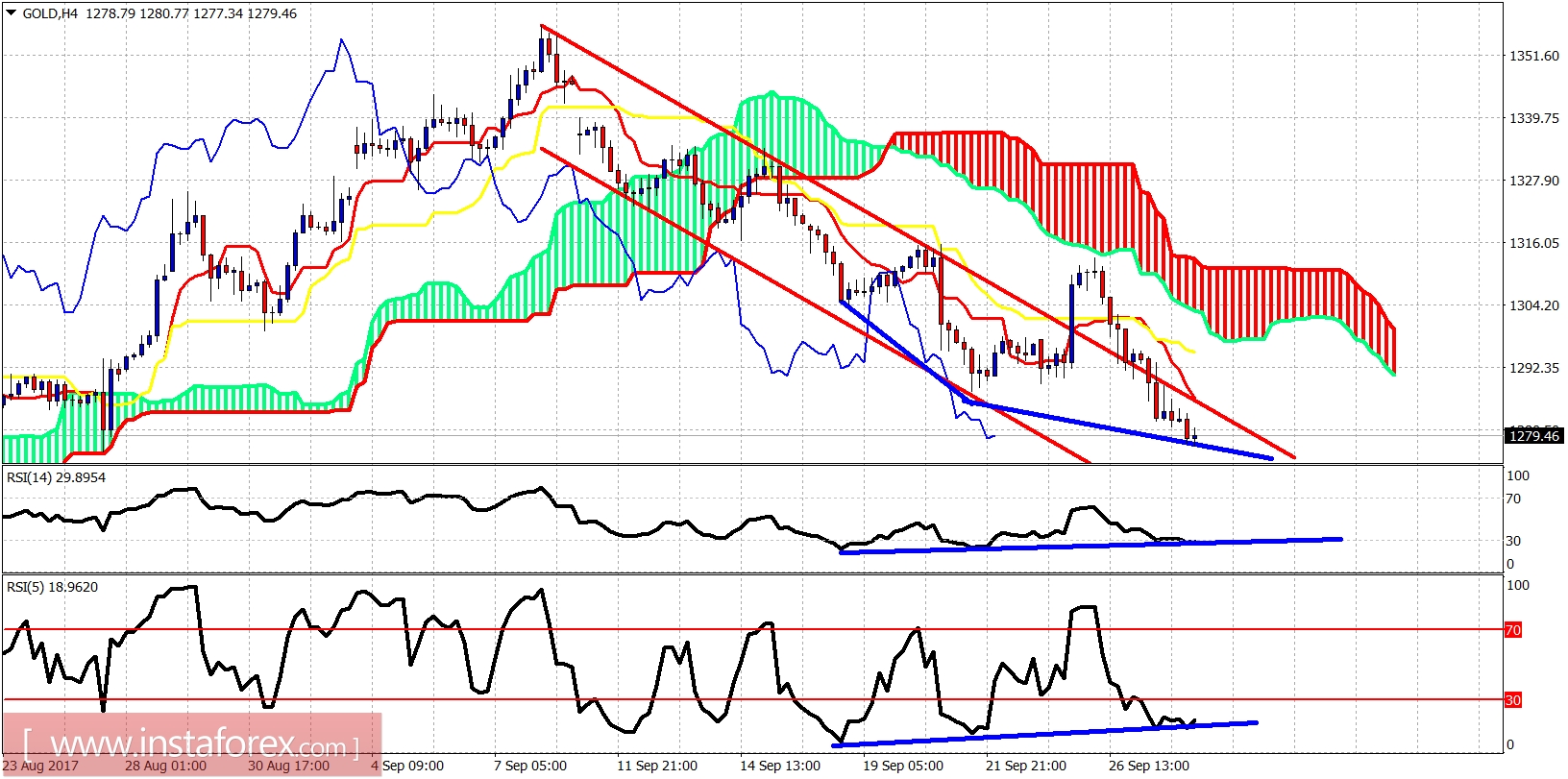

Gold price made a new lower low at $1,278 where the next support level was found. As said in our previous analysis, a new lower low does not cancel our bullish view. A pullback is seen as a buying opportunity, and bullish divergence signs here are signalling that downside is limited.

Gold price has entered inside the bearish channel after being rejected at the 4hour Kumo (cloud) resistance. Both RSI indicators are diverging. Gold should bounce strongly soon. Resistance is at $1,297 and the next one lies at $1,317.

