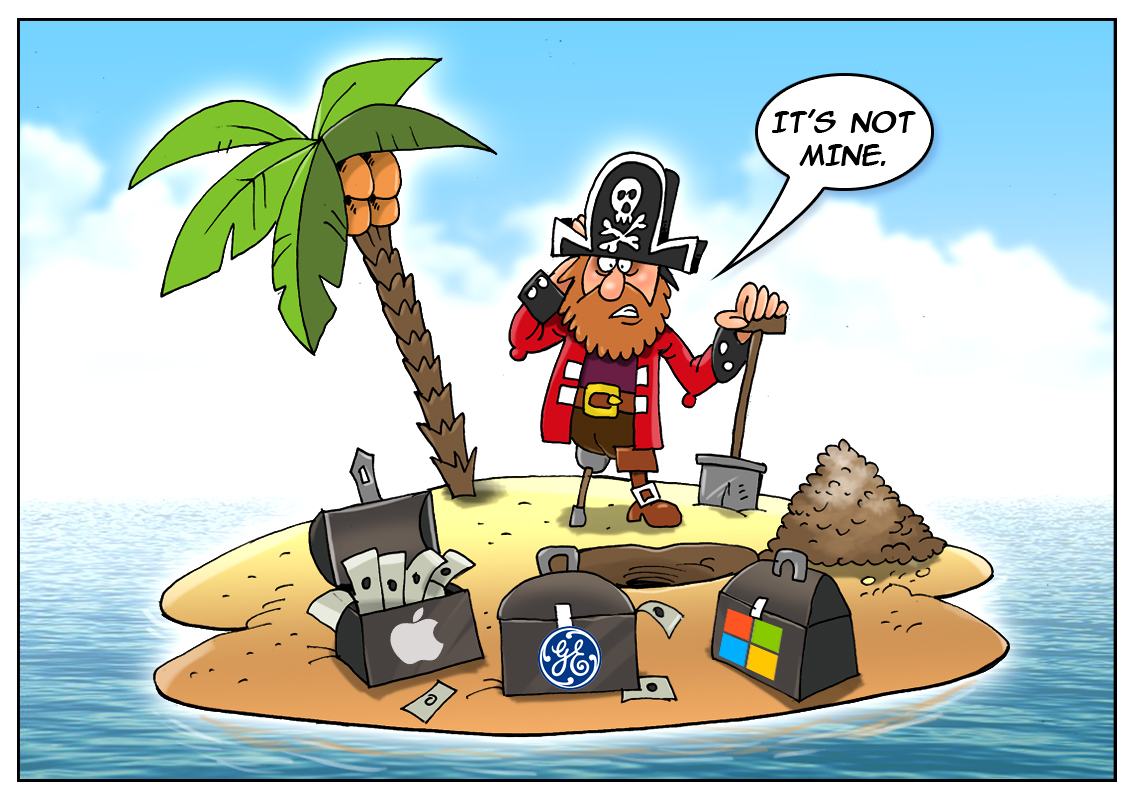

Recently, offshore scandals are dominating headlines in reputable mass media. Criminal and private investigations reveal that unexpected big names and top companies are involved in large-scale tax evasion.

Anti-poverty charity Oxfam carried out analysis of financial affairs of 50 US corporations. The survey reads they have a whopping $1.4 trillion stashed in offshore tax havens. Three technology giants, Apple, General Electric, and Microsoft, are the leaders of the anti-rating. The world-famous companies are widely exploiting opportunities to avoid billions of dollars in tax each year. Interestingly, Panama banks are not popular among the biggest US businesses. Oxfam found out that British overseas territories such as Bermuda won favor with US companies. On the whole, the use of tax havens allowed the US firms to reduce their effective tax rate from the US headline rate of 35% to an average of 26.5% between 2008 and 2014.

Legendary hi-tech giant Apple tops Oxfam’s list with $181 billion held offshore. General Electric comes second with $119 billion stored in tax havens. Computing firm Microsoft is ranked third with $108 billion hidden offshore. The top 10 also includes pharmaceuticals giant Pfizer, Google’s parent company Alphabet, and Exxon Mobil. In light of these revelations, statements of Apple CEO Tim Cook are now viewed from a different angle. In response to charges of tax dodging, Cook said “it’s total political crap”. "There is no truth behind it. Apple pays every tax dollar we owe. We pay more taxes in this country than anyone," he noted in an interview in December 2015.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română