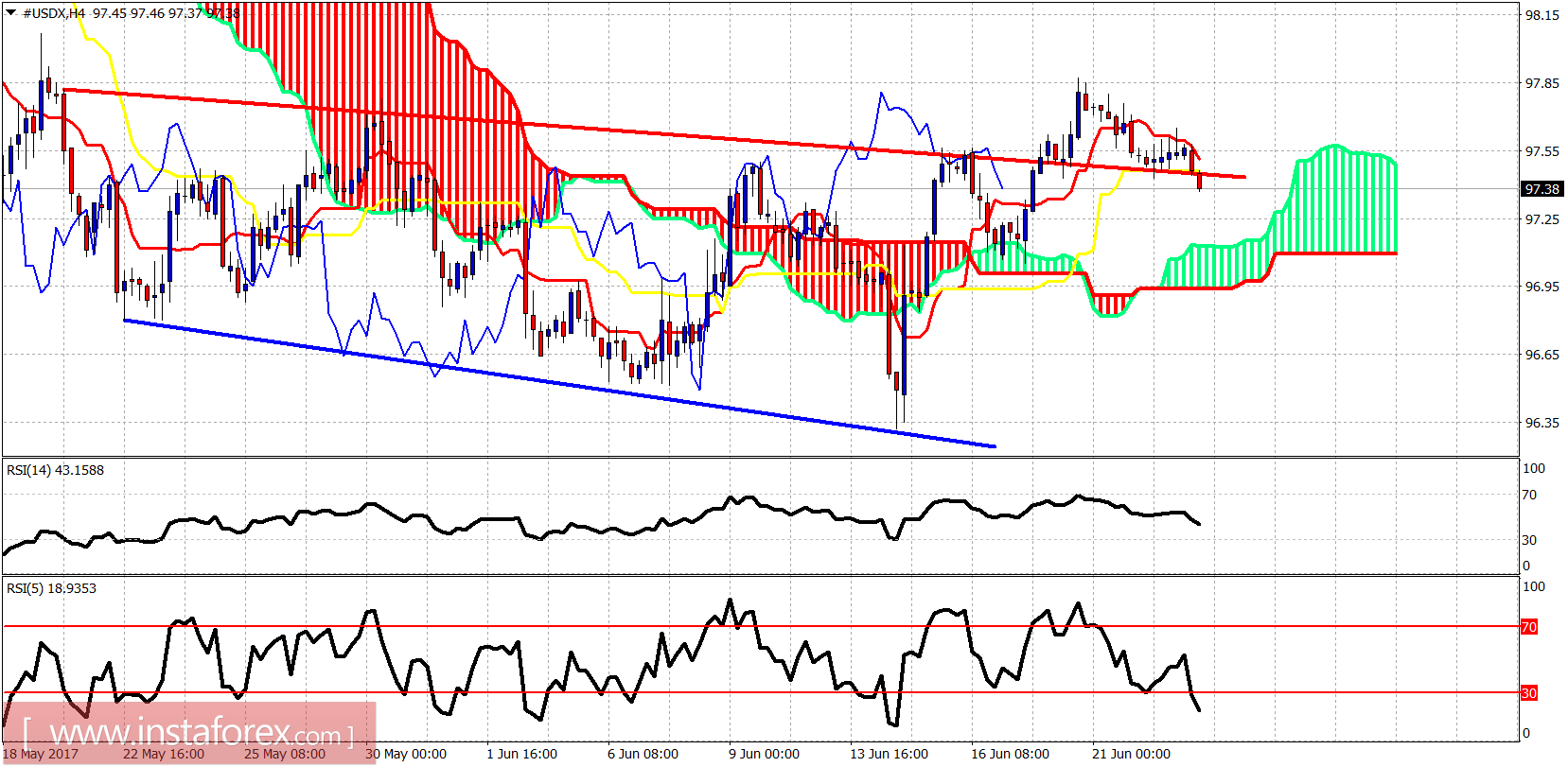

The Dollar index is weakening. Price is breaking below support and this is not a good sign. The bounce we were expecting was shallow. If price breaks below 97, we should expect more selling pressures to push the index to new monthly lows.

Blue line- support

The Dollar index has broken below both the tenkan- and kijun-sen indicators. Price is heading towards Kumo (cloud) support at 97.15-97. Breaking below the 4-hour Kumo will turn trend back to bearish and will bring more sellers and push price towards 95-94.

