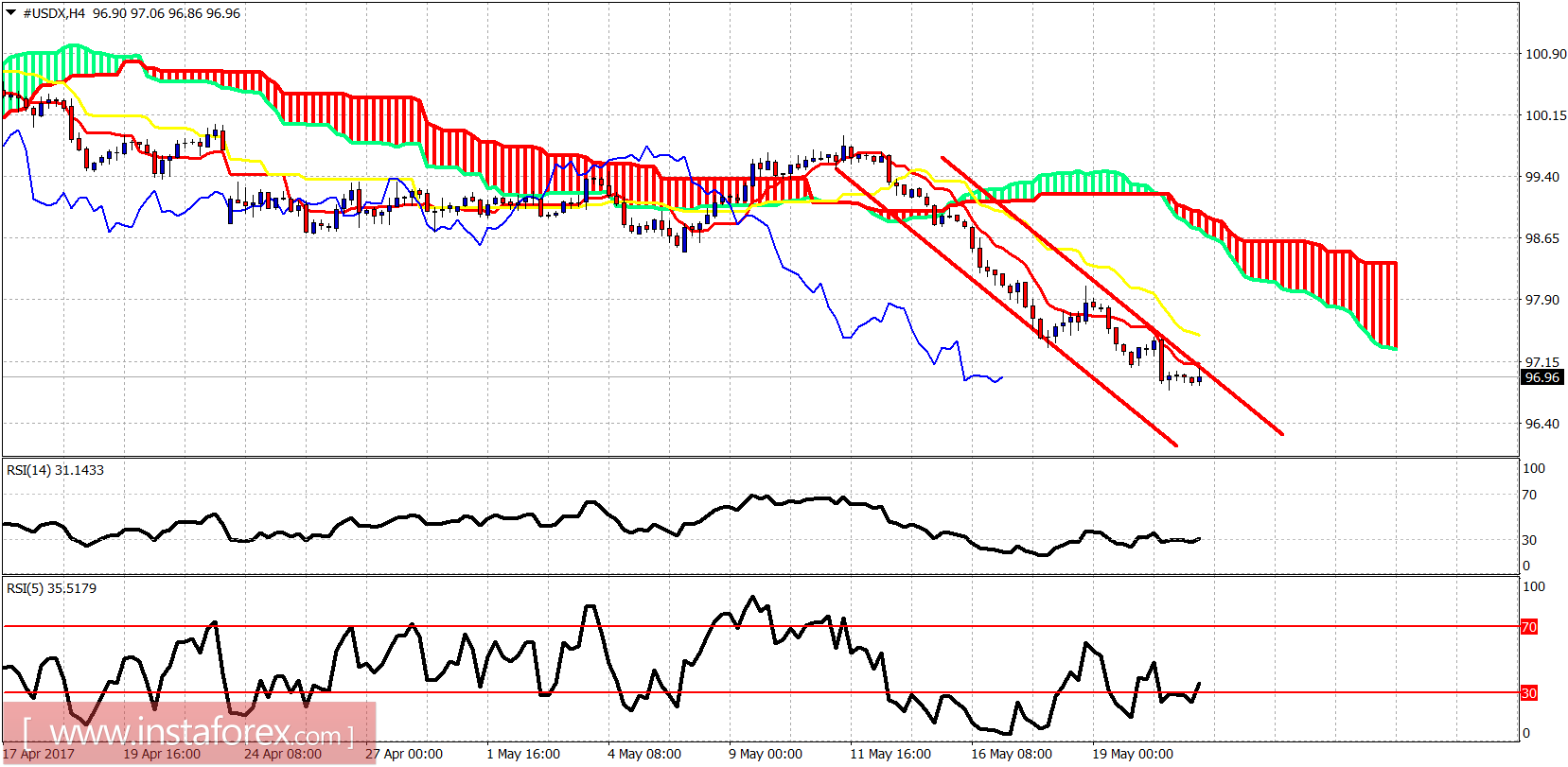

The Dollar index remains in a bearish channel. Trend remains bearish. I favor a dollar bounce this week from current levels but we still have no confirmation of a reversal.

Short-term resistance by the tenkan- sen is at 97.12 and by the kijun-sen at 97.47. Cloud resistance and target of the bounce expected is at 98.60-99. The RSI is diverging on the 4-hour chart.

