Global macro overview for 26/05/2017:

The National CPI index in Japan remains stable in April. The data released overnight revealed that the National CPI rose for a fourth consecutive month in April to the level of 0.4% in line with market expectations. Consumer prices excluding food and energy costs rose 0.1% in April, after falling 0.1% the previous month. The Tokyo Core CPI, which is considered a barometer of nationwide price trends, increased 0.2% and it was better than anticipated increase of 0.1%. The long-term Bank Of Japan inflation target is still at 2.0%, but the declining household spending and tightening job market might make this target difficult to reach. Nevertheless, the Japanese economy is still expanding at a steady pace of 0.5%, so the most appropriate approach for BoJ is to wait-and-see for the further events to unfold.

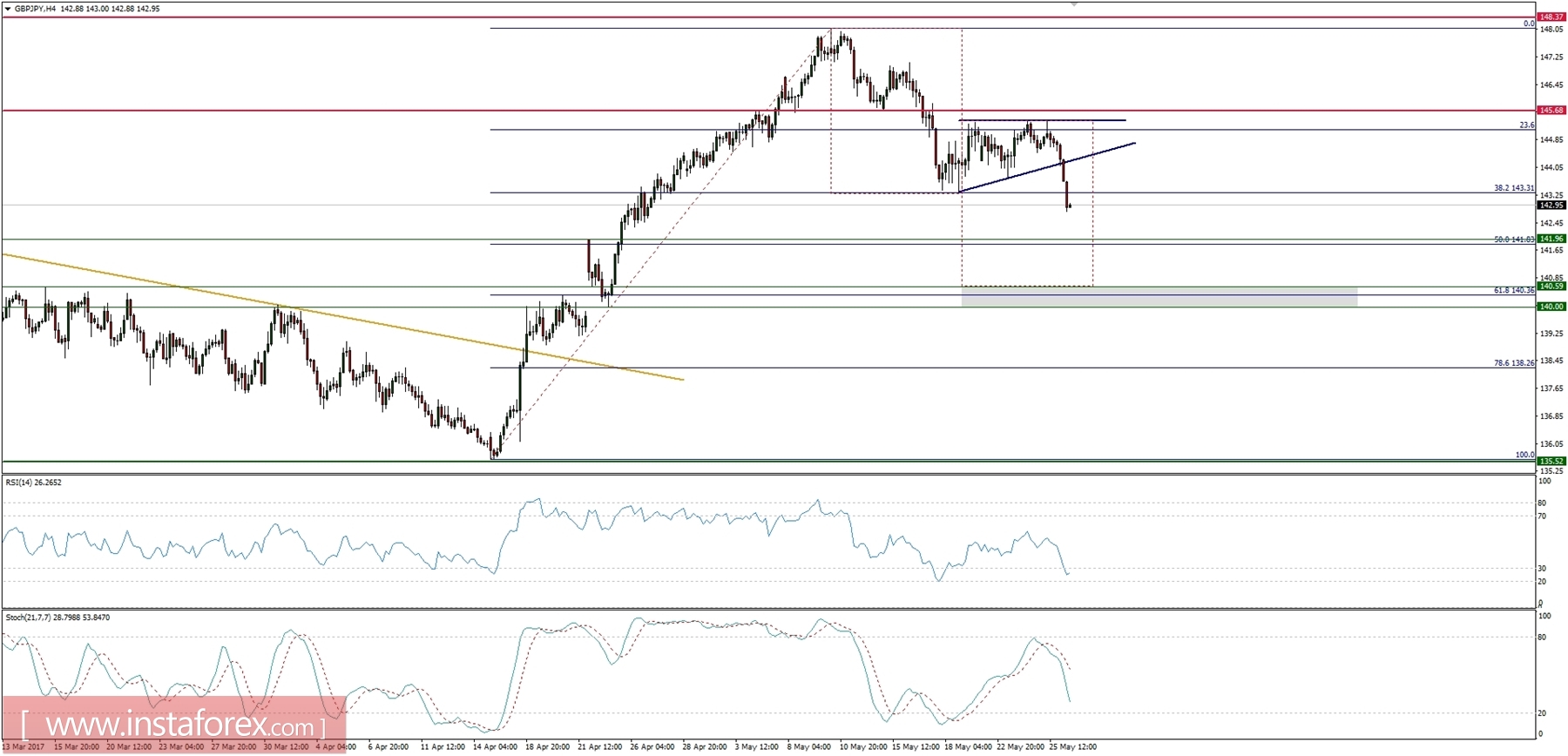

Let's now take a look at the GBP/JPY technical picture on the H4 timeframe. The Bears have managed to break out below the technical support at the level of 143.31 (38%Fibo) and it looks like the next target for them is at the level of 50%Fibo at the level of 141.03. The Fibonacci projection, however, indicates another target at the 100% expansion at the level of 140.59, which is close to the 61%Fibo at the level of 140.36 and technical support at the level of 140.00. The momentum indicator and stochastic oscillator support the bearish bias.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română