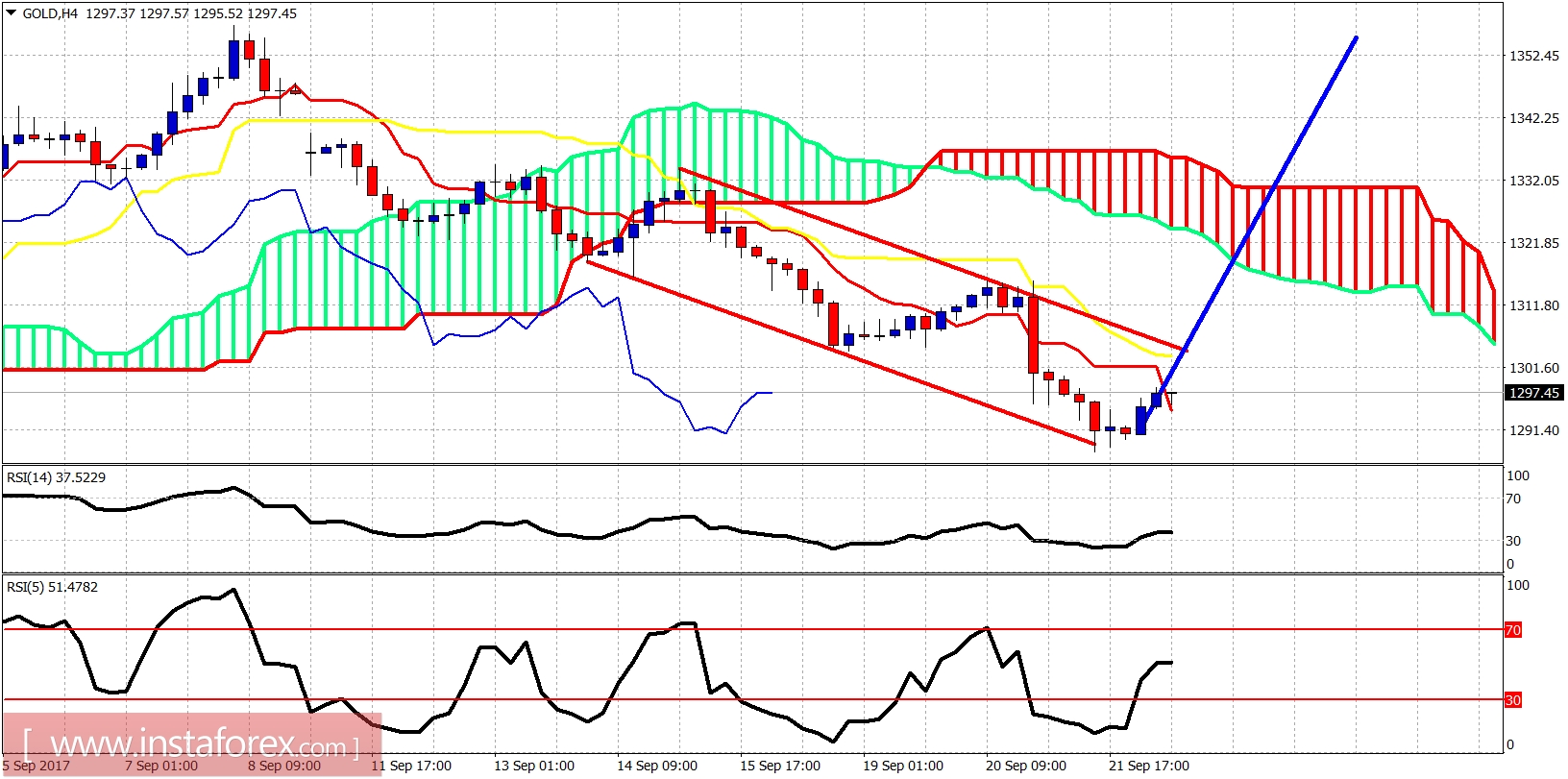

Gold price is showing reversal signs off the $1,290 area and the bottom of the bearish channel. As we were expecting Gold provided a new low below $1,300 and is now rising. Gold price could have already made an important low.

Blue line - expectation

Gold price is bouncing. Price however remains inside the bearish channel and below the kijun-sen and the Kumo (cloud). Resistance is at $1,303 and at $1,317. Breaking above $1,317 will increase dramatically the chances for a full scale reversal and a move towards $1,400.

