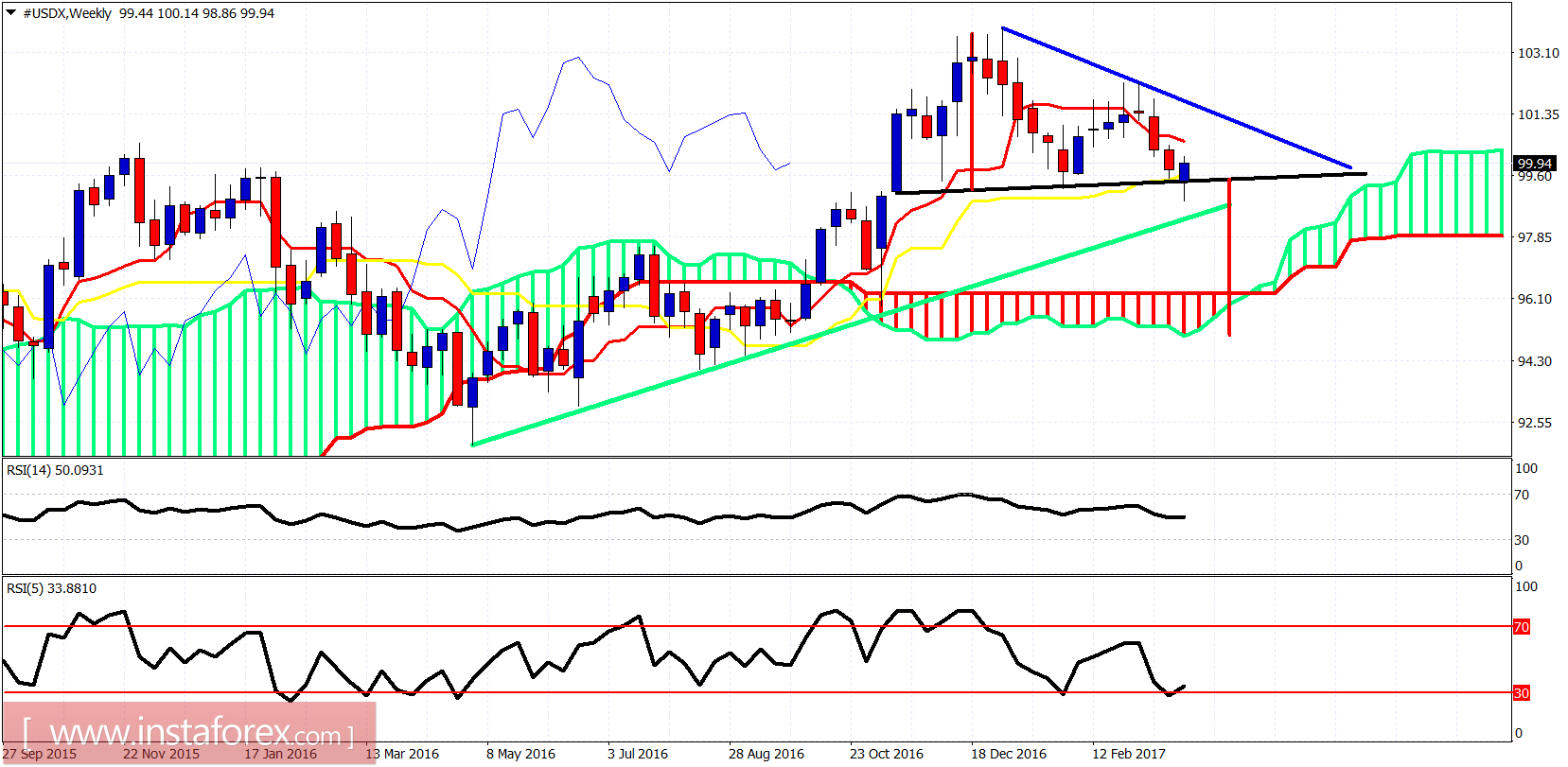

The Dollar index bounced towards important short-term resistance at 100. I expect to see at least a small pullback towards 99.60-99.40 before the resumption of the bounce. However this is not necessary. We could very well continue much lower towards 98-97.50.

