Trading plan for 25/09/2017:

The Euro and the New Zealand Dollar are under pressure of weekend voting results, and the politics also has a negative impact on the Yen's strength. Chancellor Merkel will remain in office for the fourth term, but support from another political faction will be needed. NZD is losing almost one percent (NZD / USD is at 0.7275) after the ruling Conservative Party was unable to get the majority.

On Monday 25th of September, the event calendar is light in the important news release, but the market participants will keep an eye on Ifo Busines Climate data from Germany and speeches from FOMC Member William Dudley and Charles Evans. ECB President Mario Draghi will be speaking as well later during the day.

EUR/USD analysis for 25/09/2017:

The Ifo data were all worse than anticipated. Ifo Business Climate was released at the level of 115.2 points, while the market participants expected a number of 116.0 points after 115.7 points a month ago. The Ifo Current Assesment was released at the level of 123.6 points while the market participants expected 124,7 points, just as a month ago. The last Ifo indicator, Ifo Expectations was weaker as well as it was released at 107.4 points, while market participants expected 108.0, just as a month ago. Despite the fact, that this month's Ifo figures, which are based on ca. 7,000 monthly survey responses of firms in manufacturing, construction, wholesaling and retailing) are slightly worse than expected, the levels of sentiment in Germany are still elevated and still will support the Euro across the board. It will be interesting to see the change in sentiment after the parliamentary election, but this will be available next month.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The pair gaped down slightly but the gap was quickly filled and now the level of 1.1936 will act as an intraday resistance. The pair is trading inside of a horizontal range between the levels of 1.1821 - 1.2000 as the upward momentum is decreasing. The market participants must wait for the decisive breakout in either direction now, but the larger time frame outlook remains bullish.

