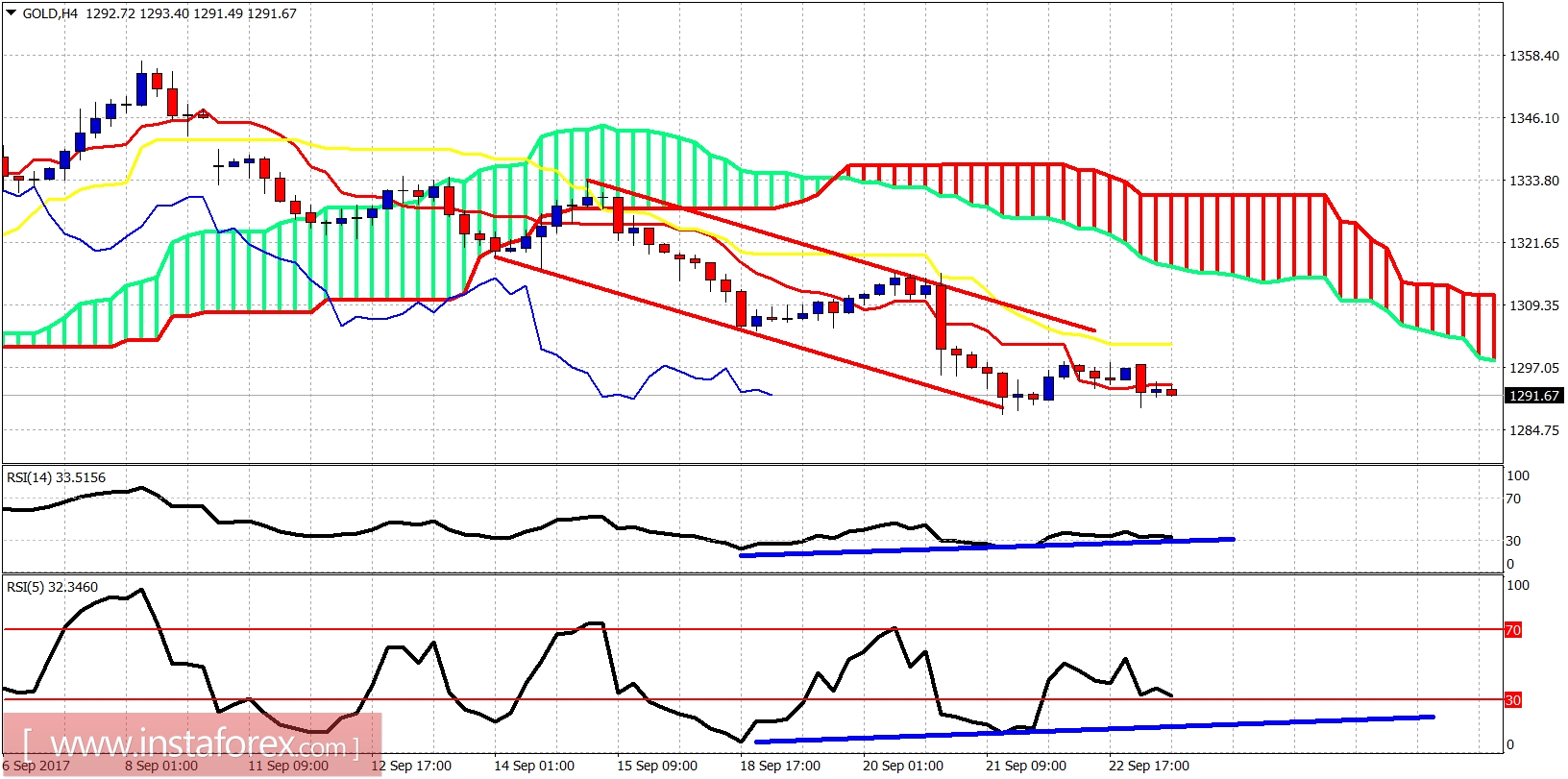

Gold price remains inside the bearish channel still. Price is trading above recent lows. There are increased chances of a new lower low towards $1,285-80 but I believe the downside is very limited, while the upside potential is very big.

Blue lines - bullish divergence signs

Gold price is below the tenkan- and kijun-sen in the 4-hour chart and inside the bearish channel. Support is at $1,290 and next one at $1,280. Resistance is at $1,300 and next one at $1,316. I believe that Gold price could make another stop run to shake out weak bulls and then reverse.

