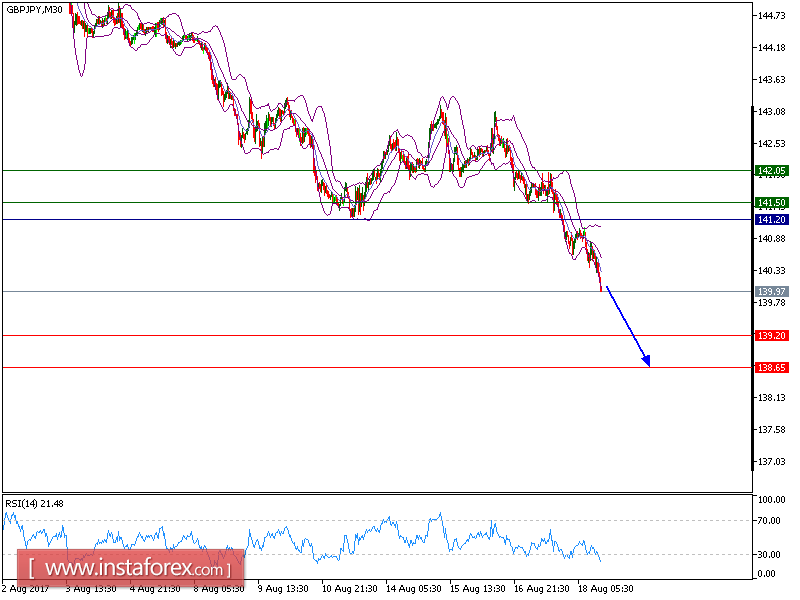

All our targets which we predicted yesterday were met. GBP/JPY is still under pressure and expected to continue the downside movement. The pair remains weak below its falling 20-period and 50-period moving averages, and is expected to post further downsides. The process of lower highs and lows remains intact, which should confirm a negative outlook. Besides, the relative strength index is still bearish, without showing any reversal signals.

To conclude, as long as 141.20 is not surpassed, the risk of a slide below 139.20 remains high. Our next down target is set at 138.65.

Alternatively, if the price moves in the opposite direction as predicted, a long position is recommended above 142.25 with the target at 142.65.

Strategy: SELL, Stop Loss: 139.20, Take Profit: 138.65.

Chart Explanation: the black line shows the pivot point. The price above the pivot point indicates the bullish position; and when it is below the pivot points, it indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 141.50, 142.05, and 143.00

Support levels: 139.20, 138.65, and 138.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română