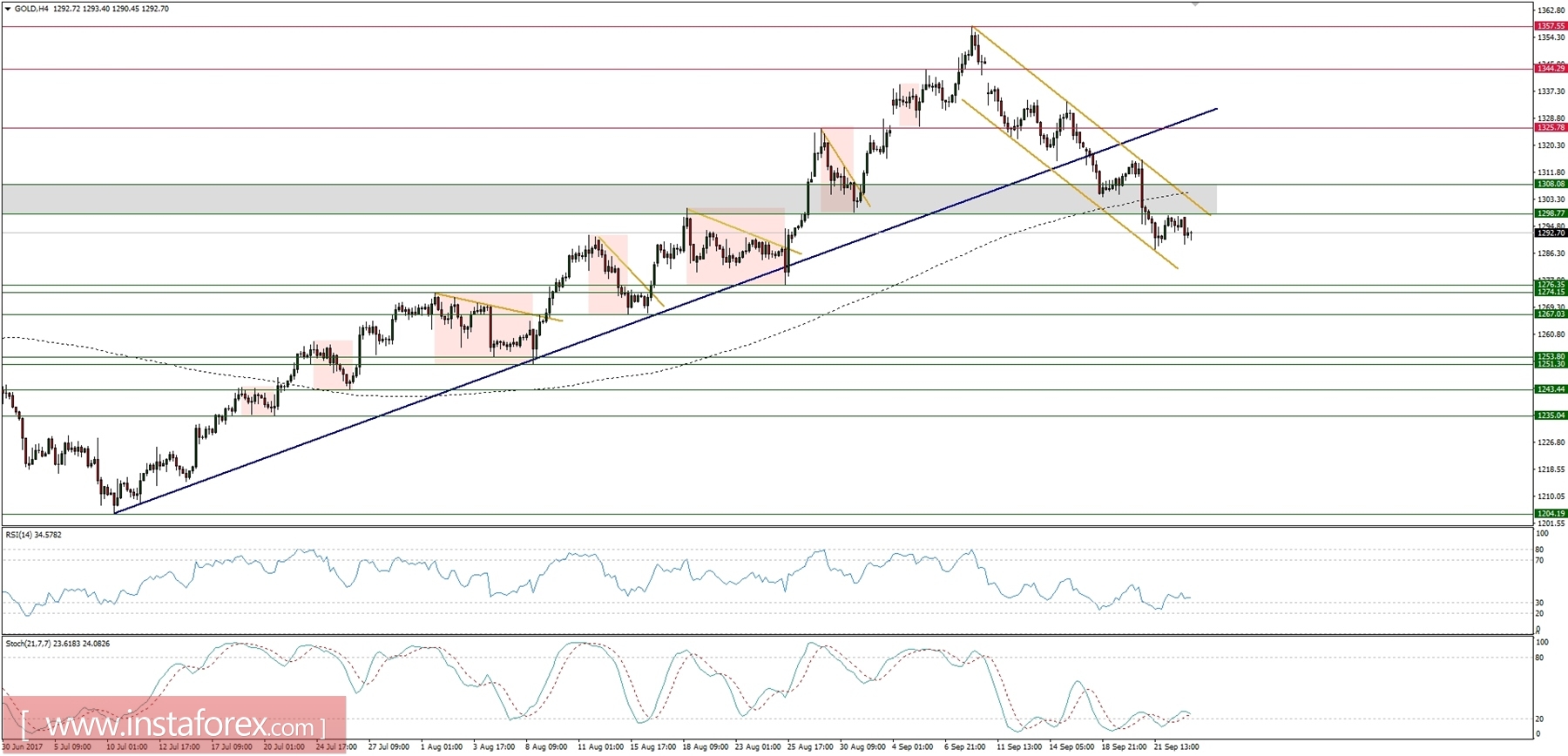

Market Snapshot: Gold still inside of a channel

The price of Gold continues to trade inside of the golden channel after the attempt to break through the technical resistance at the level of $1,298 failed. The market conditions are still oversold, but the momentum is not pointing to the north, so the possibility of another leg down in this market is still high. The next technical support is seen at the level of $1,276.

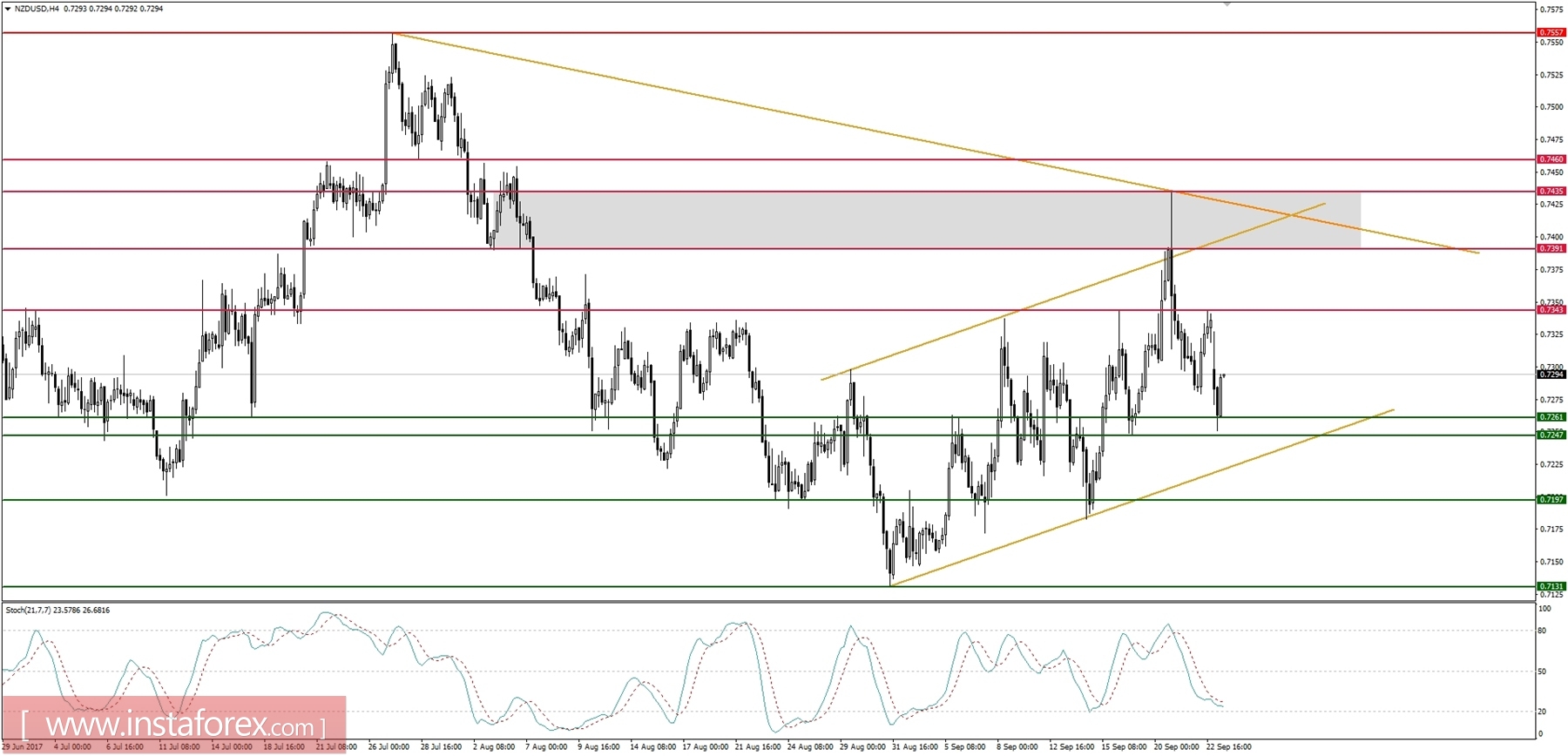

Market Snapshot: Bounces from support

After a failed rally towards new high, the NZD/USD dropped to the level of 0.7247, where the technical support was. Currently, the market bounced from that support but is still locked in a trading range between the levels of 0.7343 - 0.7247. The most important resistance for bulls is the area between the levels of 0.7391 - 0.7435.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română