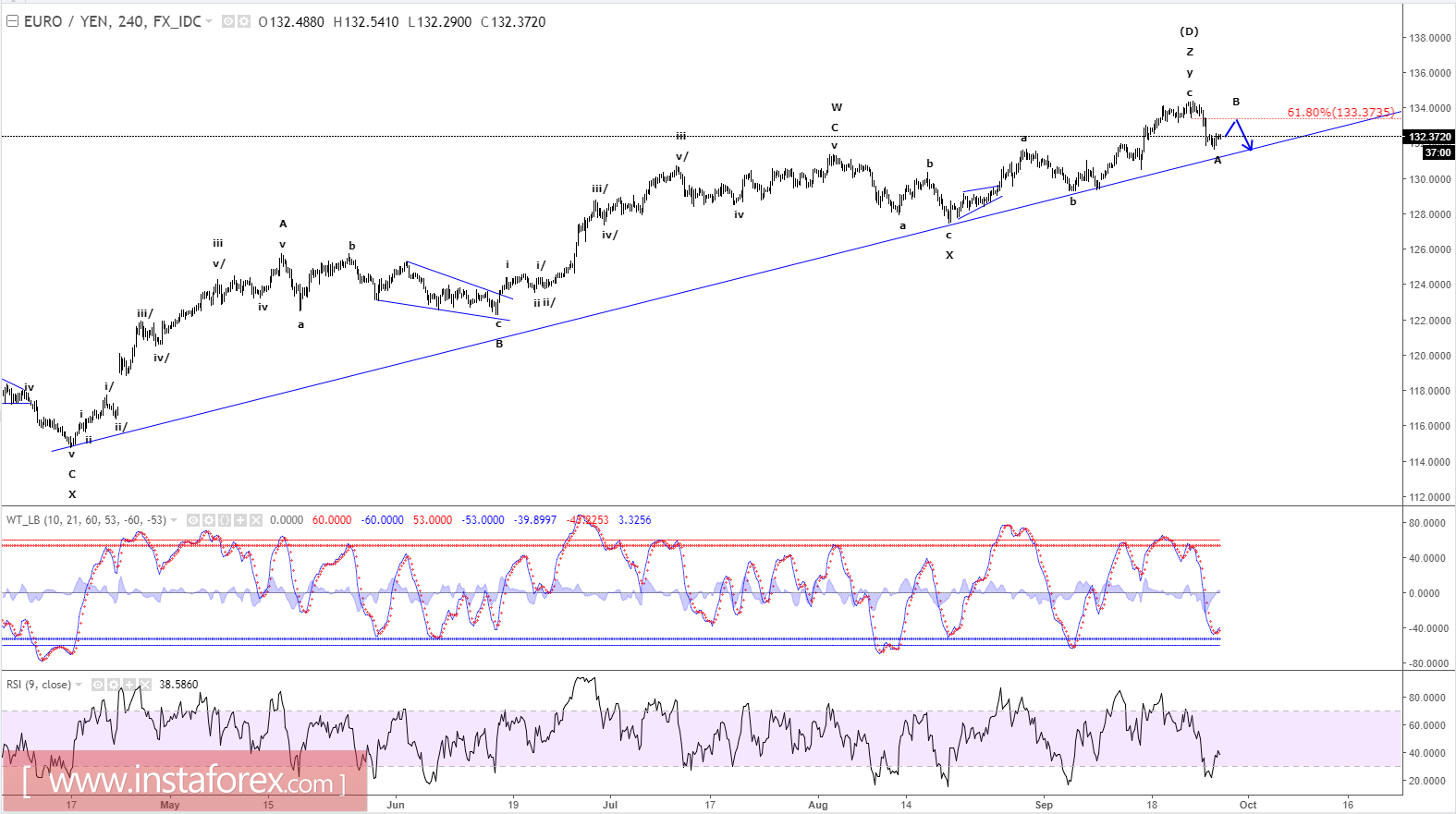

EUR/JPY - 4-Hourly

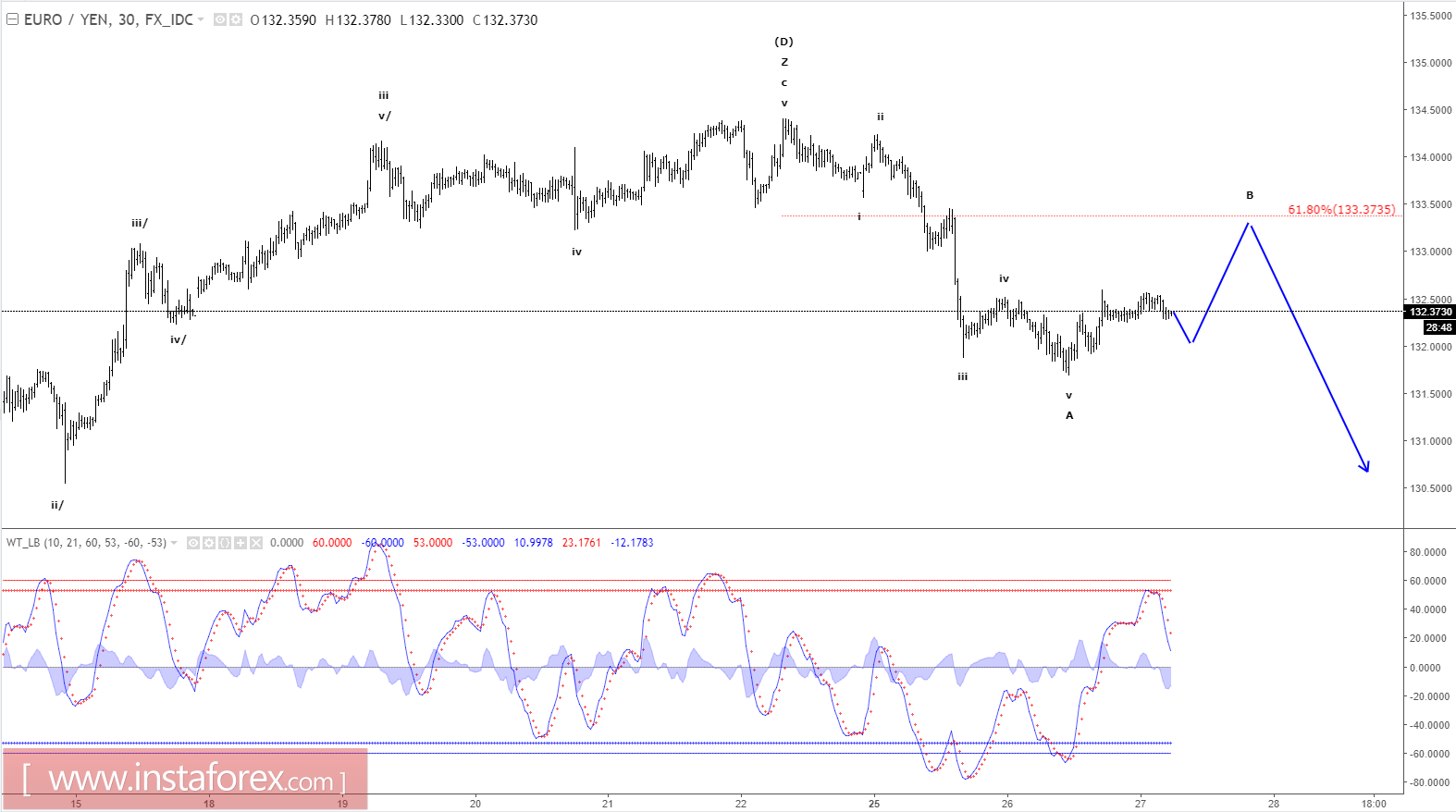

EUR/JPY - 30-Minutes

Wave summary:

We have seen a nice five-wave decline from 134.41 to 131.70, which adds confidence in our assumption that wave (D) of the huge triangle consolidation did complete prematurely at 134.41. This means wave (E) now is developing. We have to say that E-waves of triangles is tricky as they can unfold as sub-normal waves, they can be of normal length and they can be triangles themselves. So the best way to handle them is to expect the pair to follow the normal guidelines, but at the first unexpected move they should be considered complete.The normal behavior for this wave (E) would be a decline to at least 125.53 and likely closer to 119.68.

R3: 133.83

R2: 133.38

R1: 132.60

Pivot: 132.25

S1: 131.93

S2: 131.70

S3: 131.30

Trading recommendation:

We will sell EUR at 133.25 or upon a break below 131.93.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română