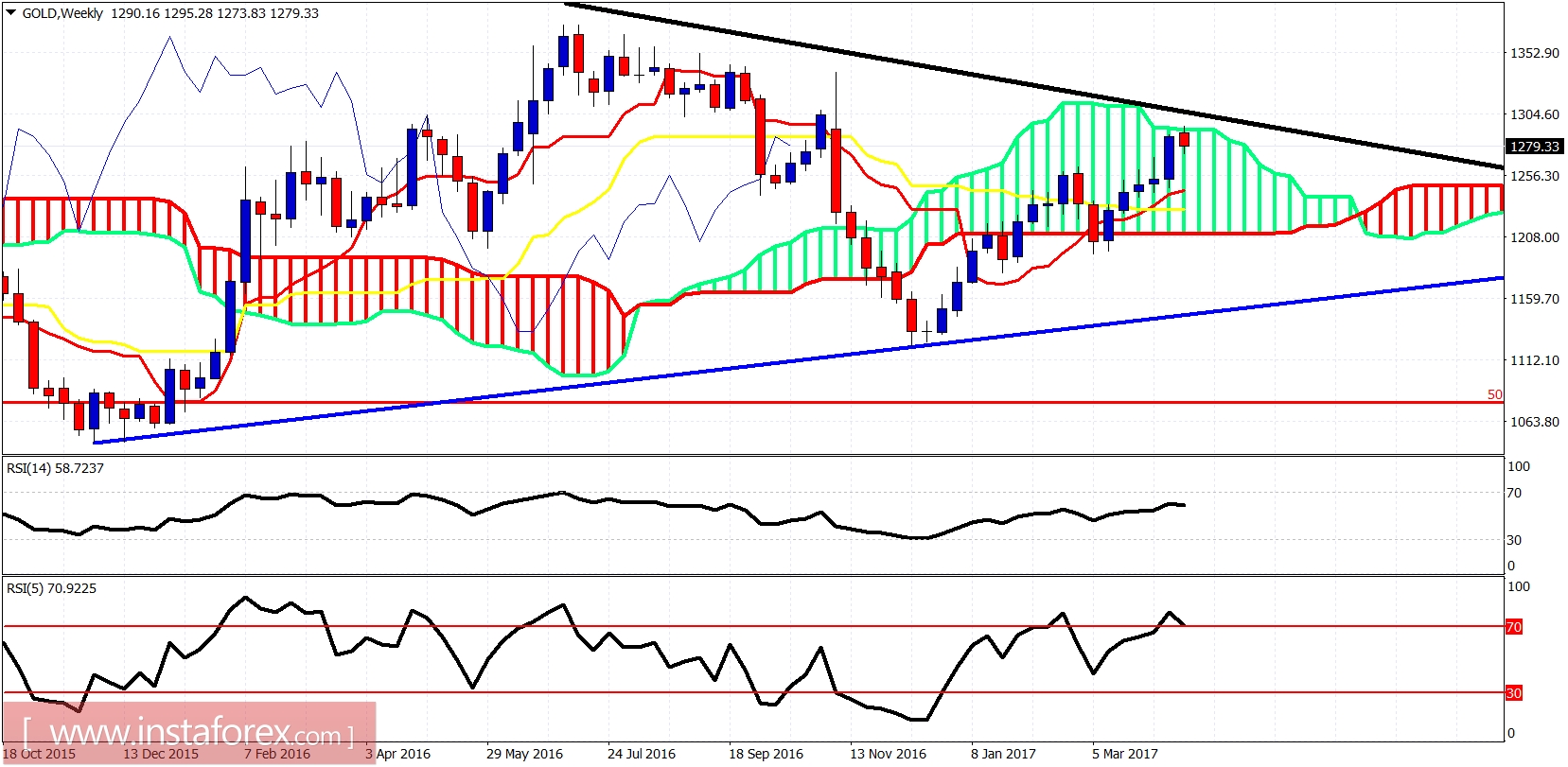

Gold price continues to move sideways in a corrective manner. The move that started from recent highs is part of a correction and we are just above the 38% Fibonacci retracement of the rise from $1,246. I remain longer-term bullish but cannot rule out a steep decline towards $1,250 before the resumption of the up trend.

