Trading plan for 28/09/2017:

US Dollar's rally continues on Thursday, albeit at a slower rate. Trump's announcement of the tax reform was more or less in line with expectations, and he fits into the last positive sentiment around the US Dollar. EUR/USD is getting closer to 1.1700, USD/JPY is on the way to breaking through yesterday's highs at 113.23.

On Thursday 28th of September, the event calendar is light in important economic releases, but market participants will keep an eye on Bank of England Mark Carney speech, Reserve Bank of Australia Assistant Governor Guy Debelle speech and Consumer Confidence from Eurozone and Preliminary CPI data from Germany. During the NY session, the US will release Final GDP, Goods Trade Balance and Unemployment Claims data. Later during the day, Vice Chairman of the Federal Reserve Stanley Fischer will give a speech.

GBP/USD analysis for 28/09/2017:

The data calendar is fairly thin today, so the market focus will probably be on the US tax policy proposals, where key Republican policymakers sent out their proposal yesterday, demanding deep tax cuts but adding few details on how to pay for them.

On the other side of the pond, Bank of England Mark Carney's speech is scheduled at 08:15 am GMT. During his last speech, Carney reiterated caution in assessing the risks of Brexit and reminded, that an interest rate hike might come in the "coming months", but it will be gradual and limited. He added that monetary policy may have to "move in order to stand still" due to the possibility that global equilibrium interest rates are rising. Later on, he expressed his concerns regarding the post-Brexit situation as he said that lower immigration due to Brexit could contribute "more materially" to inflation pressure in the short term, with only modest impact in the long term. Since then not much changed in the BoE monetary policy, so his today's speech might still be a repetition that global investors heard last time. However, any hawkish remarks regarding the interest rates will likely support the British Pound across the board.

Let's now take a look at the GBP/USD technical picture at the H4 time frame. After the local swing high was made at the level of 1.3655, the candlestick pattern of Dark Cloud Cover indicated a reversal in progress. Since then the market broke out of the consolidation zone and deteriorated towards the technical support at the level of 1.3327. Currently, the market conditions are oversold, but the momentum indicator is below the fifty level and pointing down. The next important technical support is seen at the level of 1.3269.

