At the end of October, the Wall Street Journal published an article written by Michael Spence and Kevin Warsh of Stanford University who argue that the Federal Reserve’s $3 trillion bond purchase program has in fact caused a decline in commercial investments.

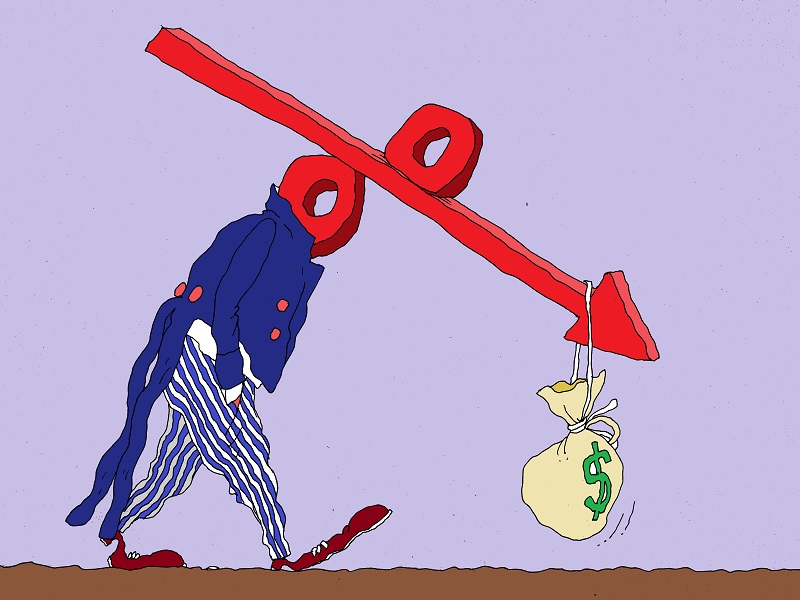

The authors of the op-ed mentioned above believe that the quantitative easing (QE) program has made stocks and bonds more attractive for investors. The rise in their capital value thereby triggered a capital outflow from more productive long-term investments into the ‘real economy’, resulting in reduced investment growth rates, weaker productivity and ‘frozen’ wages.

PIMCO co-founder Bill Gross agrees that low interest rates paralyze the financial market, leading to significantly lower business investments and slower US GDP growth.

At the same time, the Fed’s near-zero interest rates can hardly be claimed responsible for today’s economic problems as lower prices always tend to boost, rather than hurt, demand.

Joseph Cagnon of the Peterson Institute for International Economics believes that it is weaker spending and smaller-sized investments that are keeping the benchmark federal funds rate low, not the other way around.

It is no secret that the Fed really wants to start raising its long-term interest rates. Nevertheless, the US regulator considers it best to wait for the moment when the liftoff might happen in a natural way, as a consequence of faster economic growth.

Seeking out easy answers to America’s economic problems, financial commentators are blaming the central bank for all of the troubles. However, the greatest hindrance to a stronger economic recovery in the US remains the weak aggregate demand.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română