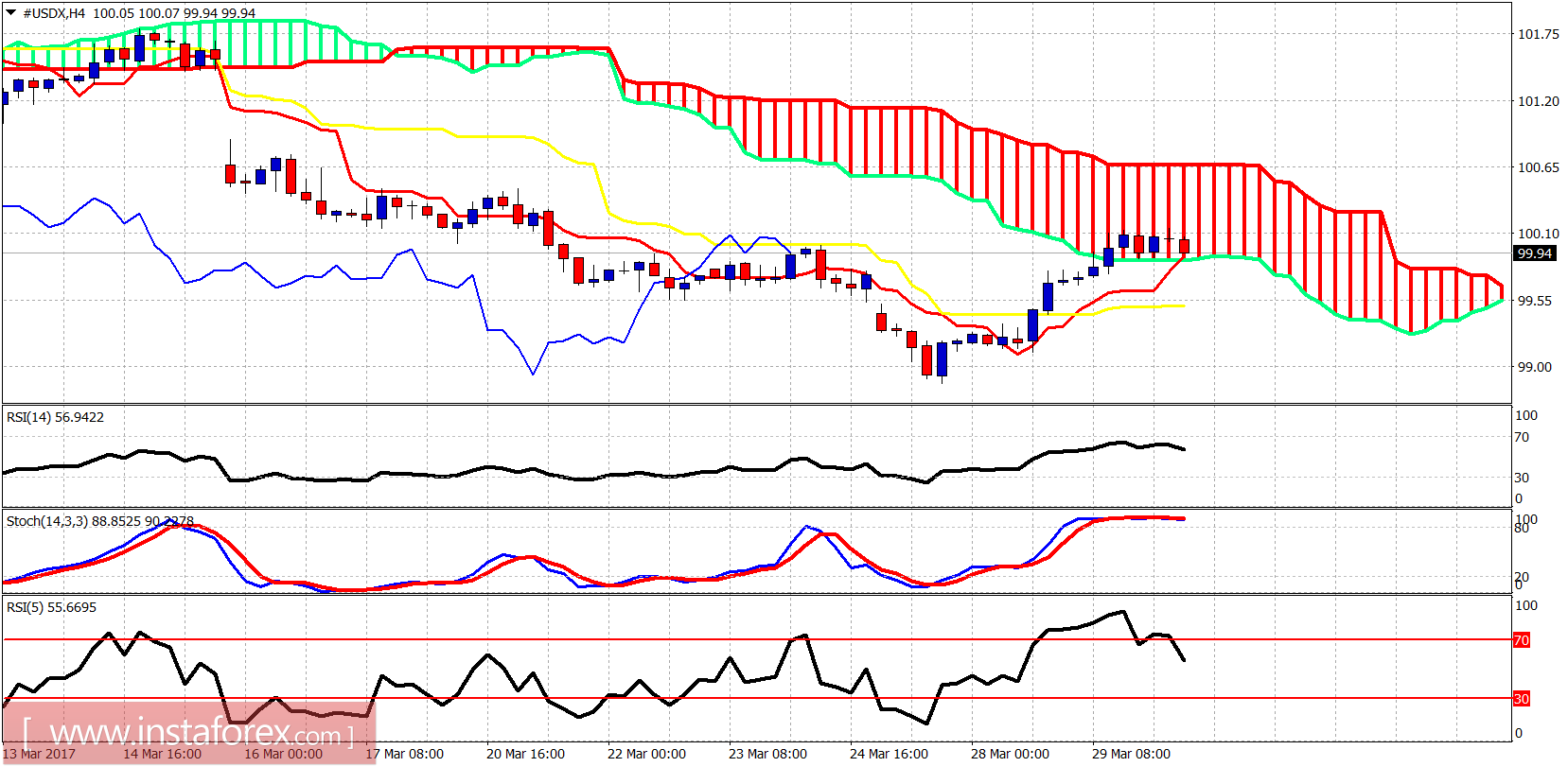

In the 4-hour chart we see that the Ichimoku cloud has provided enough resistance to stop the rise in the Dollar index and with the oscillators overbought and diverging, I will be expecting a decline in the Dollar index at least towards the 4-hour kijun-sen (yellow line indicator) support.

Blue line- resistance trend line

Green line - long-term trend line support

On a weekly basis the Dollar index holds above the neckline support. A break below 99 will confirm the initial break down and the price will be expected to mount a serious challenge at the long-term green trend line support at 98. Breaking below it will open the way for a test of the cloud support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română