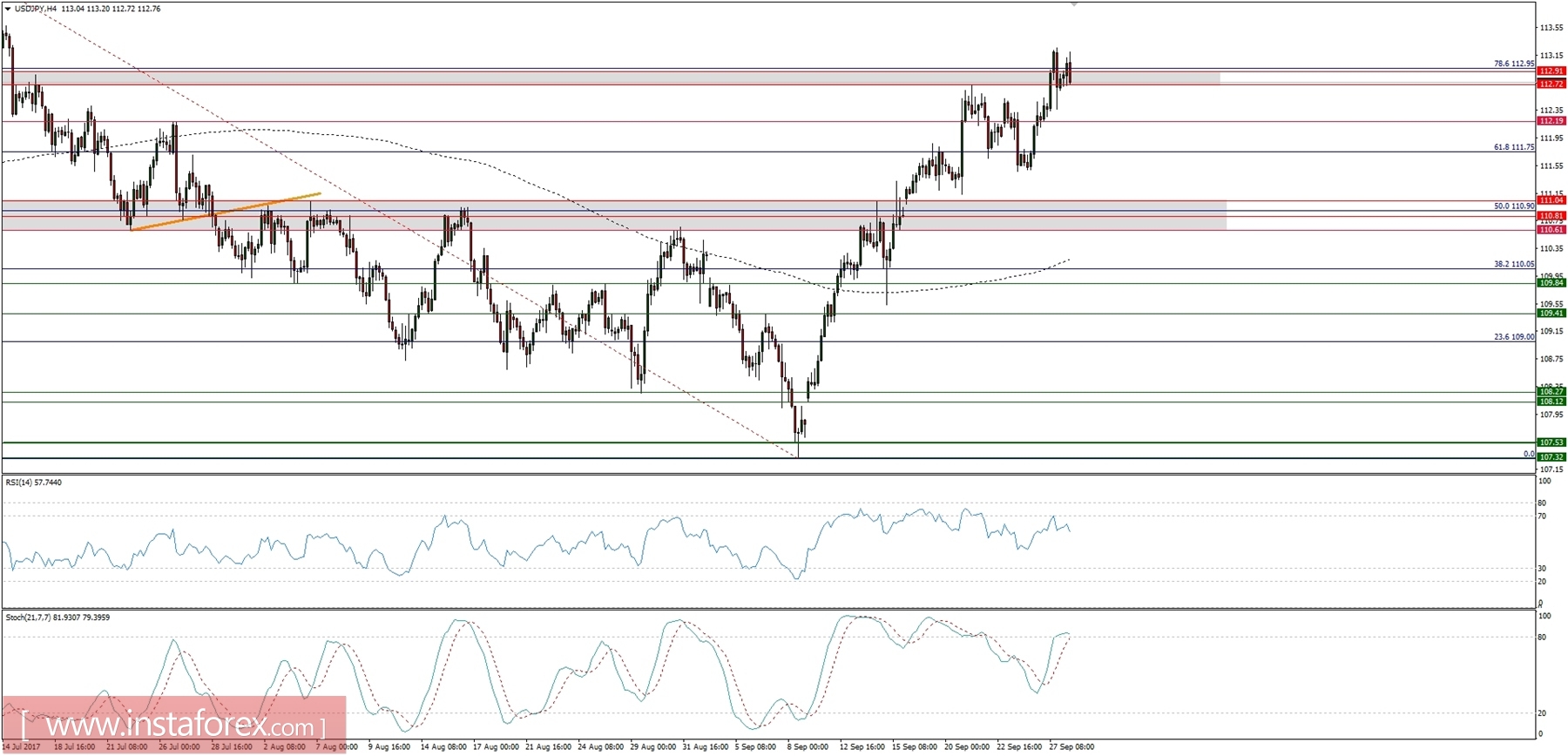

Market Snapshot: USD/JPY tests the 78% Fibo again

The price of USD/JPY has a clear problem to break through above the 78%Fibo at the level of 112.95 as it is being permanently pushed lower. The visible bearish divergence between the price and momentum oscillator does not help the bullish case and it looks like some corrective decline towards the level of 112.19 and below might get triggered anytime soon.

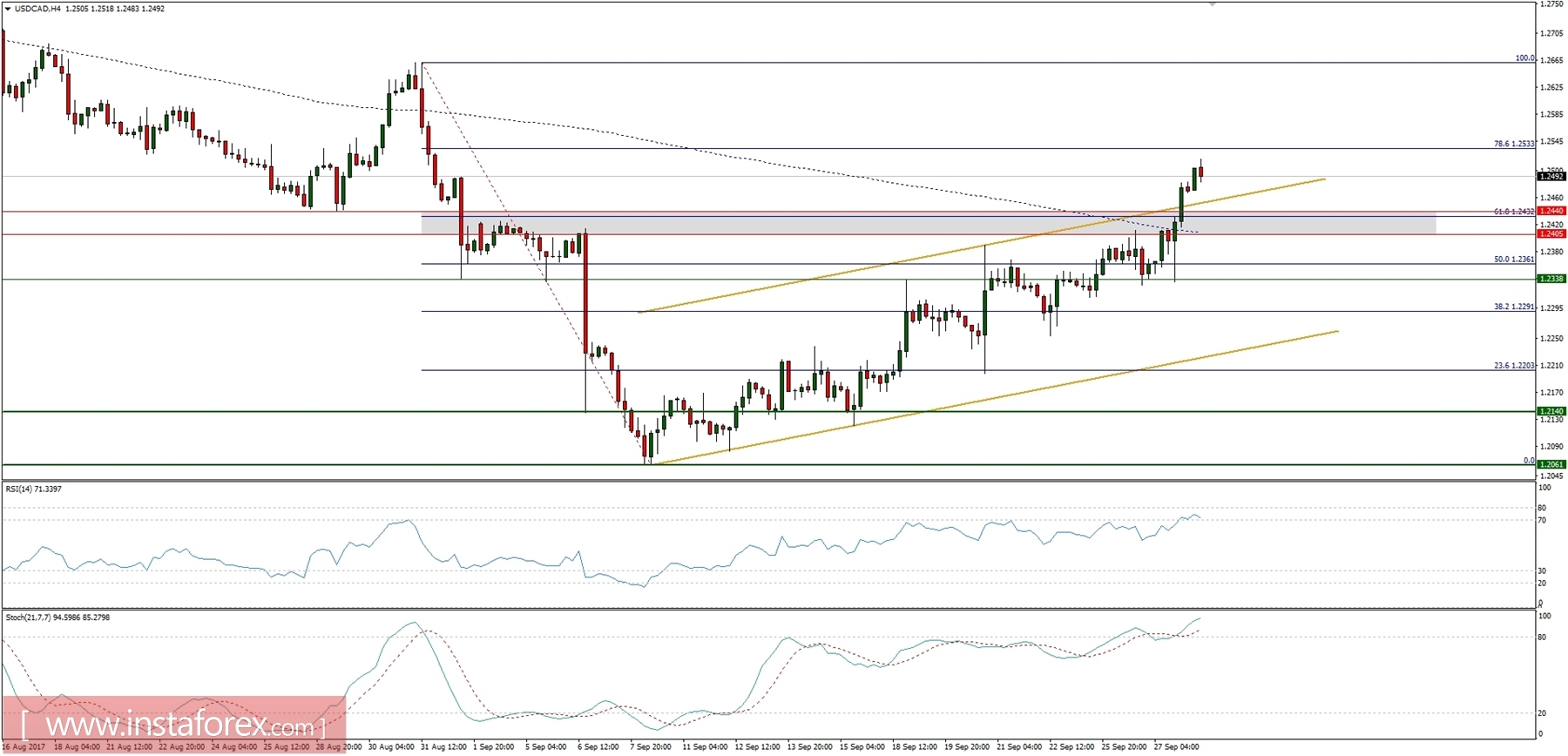

Market Snapshot: USD/CAD above 61%Fibo

The price of USD/CAD has broken through the important technical resistance zone at the level of 1.2440 and 61%Fibo at the level of 1.2432. Currently, the price is about to test the 78%Fibo at the level of 1.2533 and if this retracement is violated, then the next technical resistnace is seen at the level of 1.2655.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română