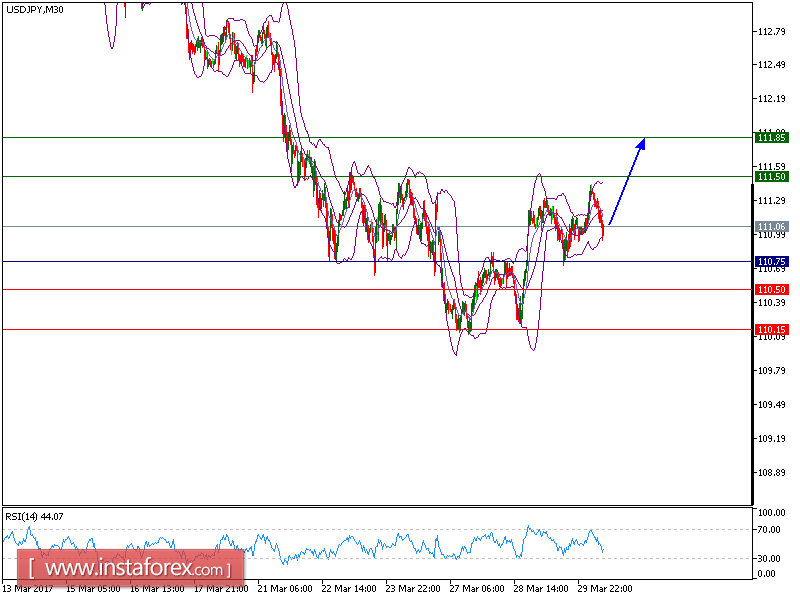

USD/JPY is expected to trade with bullish outlook. The pair broke above its 20-period and 50-period moving averages and is holding on the upside. The relative strength index stands firmly above its neutrality level at 50 and lacks downward momentum. Additionally, 110.75 is playing a key support role, which should limit the downside potential.

As long as this key level is not broken, look for a further upside toward 111.50 and even 111.85 in extension.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 111.50 and the second one at 111.85. In the alternative scenario, short positions are recommended with the first target at 110.50 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 110.15. The pivot point is at 110.75.

Resistance levels: 111.50, 111.85, and 112.15

Support levels: 110.50, 110.15, and 109.75

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română