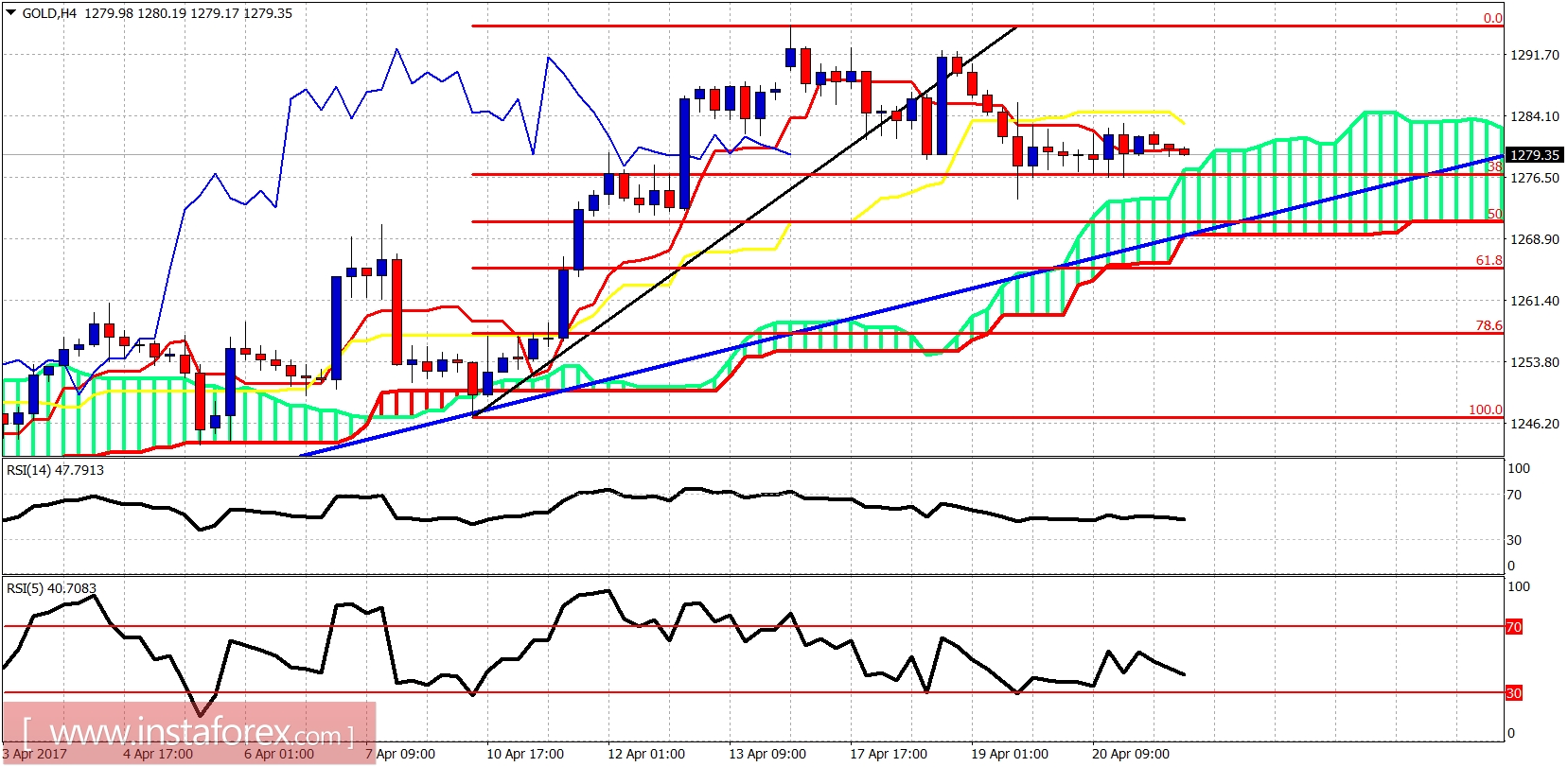

Blue line - support trend line

Gold price is trading above the Ichimoku cloud in the 4-hour chart. Price is trading below the kijun-sen and the tenkan-sen. Oscillators are now again in a neutral zone. Price is mainly moving sideways above the 38% Fibonacci retracement. Short-term support is at $1,275. Resistance is at $1,285.

Blue line - long-term support

Gold price has stopped its up trend just below the long-term black trend line resistance and the upper cloud boundary. This is an important resistance area. The trend line comes back from the all time highs in Gold, so breaking it will be an important bullish signal for a bigger move higher and not just 20-30$. I remain longer-term bullish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română