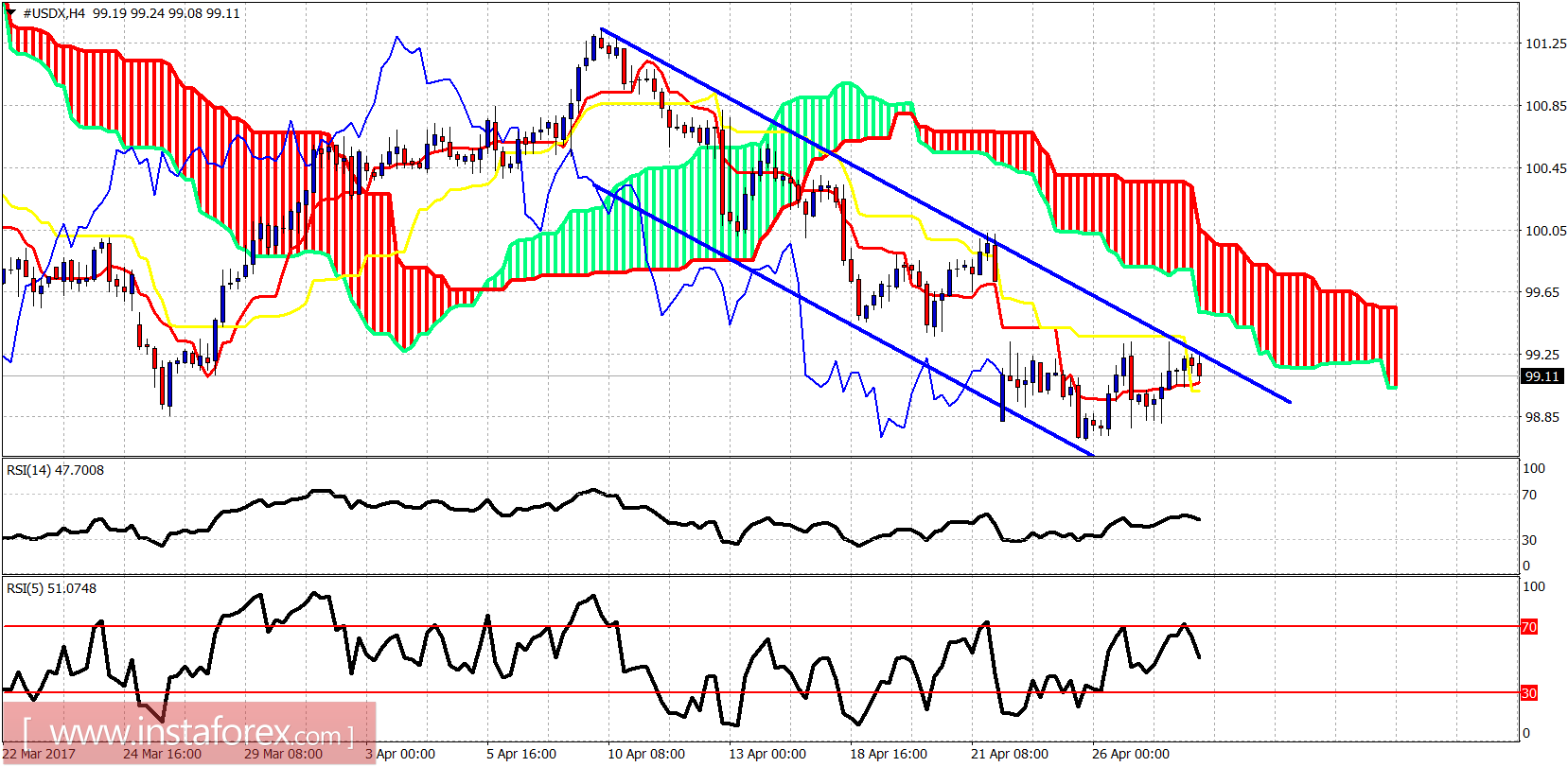

The US dollar index remains inside the bearish channel and I expect the price to move lower today and get rejected at the channel resistance. However, I would not bet on the downside as I believe it is limited.

The dollar index is showing rejection signs at the upper channel boundary. A new low is expected to be seen today before the upward reversal. The short-term resistance lies at 99.35. Support is found at 98.80 and the next one at 98.

