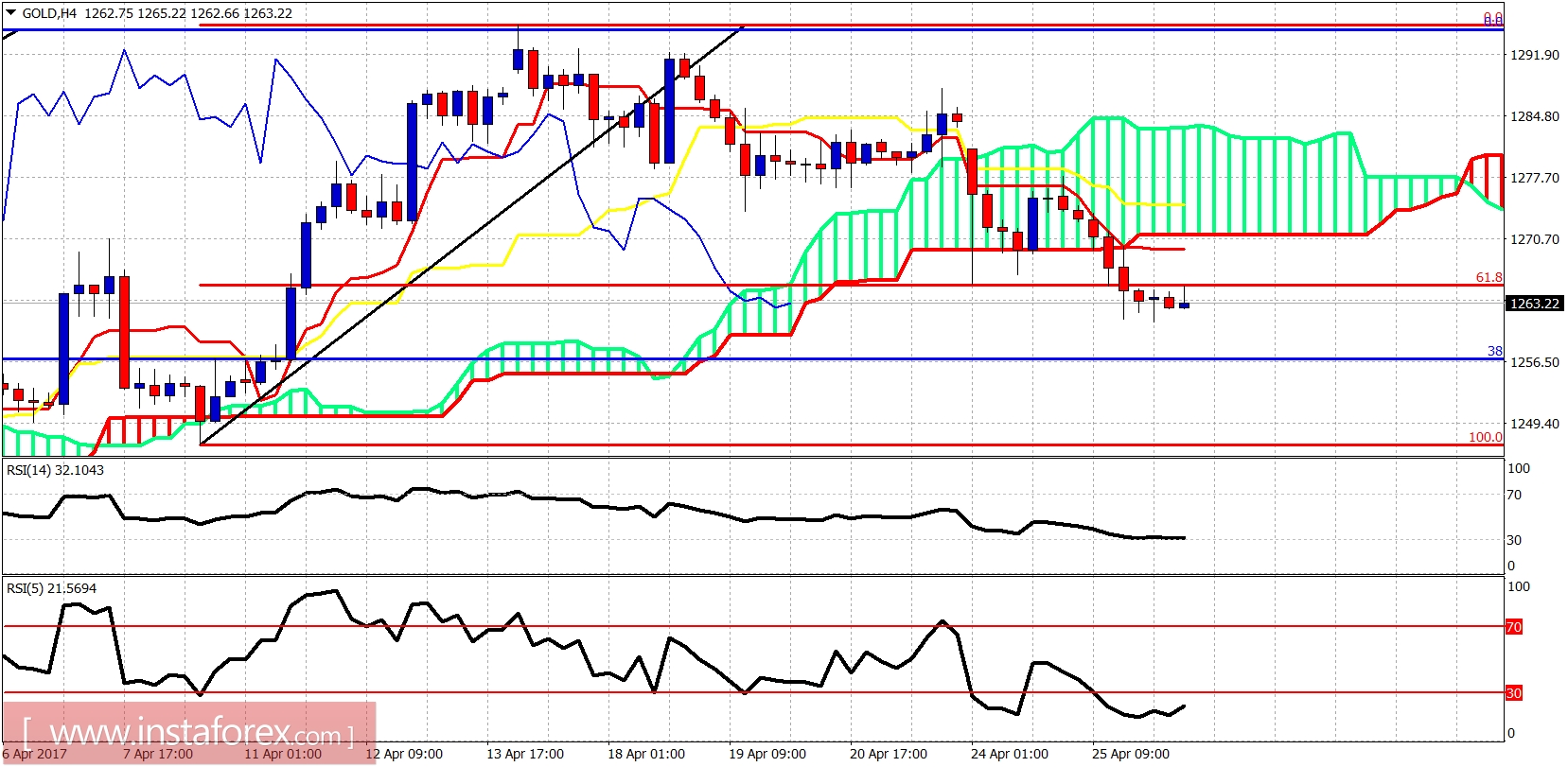

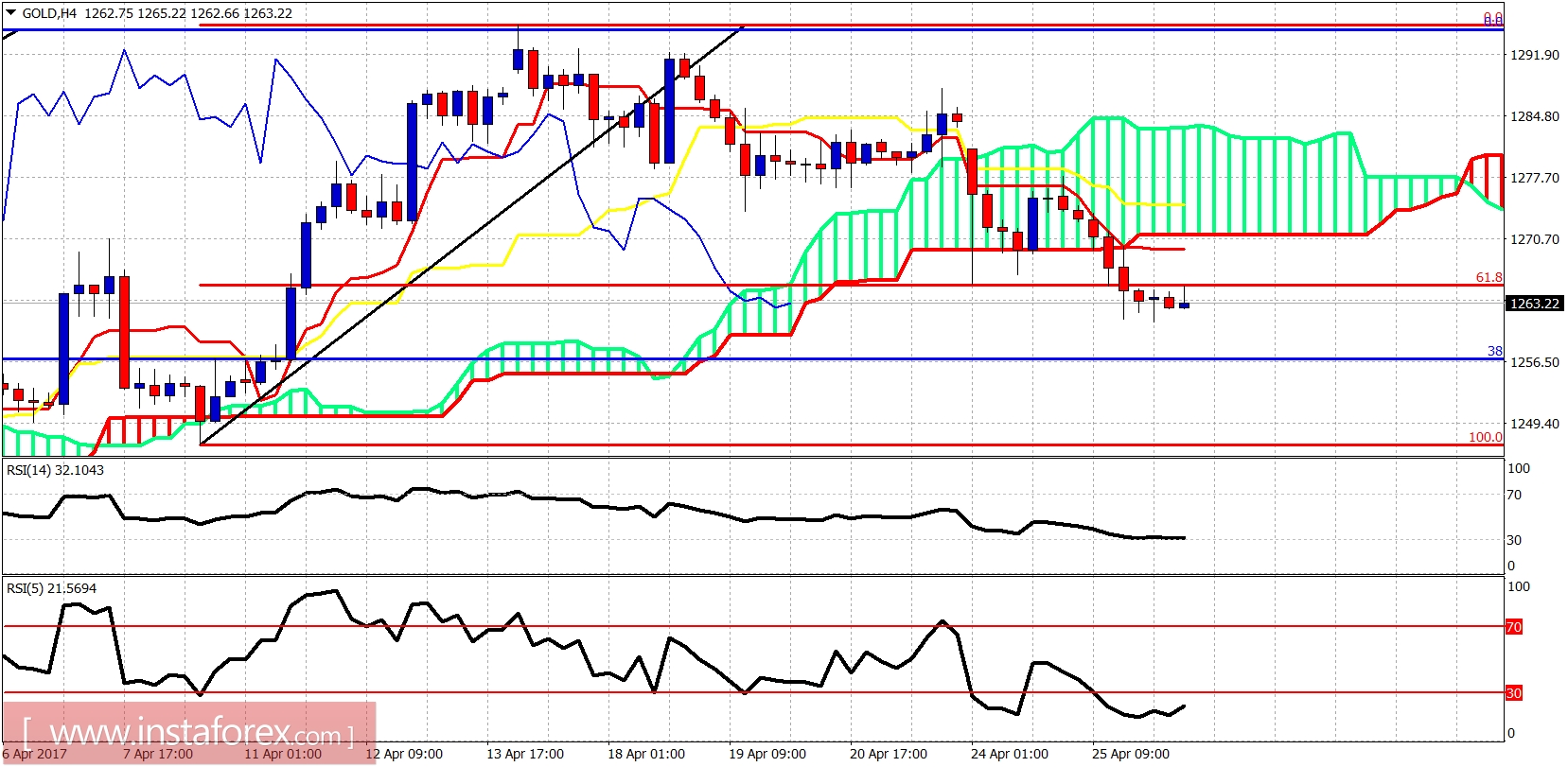

Gold price is trading around important Fibonacci support area of $1,265. Gold price is expected to at least make a bounce towards $1,275-80 where important short-term resistance is found. Gold could very well have finished the entire corrective decline.

There are bearish divergence signs in the 4-hour chart that imply a back test at least of the cloud is expected. The cloud resistance is at $1,270. Breaking above it could push price towards $1,284 where the upper cloud boundary is found. Next major support for Gold is at $1,256.

