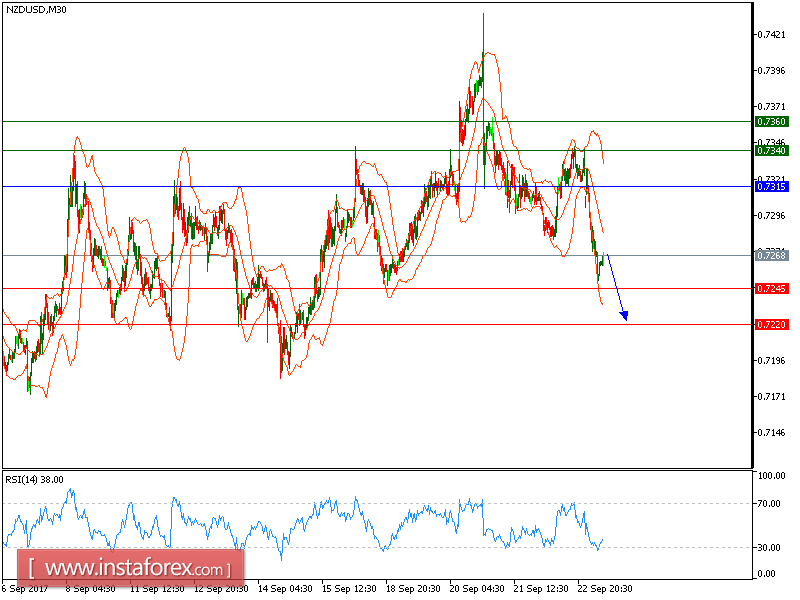

Our first downward target which we predicted in our previous analysis has been hit. NZD/USD is expected to trade with a bearish outlook. The pair retreated from 0.7340 (the high of September 22) and broke below the lower boundary of Bollinger Bands, which signaled the continuation of bearish trend. The 20-period moving average is turning down. The relative strength index shows downward momentum.

To conclude, below 0.7315, look for a further decline with targets at 0.7245 and 0.7220 in extension.

The black line is showing the pivot point. Currently, the price is above the pivot point, which indicates long positions. If it remains below the pivot point, it will indicate short positions. The red lines is showing the support levels and the green line is indicating the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 0.7340, 0.7360, and 0.7410

Support levels: 0.7245, 0.7220, and 0.7180

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română