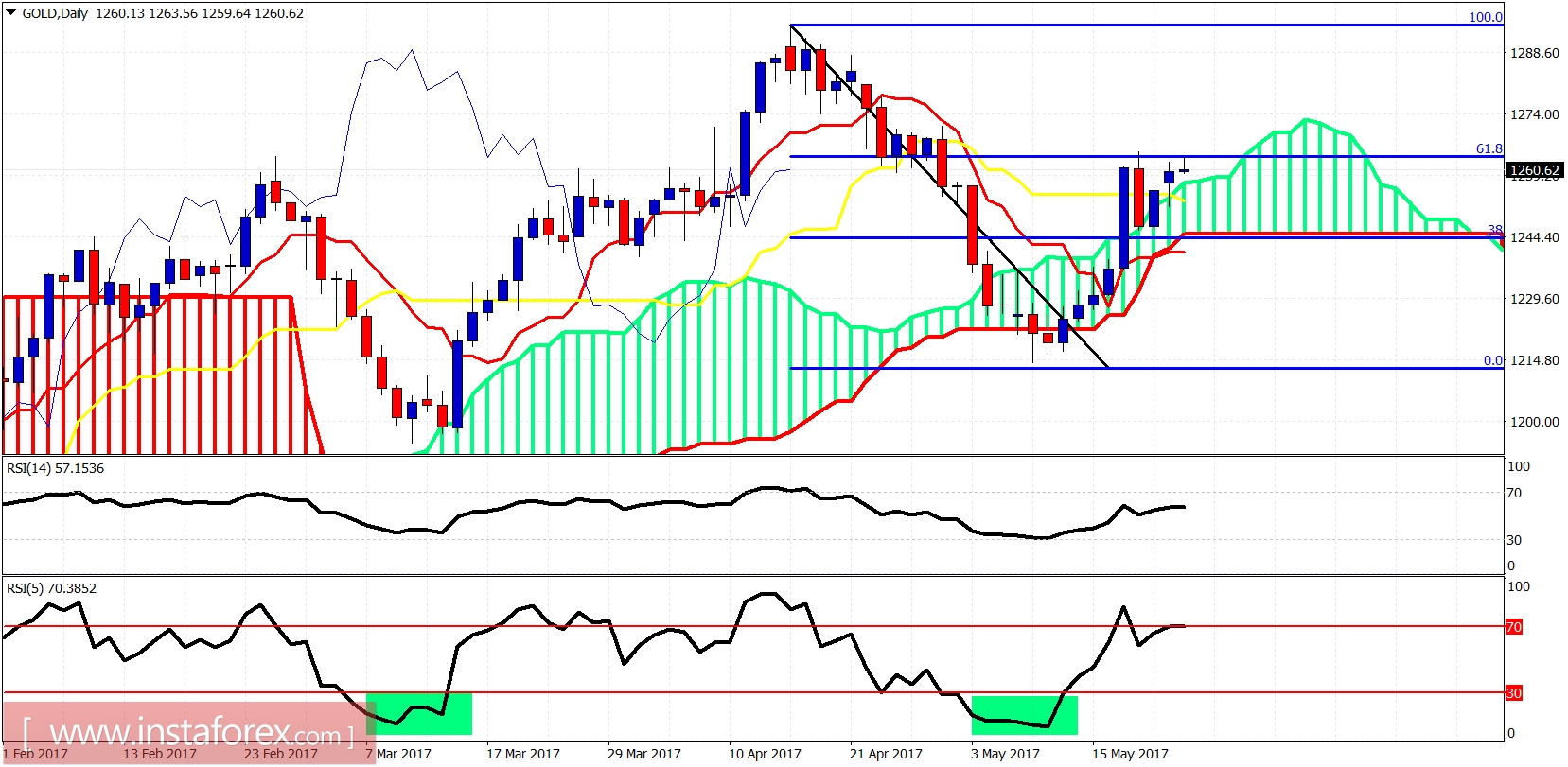

Gold price remains just below the important resistance of $1,265 where the 61.8% Fibonacci retracement is found. Trend remains bullish but a pullback towards $1,250 is justified in the short term. As long as price is above $1,213, I expect Gold to reach $1,280-$1,300.

