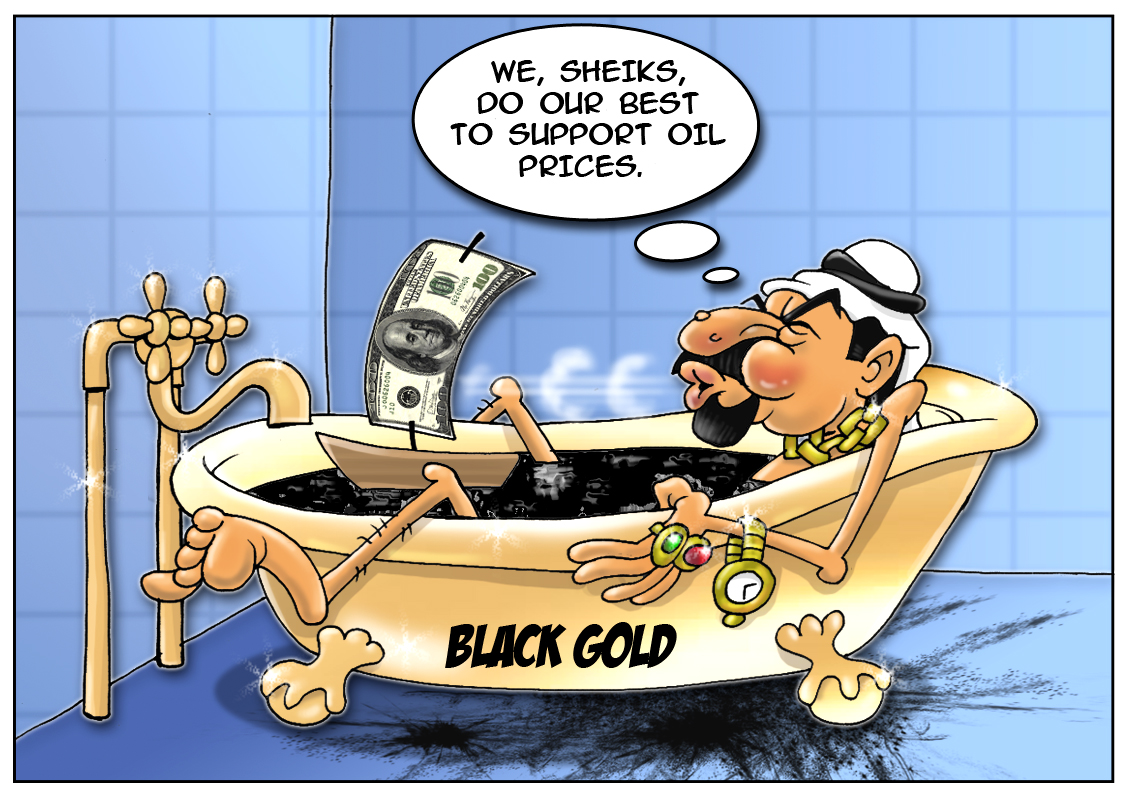

Experts at BNP Paribas and Societe Generale say that if Saudi Arabia wants to keep crude oil price above $100 a barrel, it needs to cut production of black gold. According to the latest report, the world’s largest oil importer made a submission to OPEC that showed the country cut its crude supply by 408,000 barrels a day. Thus, Saudi Arabia neared Australia in terms of oil production. Moreover, the fall in price is also affected by an increase in oil production in Nigeria, Iraq and Iran. Supply grows, causing a decline in price. The increase has led to crude oil futures falling below $100 for the first time since June 2013.

Analysts predict a decrease in oil production in Saudi Arabia approximately at the same pace. This is necessary for the country to stabilize crude oil price on the global market. However, it never rains but it pours. In addition to growing volumes of production that Saudi Arabia’s competitors have, negative influence is caused by the shale gas boom in the United States. That is particularly why there is the weakest crude oil demand since 2011. Report of the International Energy Agency reveals that non-OPEC production is growing at its fastest pace since 1980.

The market replied by a predictable decline in prices to a glut in the world oil market. Most partner countries of OPEC in the Middle East are forced to follow the trend by selling oil at a lower price. “We are swimming in crude, and they know that better than anyone because they are the biggest exporter,” Mike Wittner, the head of oil market research at Societe Generale in New York, said. “History shows that the Saudis will just do what’s necessary.”

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română