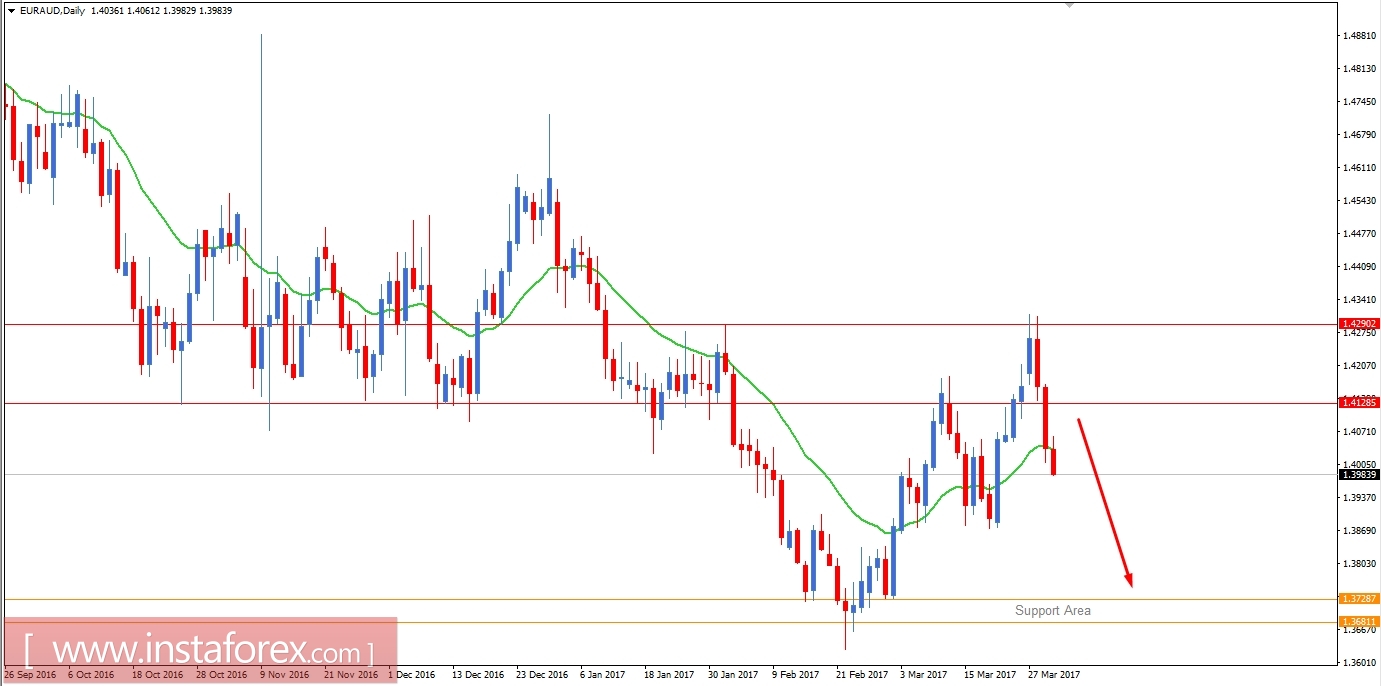

EUR/AUD has reacted quite impulsively to the negative EUR economic events this week. The BREXIT effect seems to be affected quite negatively EUR against other currency crosses and negative economic reports are also pushing the situation much deeper. Today EUR had some negative reports of Spanish Flash CPI at 2.3% which was expected to be at 2.6% and German Prelim CPI at 0.2% which was expected to be at 0.4%. On the other hand, AUD started the day with a positive outcome of HIA New Home Sales at 0.2% which previously was negative at -2.2%. Overall, EUR has been seeing bad days getting out of the BREXIT situation and negative economic reports whereas AUD has maintained the consistency in sustaining the stronger position in the market.

Now let us look at the technical view, the price has bounced off from the resistance area of 1.4130-1.4290. Currently the price is moving impulsively downward and having no good support in the way, the price is expected to reach the lowest support area of 1.3680-1.3730 in the coming days. Some retraces may take place to reach the support but the impulsiveness of sellers in the market does signify good amount of non-volatile bearish situation of the pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română