Global macro overview for 30/03/2017:

According to National Association of Realtors (NAR), the Pending Home Sales in the US for the month of February rose sharply by 5.5% compared with expectations of a 2.4% monthly gain and following a 2.8% decline for January. The February data provided a 2.6% increase in yearly data, so this is the highest level of sales in 10 months. The biggest gain of 11.4% was noted in West and Midwest parts of the US, but Northeast was good too with the sales at the level of 6.0%. South registered a 4.2% annual gain. In conclusion, housing trend had been mixed over the past month with a decline in existing home sales for February offset by stronger data for new homes sales. Last week consumer confidence data were on the record levels too, so it looks like the market participants might expect even better numbers of sales during the next quarter.

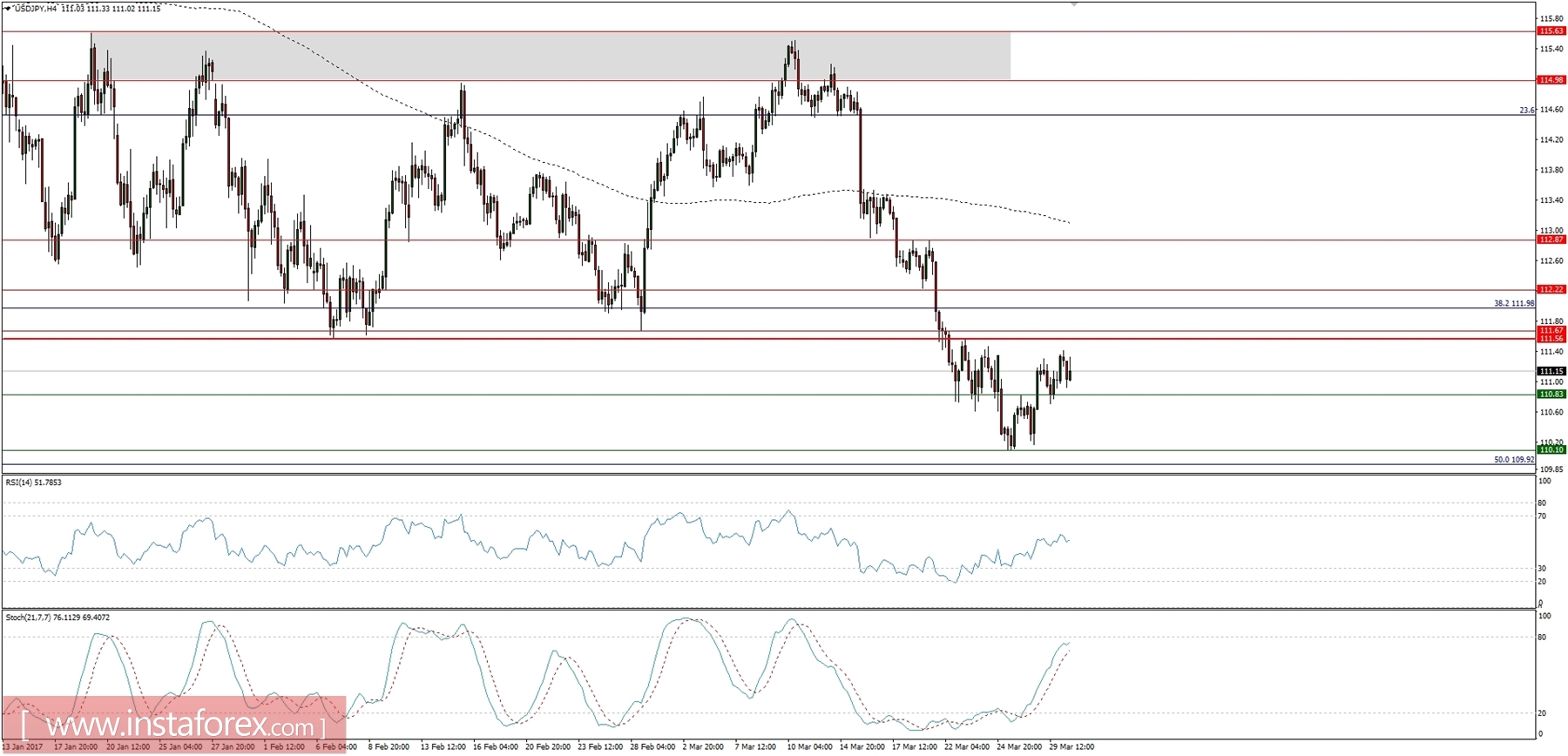

Let's now take a look at the USD/JPY technical picture at the H4 time frame. The market still trades below the important technical resistance at the level of 111.56, but the bull camp is still trying to break out above it. In a case of a break out, the next resistance is seen at the level of 112.22 and 112.87. In a case of a failure, the next support is seen at the level of 110.83 and 110.10.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română