The US dollar index remains in a bullish short-term trend. Price target mentioned in our last analysis has been achieved. There are also signs of bearish divergence providing a warning for dollar bulls.

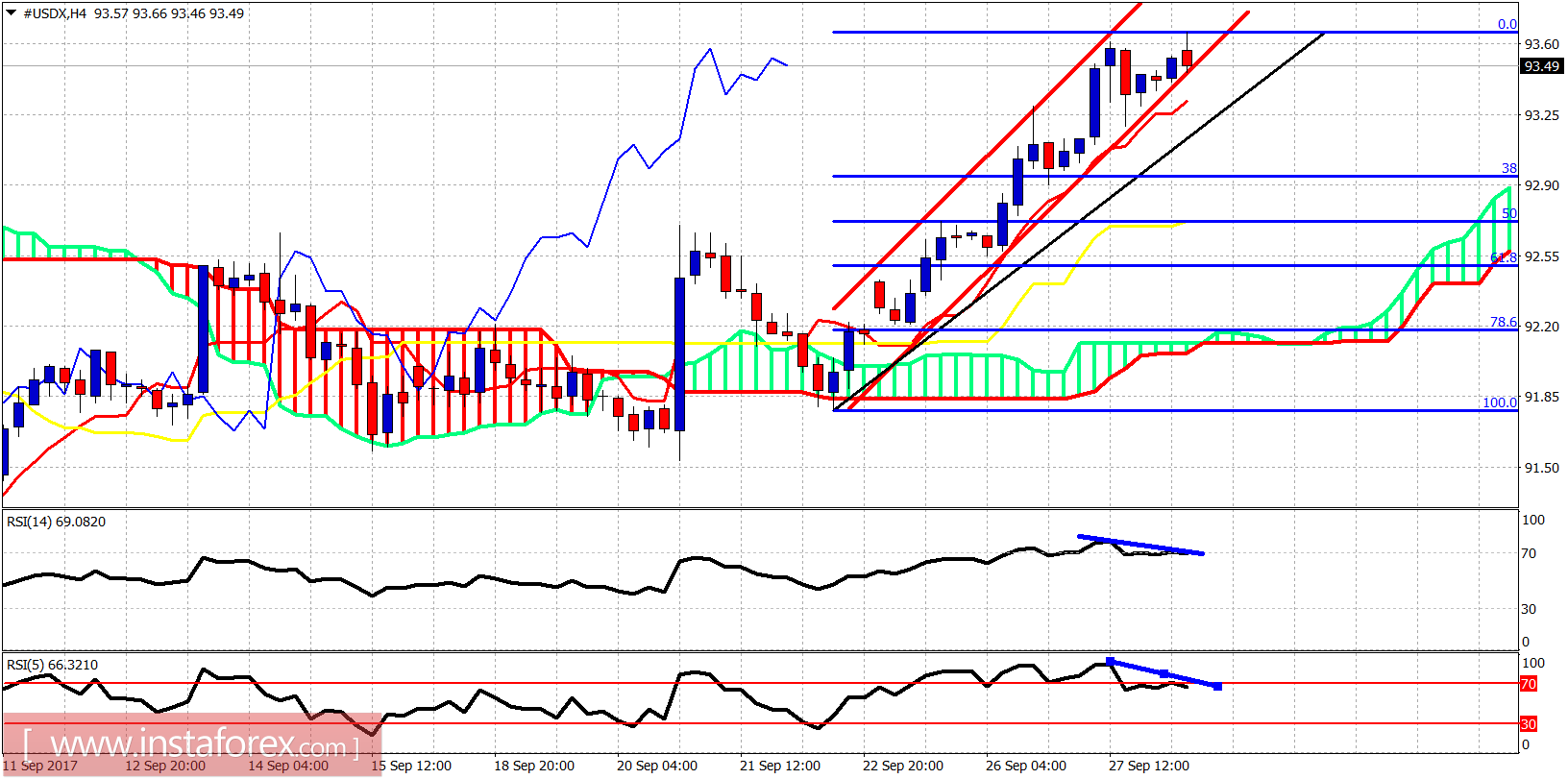

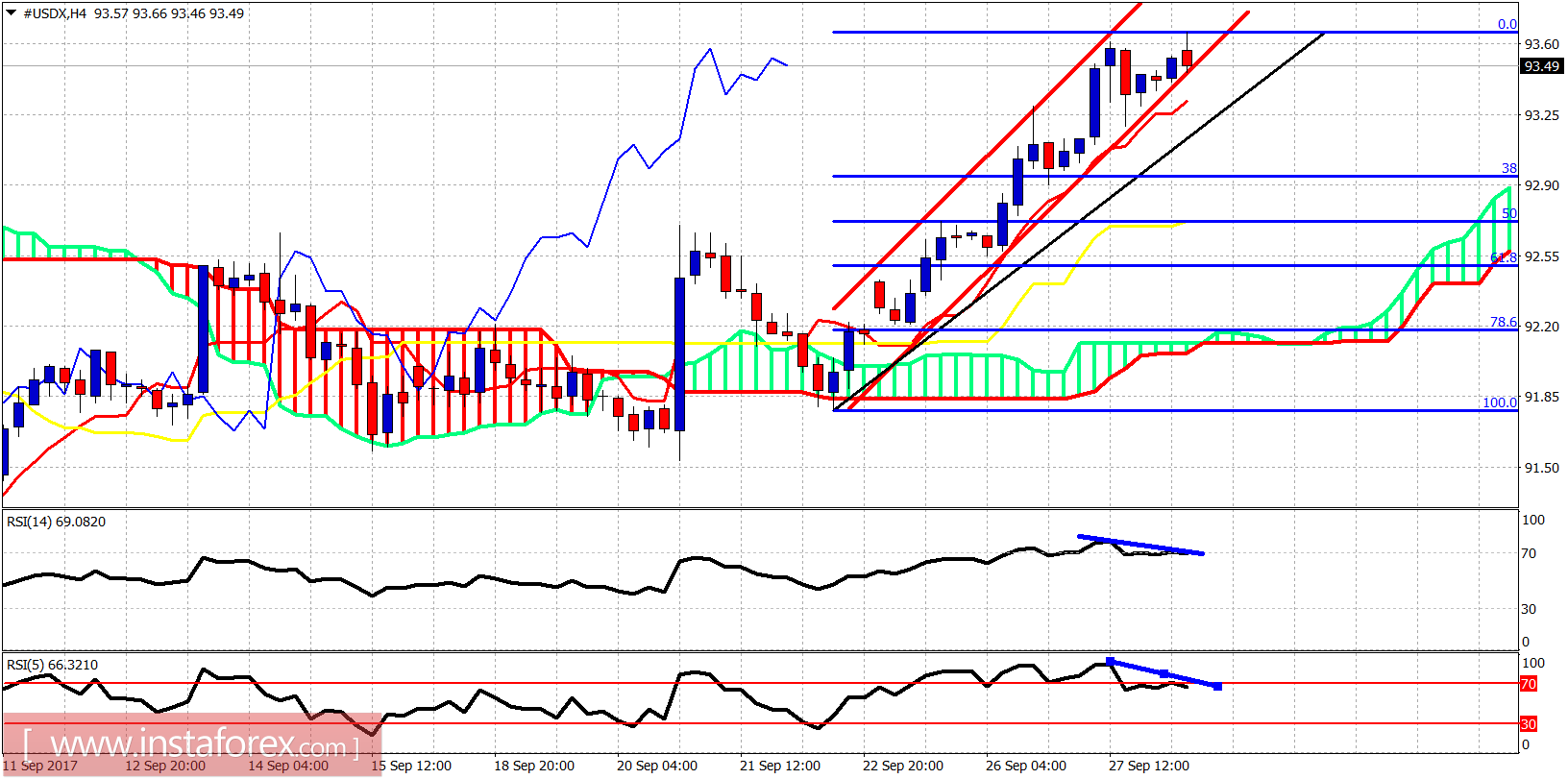

Red lines - bullish channel

The US dollar index is inside the bullish channel. Both RSI indicators are diverging. Price could make a pullback towards 92.95 which is the short-term support and the 38% Fibonacci retracement of the latest rise. Cloud support is at 92.20. As long as we trade above it, the short-term trend is bullish.

