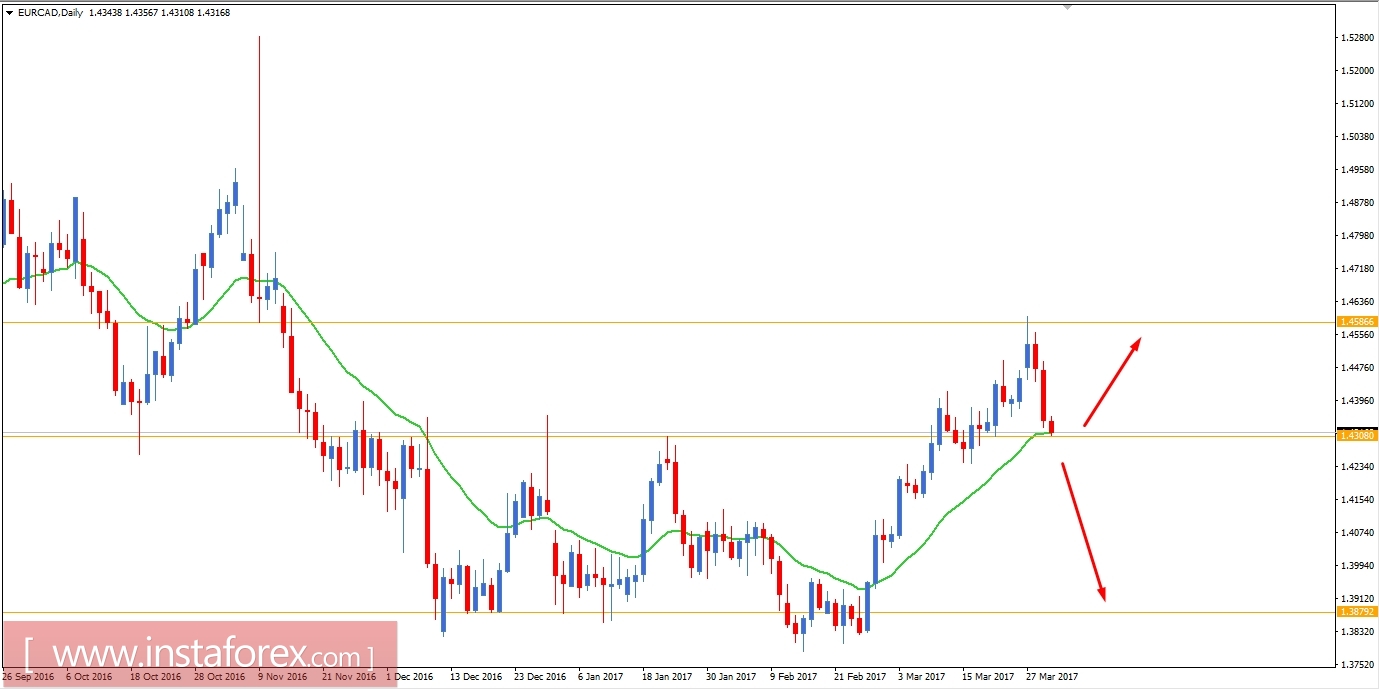

EUR/CAD has been in a non-volatile bullish move until the event level resistance at 1.4590 is hit. After the bounce back from the level the bears are taking control now. Today EUR German Prelim CPI which came at a decreased rate of 0.2% which was expected to be at 0.4%, Spanish Flash CPI also followed the trend of decreased actual data of 2.3% which was expected to be at 2.6%. Today is going to be an important day for CAD as well due to several economic events today. Today we have RMPI report which previously was at 1.7% but forecasted a decreased rate at 0.8% and IPPI report which previously was at 0.4% and forecasted to be unchanged. Any positive or negative outcome of the CAD will make the EUR/CAD pair very volatile and set the trend for upcoming moves in this pair.

Now let us look at the technical view, the price has bounced off from the resistance of 1.4590 and currently it is testing the dynamic support of 20 EMA at price 1.4300. As we have some important CAD economic reports to be published today, a daily close below the 1.4300 support will lead to more downward move towards a lower support at 1.3880 and a daily close above 1.4325 will confirm the support rejection of the bears and will lead the price upward towards the 1.4590 resistance again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română