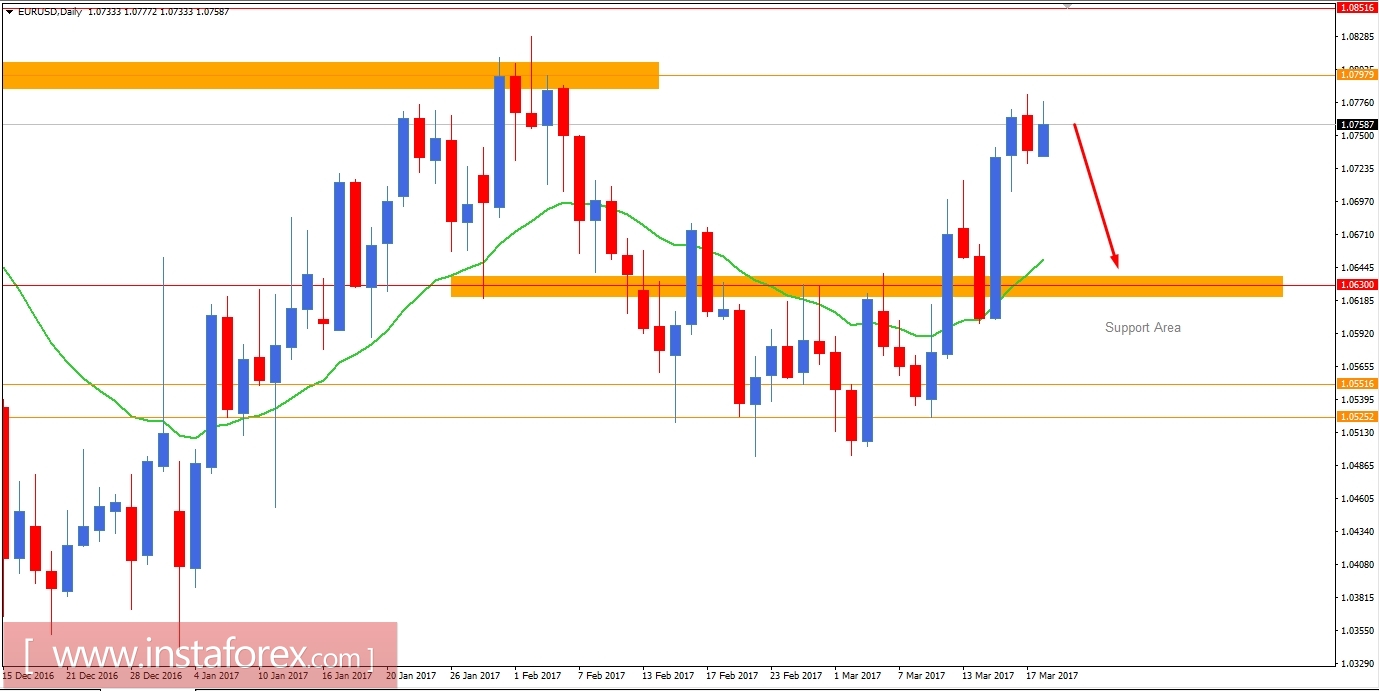

After the FOMC Meeting held on Wednesday, EUR/USD has surged up higher than recent highs made by the pair. As of sudden rate hike decision from 0.50-0.75 to 0.75-1.00, USD has got an opposite reaction from the market and price was just about to hit the resistance of 1.08 on Thursday. Friday was a bearish day for the pair but currently, as of sudden spike in the market, it is time for some correction to be made. Today market is expected to be corrective as Euro Group Meeting is going to be held for the whole day and on the USD side FOMC Member Evan is about to speak about the economic conditions and monetary policies of the country. Fundamentally today there is fewer things to be going on to provide any impulsive pressure or some volatility in this pair.

Now let us look at the technical view, after breaking above the former resistance of 1.0630-40, the price is currently residing a few pips below the resistance of 1.08. As of Friday's bearish pressure from the middle of the range, it is expected that the price will move down toward the former resistance 1.0630-40 as support and if we see any bearish rejection off the level we will be buying with an upward target towards 1.08. The bullish bias is expected to continue until the price breaks below the support area of 1.0525-50. A daily close below the 1.0525-50 support area will negate the bullish bias.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română