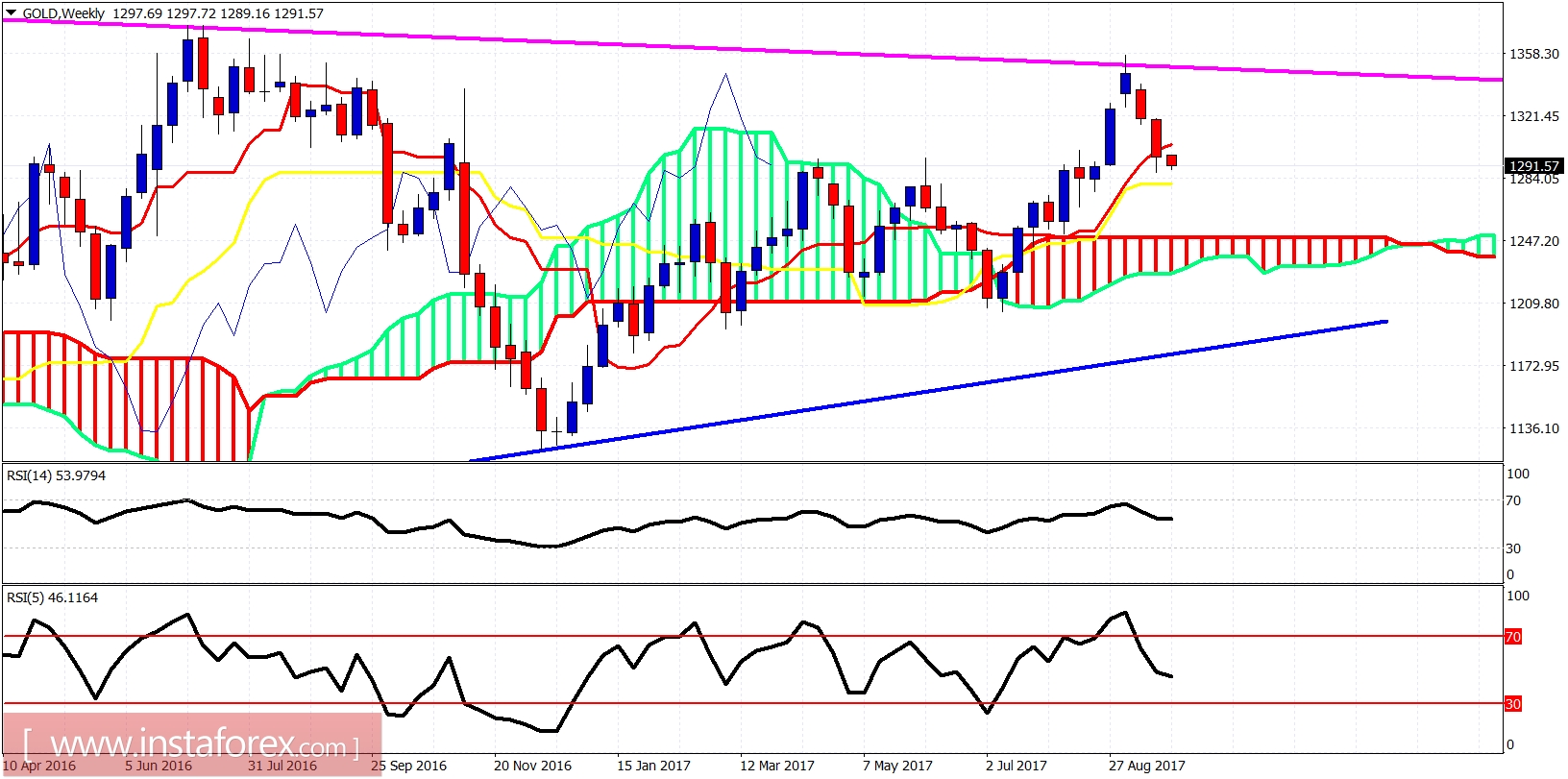

Magenta line - resistance

Blue line - long-term support trend line

Gold price is pulling back from the resistance trend line. This pullback is considered one great buying opportunity. I believe that Gold will bottom around $1,290-$1,280 and then reverse to start the next big upward move towards $1,400. I remain longer-term bullish about Gold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română