Attempts of Japan’s Prime Minister Shinzo Abe to lead the country out of the recession have not produced any results in general. It was confirmed by the data on the third quarter that showed a 0.2% decline in the Japanese GDP.

In the second quarter, the country’s economy contracted by 0.3% and by 0.8% in annual terms. Japan slipped into recession again.

Experts note that since Shinzo Abe became the Premier, recession has hit the country for the second time. It was the fifth recession in five years.

In the light of declining demand from China and other consumers, a drop in investments causes a slowdown in economy. In particular, business expenditure dropped by 1.3% in the quarter. It was the worst result since the second quarter 2014. Meanwhile, domestic consumer demand, which amounts to about 60% of GDP, increased by 0.5%.

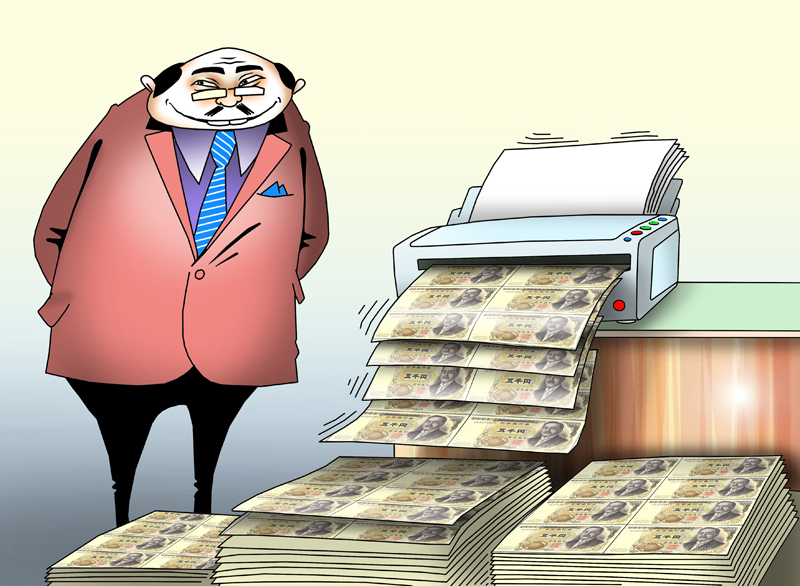

Some analysts suppose that the plans of the central bank mainly concern the stock market. Since the implementation of Abe’s policy, the Japanese economy expanded marginally, while the stock market and the Bank of Japan’s balance account showed almost vertical growth.

When a regulator raises prices for assets mainly owned by the rich, financial inequality rises. Quantitative easing has already influenced financial asset prices all over the world. It turns out that the rich benefits from such a policy much more than less successful people.

For instance, in 2015, the count of single households without financial assets climbed to almost 48%, thus reaching its highest levels since 2007. In 2014, the count totaled only 39%. Households with two or more people who held assets increased their well-being to a record high of 18.2 million yen or $149,597.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română