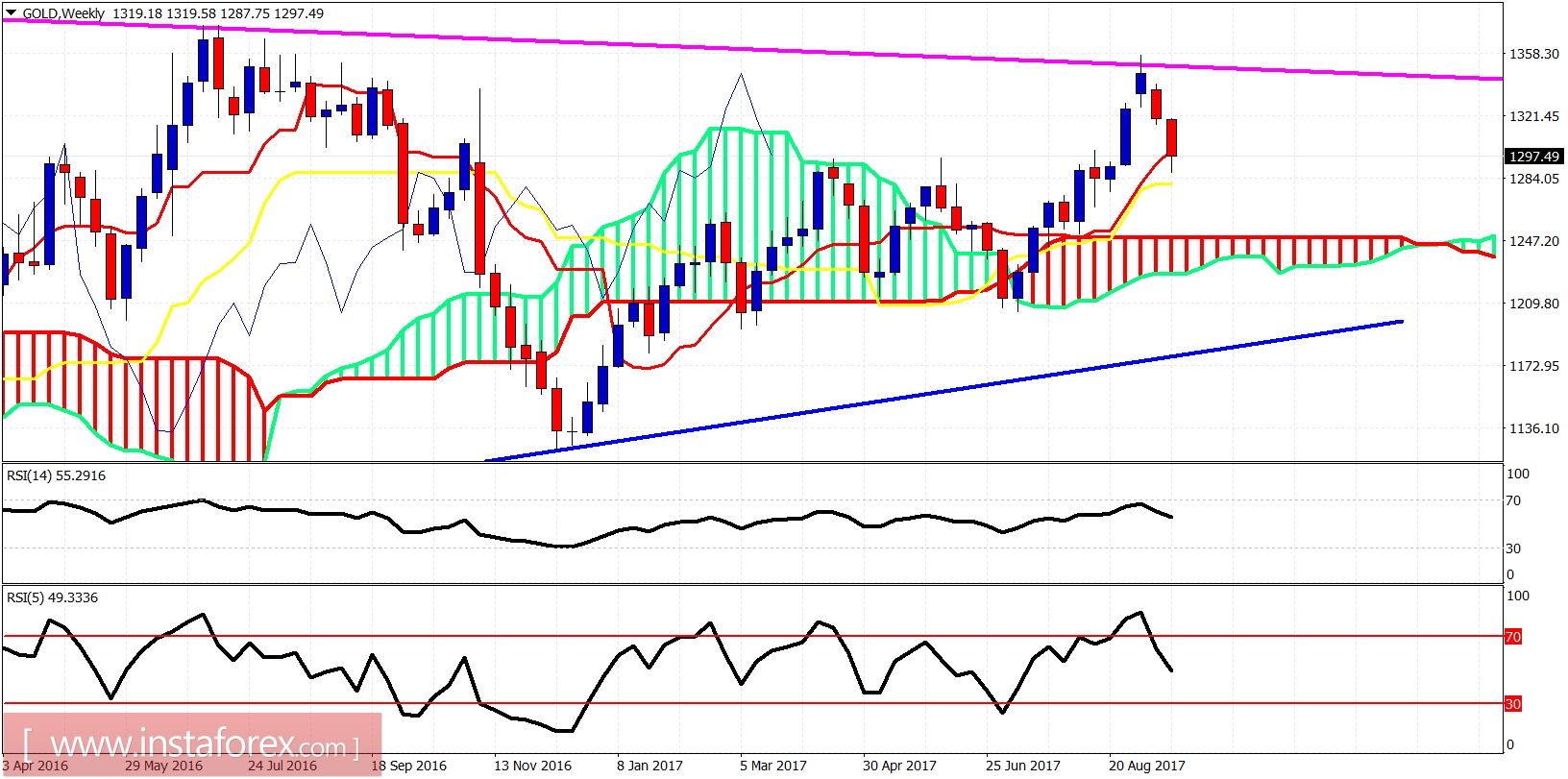

Blue line- long-term support

As we said a couple of months ago, Gold price would reach the resistance line at $1,350 and pull back for a correction before moving higher. This is exactly what is happening now and all we need to see now is a long tailed weekly candle. So this week's close could really signal something bullish for the next weeks. Gold is in a buying area as we mentioned in previous posts. We remain long-term bullish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română