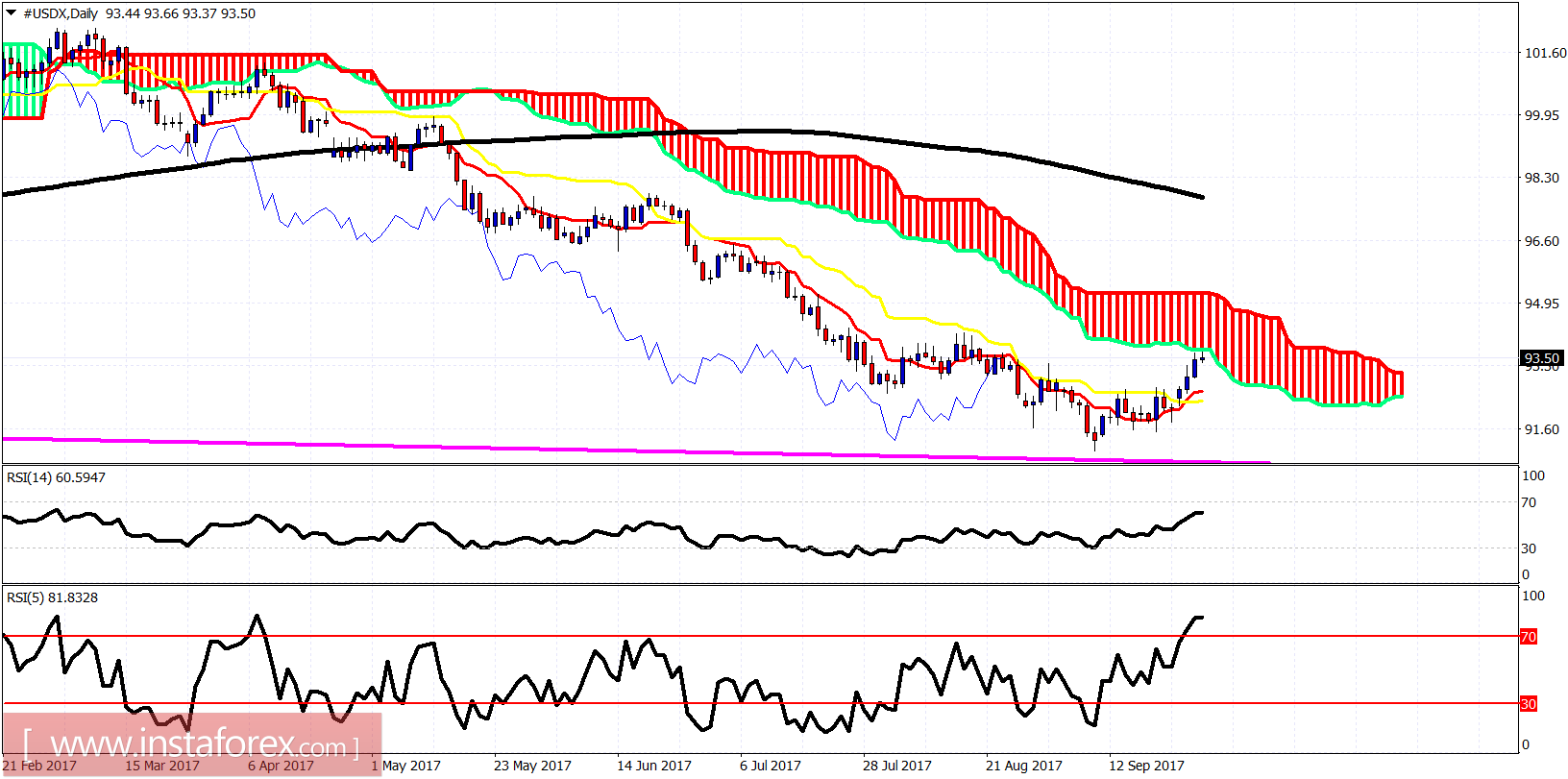

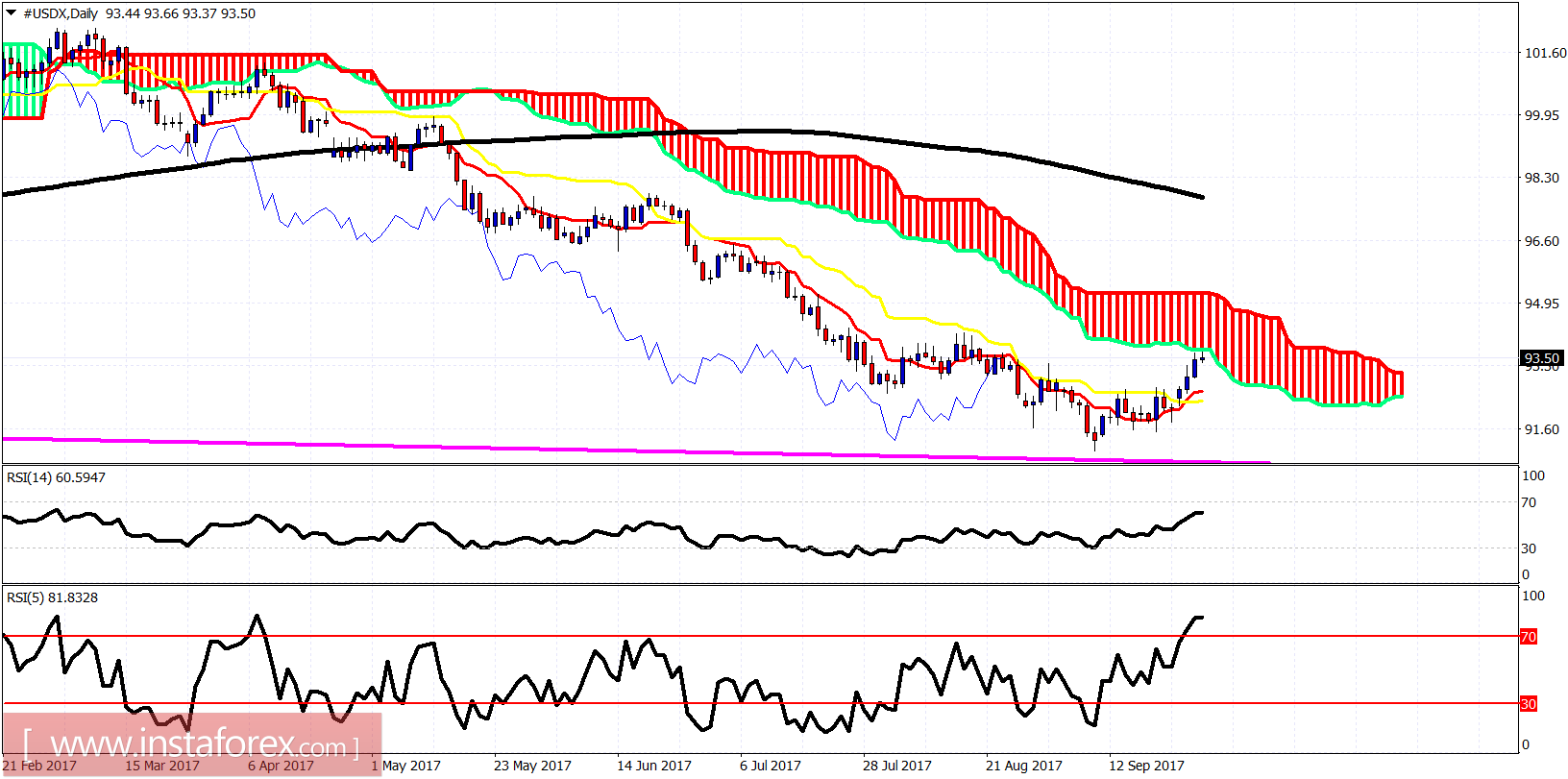

As expected, the dollar index has reached the Ichimoku cloud resistance. Price is above both the tenkan-sen and kijun-sen but below the Kumo (cloud). Trend is bullish in the short-term but in medium-term the trend remains bearish. This bounce is still considered as a short-term correction to the bigger downward trend. I expect price to get rejected and provide new lows towards 90.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română