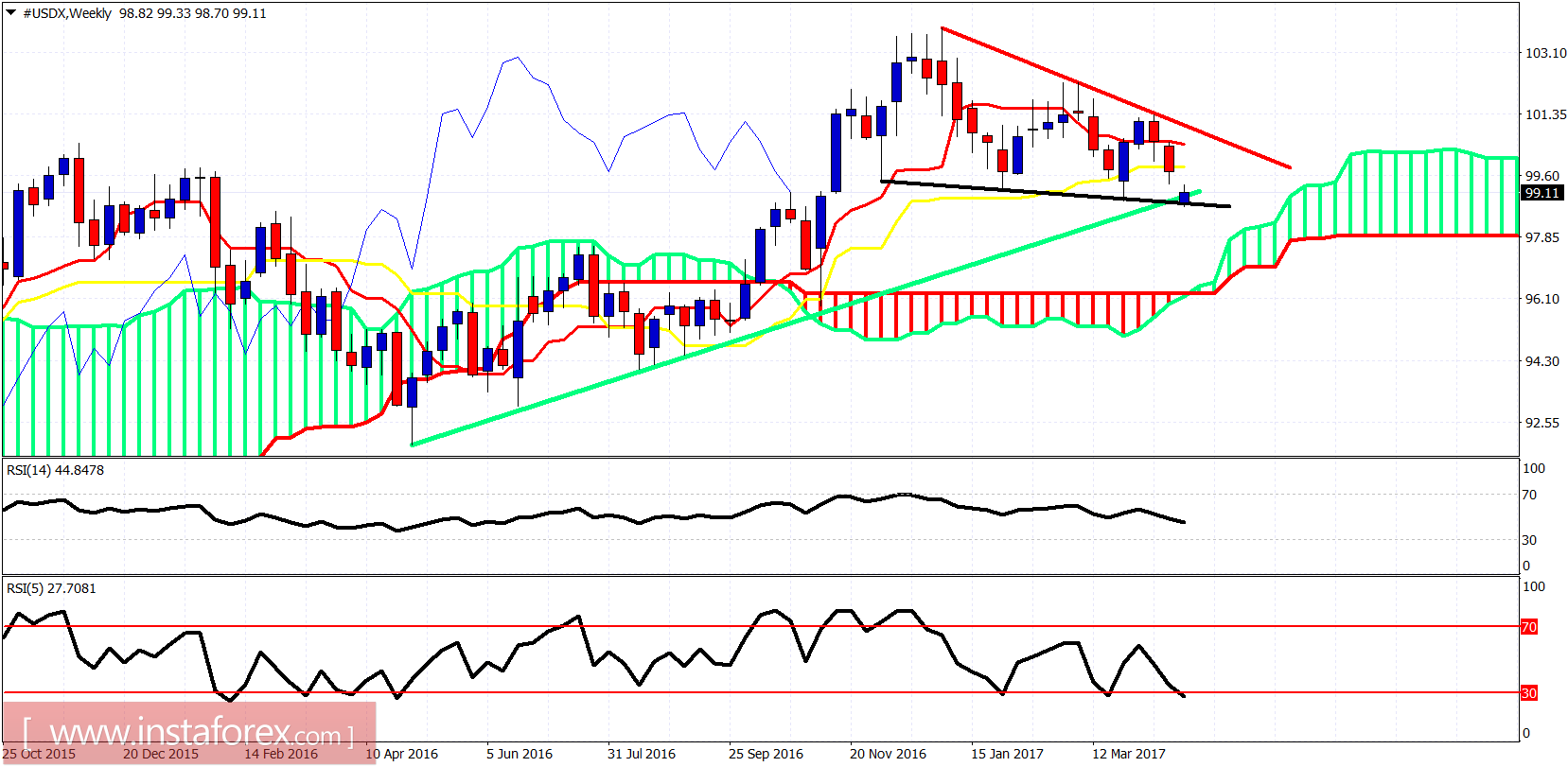

Green line -long-term trend line support

Black line - support trend line

The dollar index remains stuck right on top of the junction of the two important support trend lines for the third day in a row. We may see a false breakout below the trend lines today but overall I believe there are a lot of chances of a bullish reversal. I prefer to wait without opening a position. When I see a reversal signal, I will go long.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română