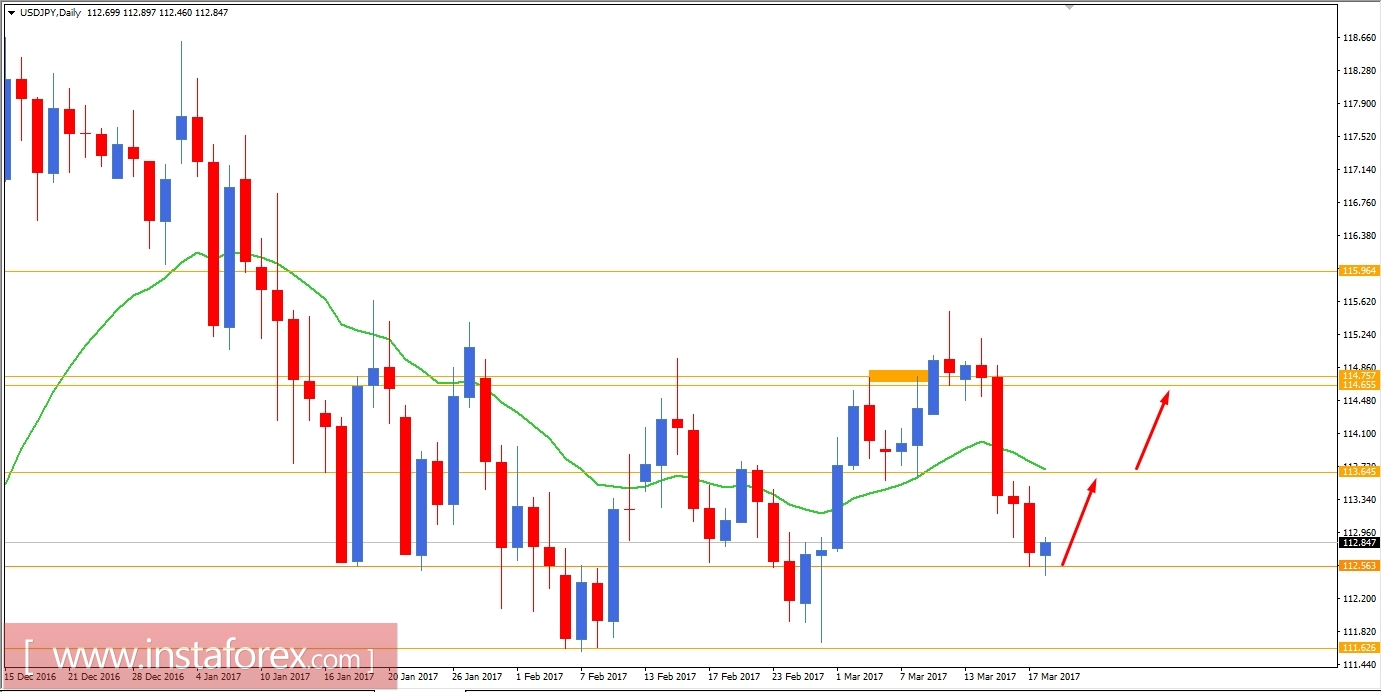

USD/JPY has been in bearish streak before bouncing off from 112.50 today. As of FOMC Meeting on Wednesday, the sudden rate hike decision did affect the performance of USD which has affected the USDJPY pair as well. Today JPY has Bank Holiday for the whole day for which there would be no volatility to occur from the JPY side and USD has a speech of FOMC Member Evans who is going to speak about the monetary policies and the economic conditions of the country. Fundamentally there is nothing much to be discussed about the pair and market is expected to remain quite corrective and non-volatile.

Now let us look at the technical view, the price has bounced off from the 112.50 support level after a week of impulsive selling. Currently, the price is showing some bullish interference which is expected to remain undisturbed until the price hits the nearest resistance at 113.65. If the price breaks above 113.65 with a daily close, we will be expecting a further upward movement toward 114.50-75 area. On the other hand, a daily close below 111.50 will negate the bullish bias in this pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română