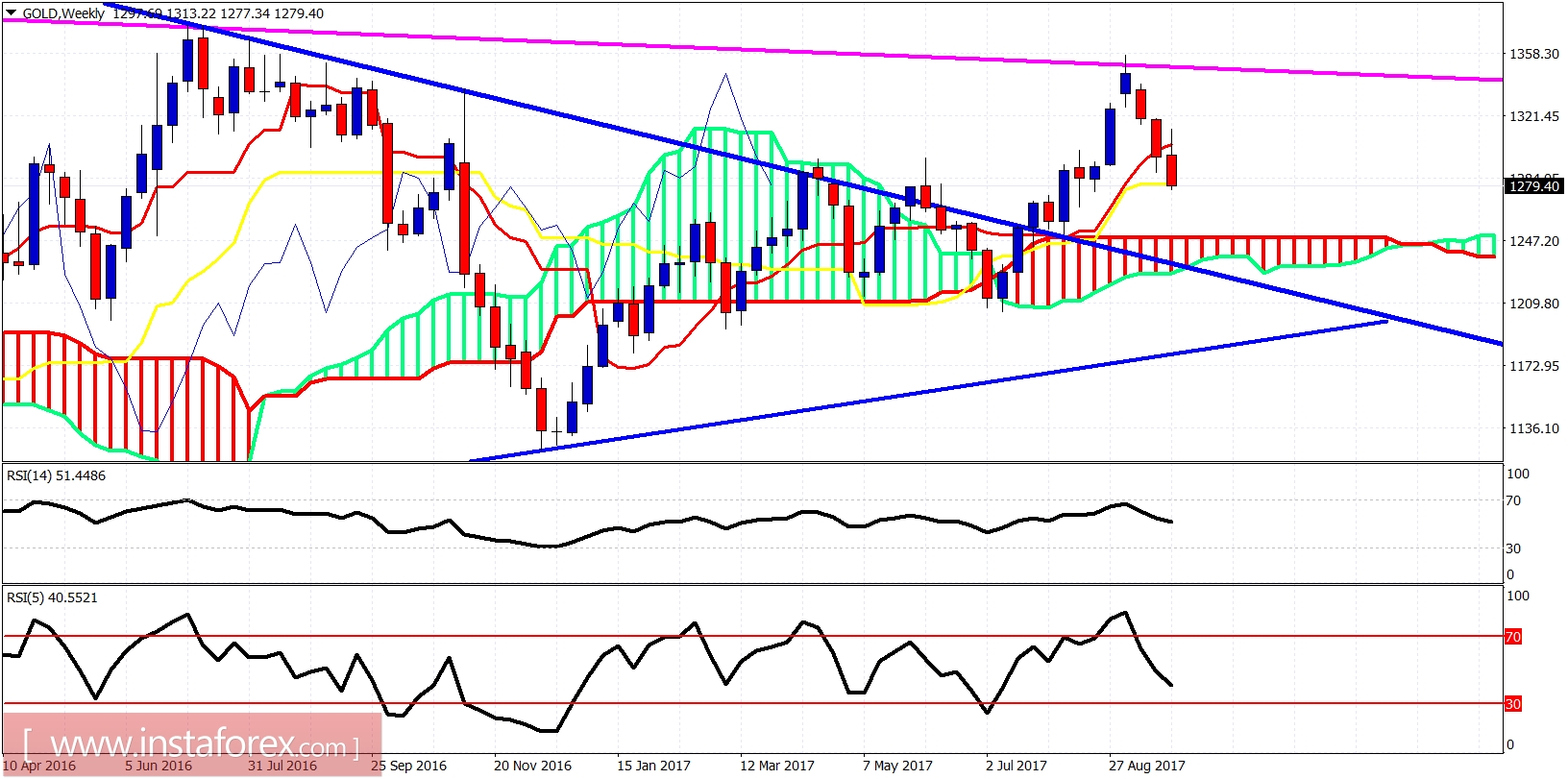

On a weekly basis, gold is making a corrective pullback towards the kijun-sen. If you remember our previous posts, we said that since the tenkan-sen is broken, we should move lower towards the kijun-sen. Now we are here right on the weekly support. The price is above the weekly cloud. Our longer-term view remains bullish looking for a move above $1,400.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română