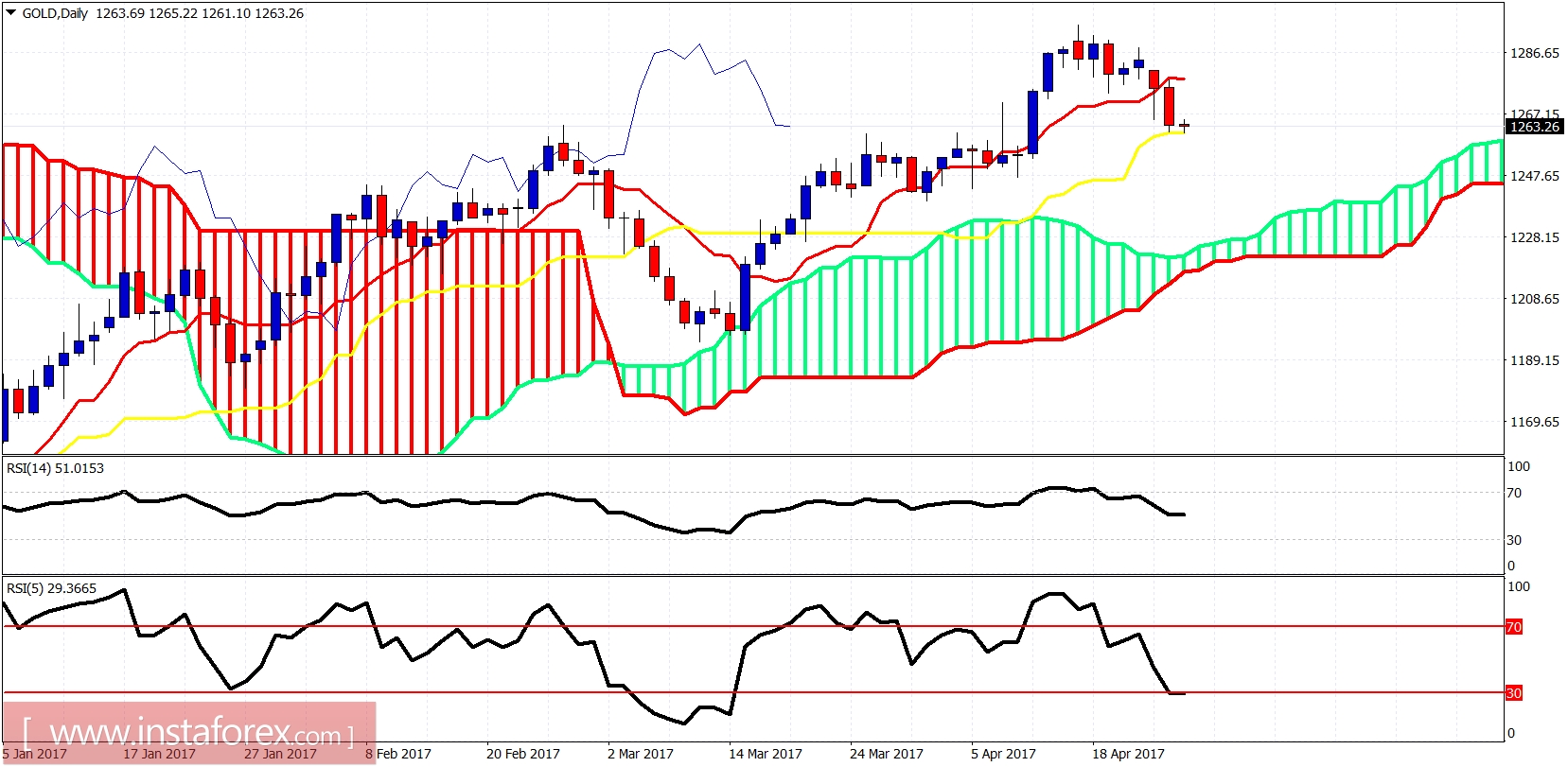

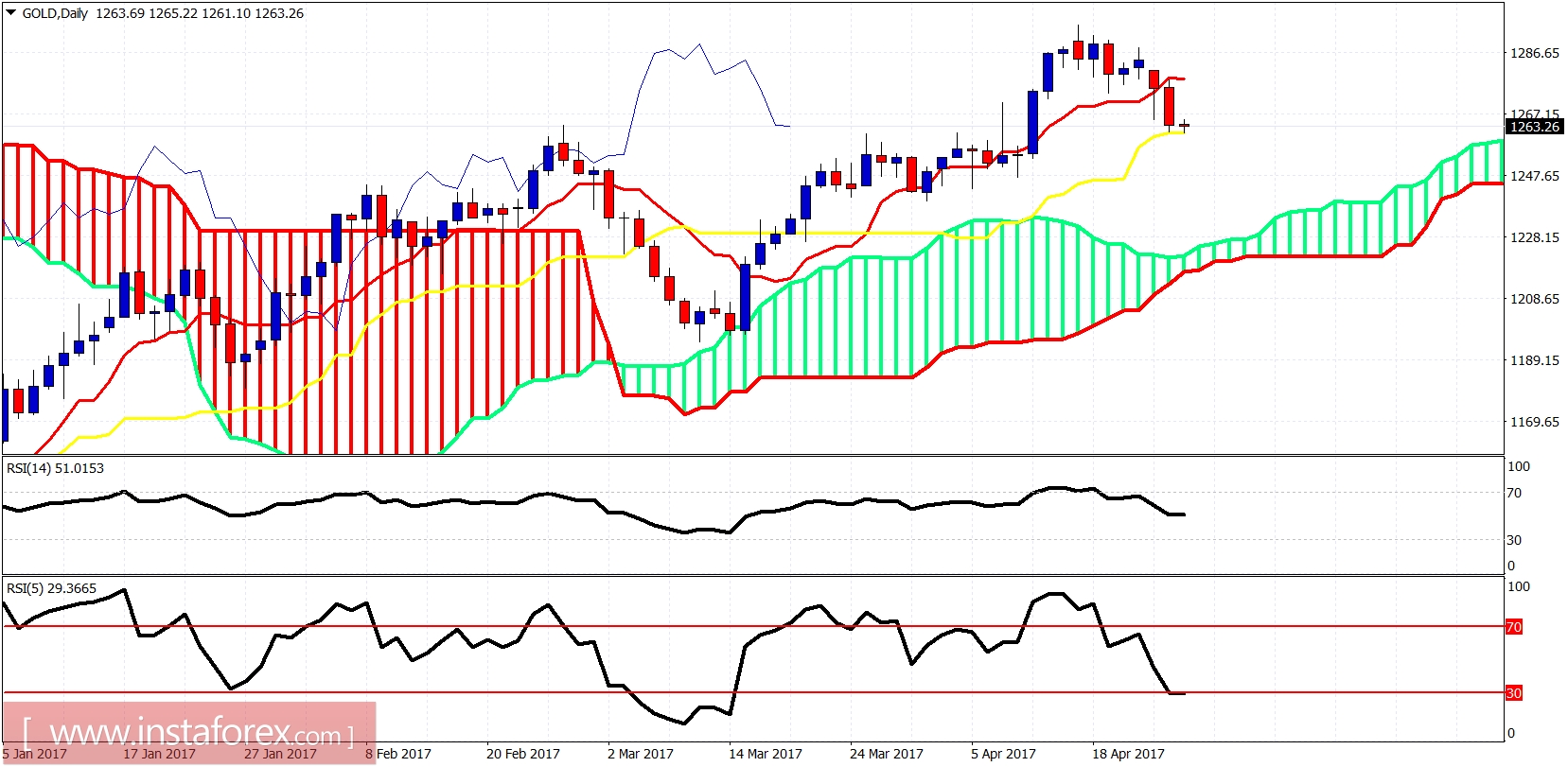

Gold price has reached the kijun-sen (yellow line indicator) support as expected after breaking below the tenkan-sen (red line indicator). A bounce from kijun-sen is justified. Resistance is now at the tenkan-sen at $1,278. So a daily close above the tenkan-sen will be a bullish sign. A daily close below the kijun-sen will most probably push prices towards the daily cloud support at $1,226.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română