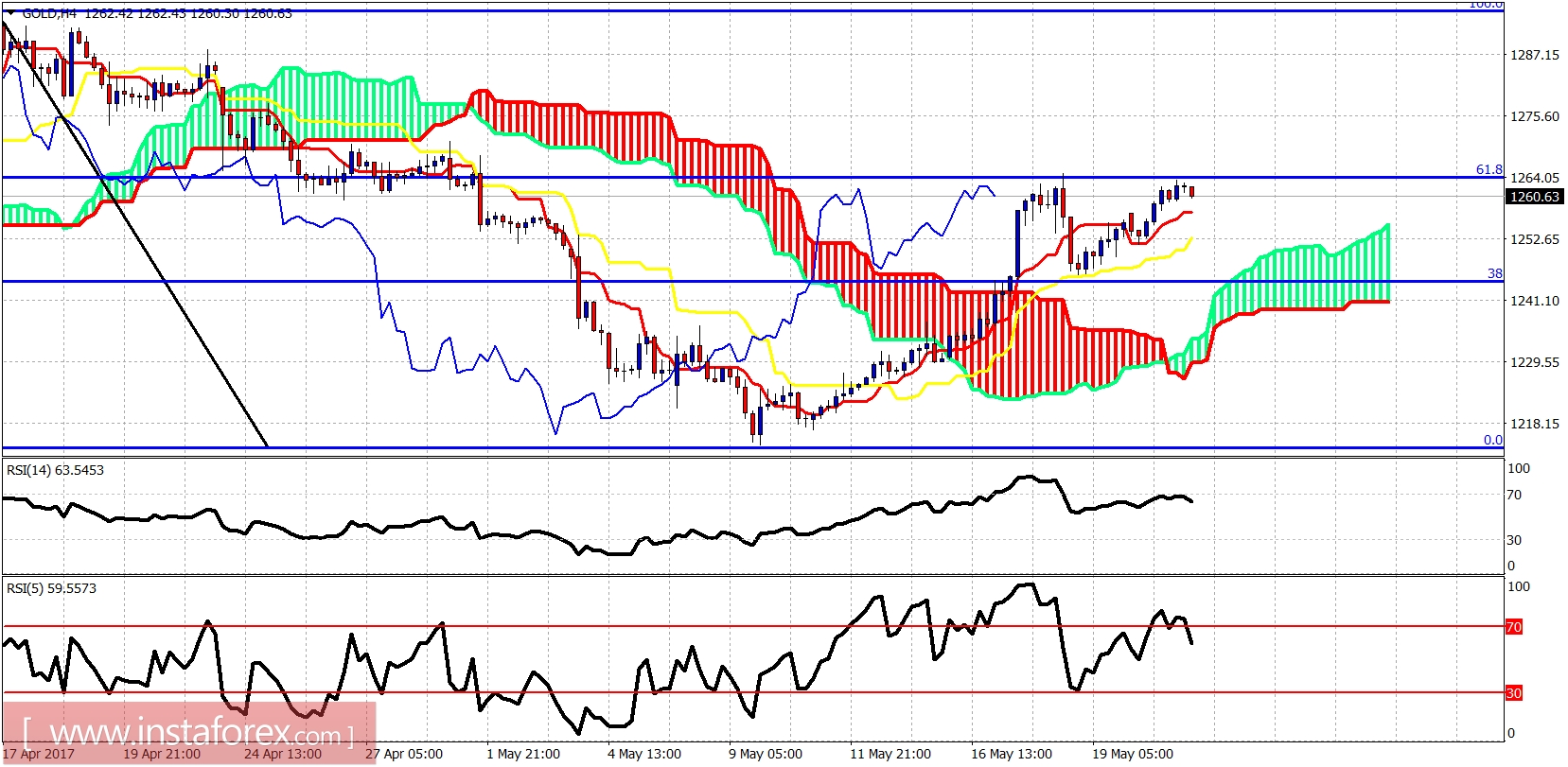

Gold price continues to trade above both the tenkan- and kijun-sen indicators. Support is at $1,257 and at $1,252. Resistance at $1,265. Cloud support is at $1,230.

Gold daily candle remains above the cloud and above the daily kijun-sen at $1,253. Gold price rise has stopped at the 61.8% Fibonacci retracement. Gold resistance is here. I expect at least a short-term pullback and then more upside. The bearish scenario of a move towards $1,150-60 will happen only on a break below $1,213.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română