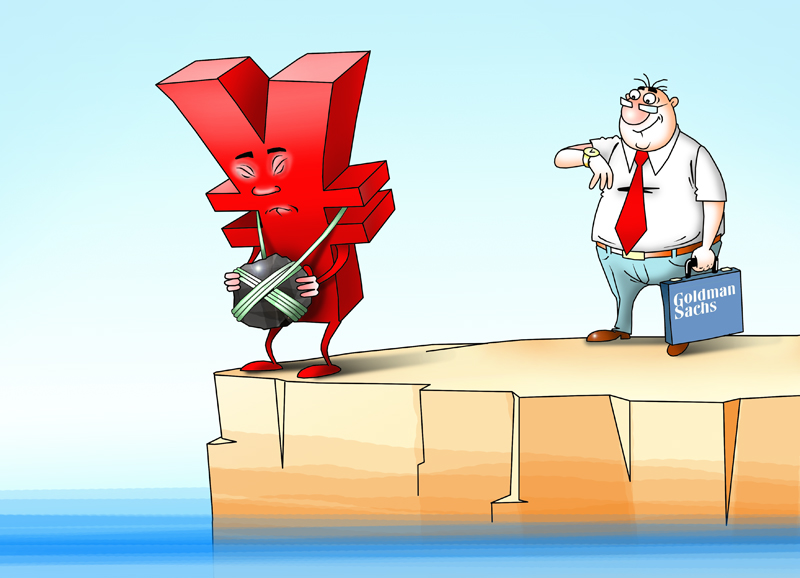

Goldman Sachs analysts think that the BoJ is not going to adhere to the agreement reached by G20. Members of G20 decided not to stick to a competitive devaluation. However, the BoJ, on the contrary, is ready to start aggressive depreciation.

According to Goldman Sachs report, the BoJ can implement easing by increasing ETF purchases in order to improve business confidence. Experts think that the market is ready to accumulate purchase amount from 3.3 billion yen to 5-6 billion yen per year.

During last several days the yen weakened significantly against the greenback. However, according to Goldman Sachs, the dollar will cost 130 yen within a year. The BoJ needs to reaffirm that its monetary policy works. Otherwise, the market participants can make a conclusion that the BoJ deflected from its goal to reach 2% inflation. Thus, the regulator has to continue easing policy for some time more.

Governor of the BoJ, Haruhiko Kuroda cannot yield, especially now, when money is being withdrawn from the Japanese investment funds. The investors are afraid that the regulator will lose control over the situation.

Goldman Sachs analysts think that the BoJ doesn’t have any way out. After negative rates were introduced in January this year, yen lost 8%. This dynamic was also caused by revaluation of the Fed’s rate hike pace. At the same time it also shows investors’ confidence in the fact that the Japanese regulator won’t have any room for maneuver.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română