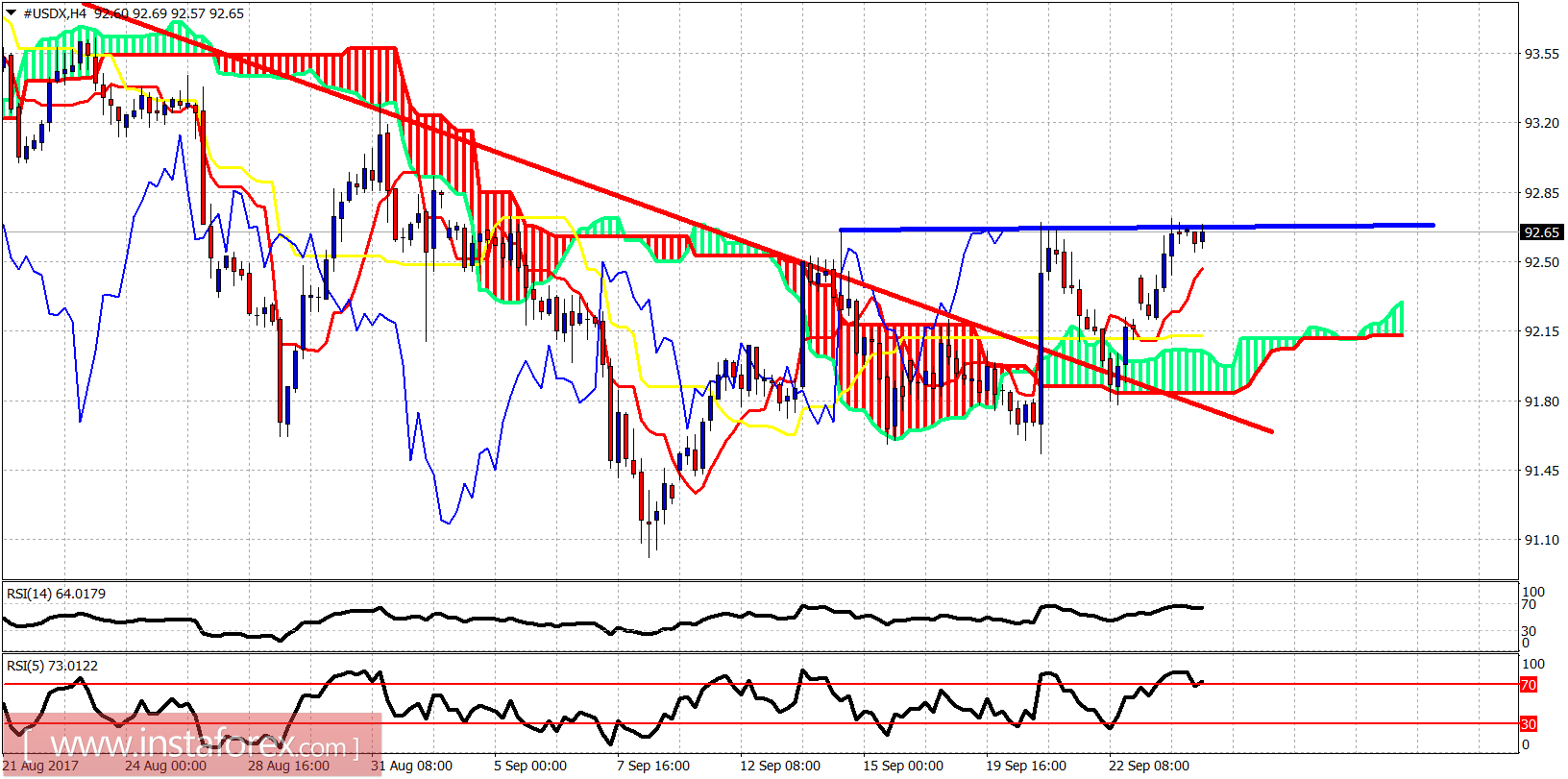

The Dollar index is testing important short-term resistance and previous high at 92.70. Trend is bullish. 93 is an important resistance level.

Blue line - previous high horizontal resistance

The Dollar index is trying to break above the previous highs at 92.70. Price back tested the cloud support and has reversed higher and is now ready to break to new short-term highs. Important support remains at 91.80.

On a daily basis we consider that the Dollar index is making a bounce that has first important resistance at 93 and next at 93.70. Both targets can be met but I believe we will first see below 91, before a bigger bounce. Short-term trend is bullish but medium-term trend remains bearish. Breaking below 91.80 will open the way for a move towards 90 or lower.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română