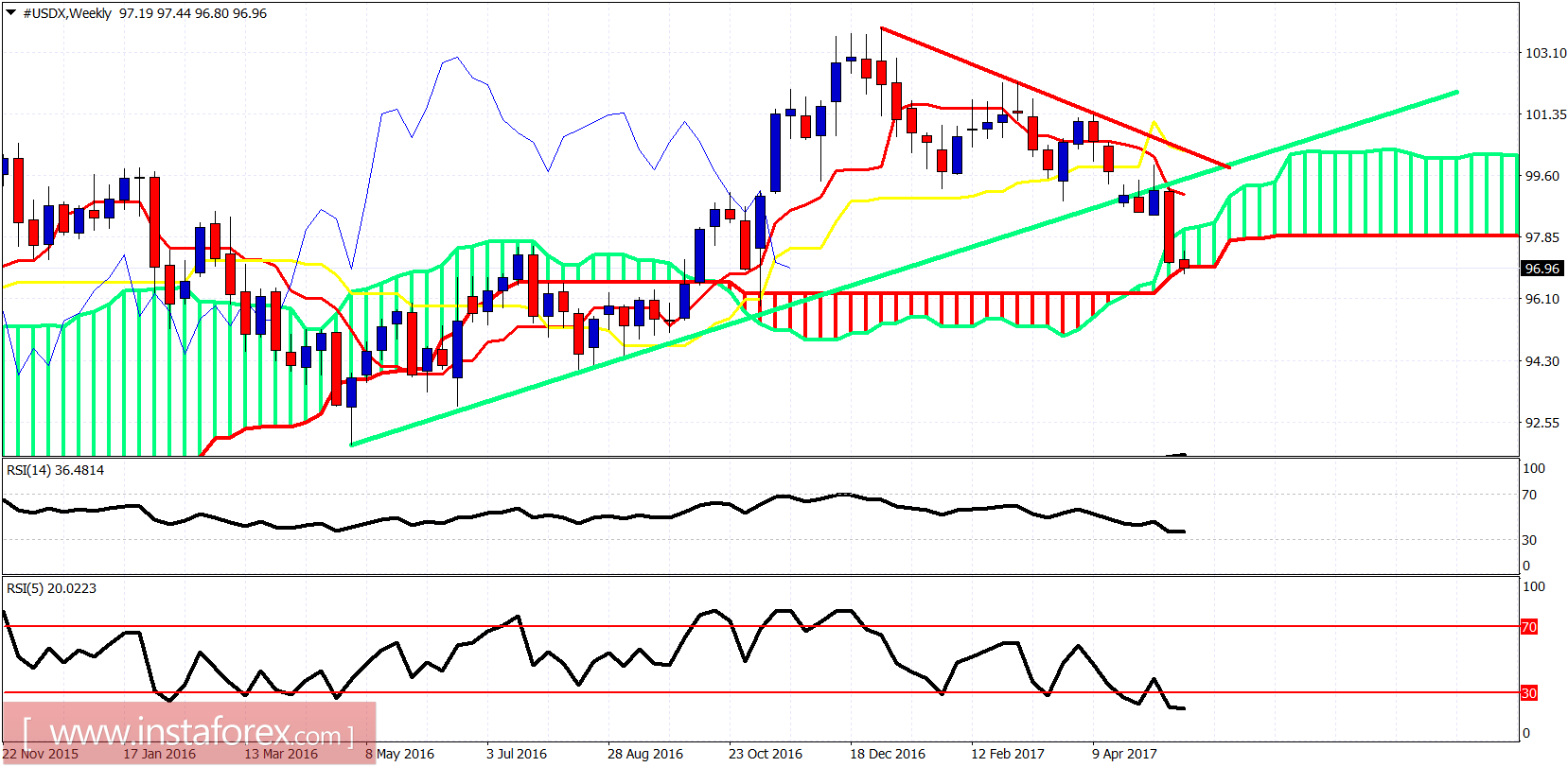

Green line - long-term trend line support (broken)

The weekly candle is testing the weekly Kumo support at 96.90-97 area. The RSI is oversold on a weekly basis. This is not the time be shorting but to be looking reversal signs. The bounce that will come will give a better opportunity and a better selling price level higher. Traders need to be patient. Aggressive traders will also look to play the bounce once we get the first short-term reversal signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română