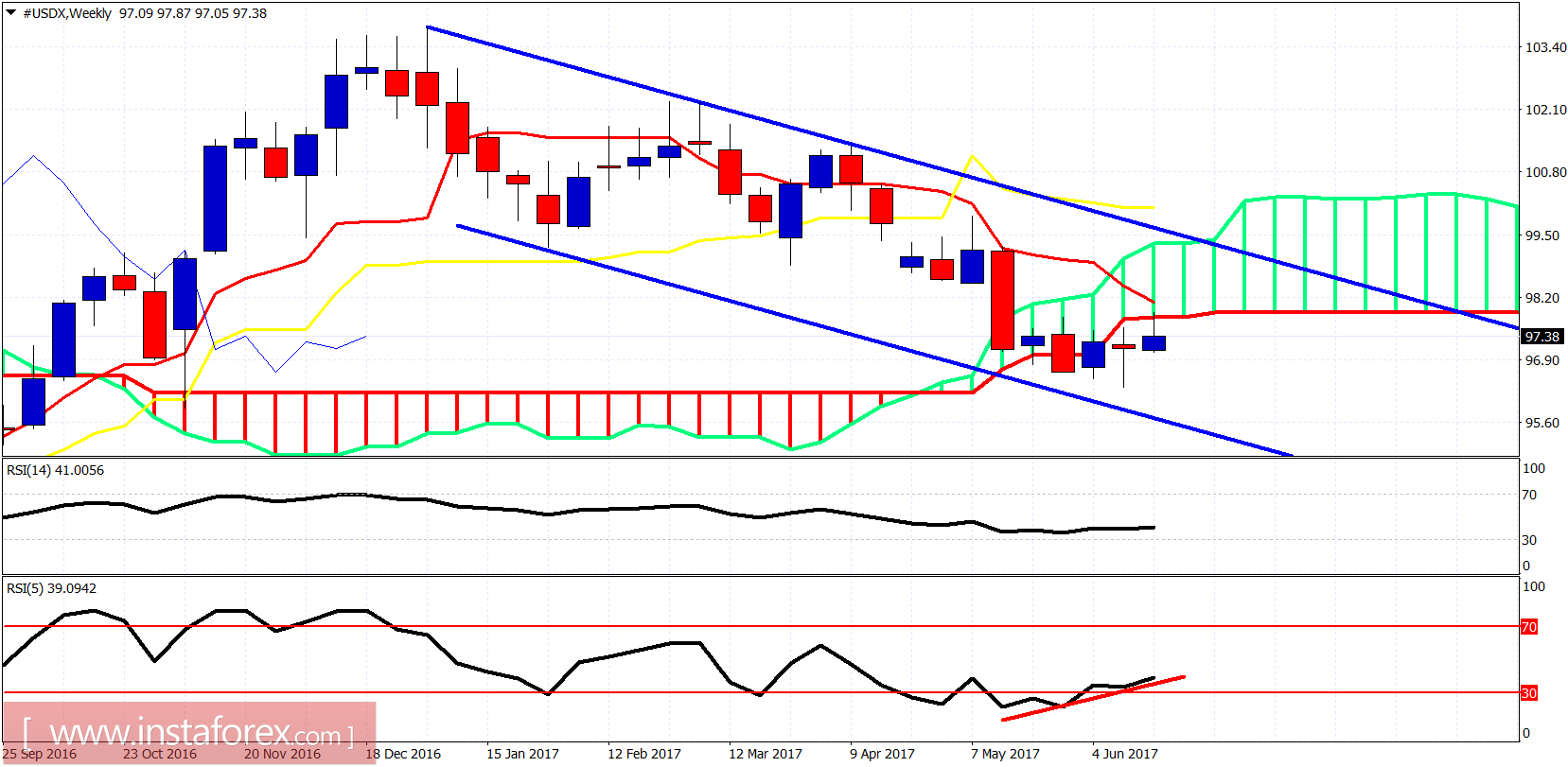

The weekly price action remains inside a bearish channel. Weekly candle got rejected at the lower Kumo (cloud) boundary resistance. This rejection is not a good sign. Bulls need to make a new weekly high to remain in control and to continue to hope for a move towards 98.50-99. The rejection has however brought a new scenario where we see a new weekly low and then reverse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română